- Jupiter’s $500M AirDrop triggers 61% wallet claims, but drives JUP’s 11% price drop in 24 hours.

- Liquidation activity stabilizes as JUP Open Interest rises 8.63% to $122.9M amid strong trading volume.

Solana [SOL]-based decentralized exchange, Jupiter [JUP], has officially launched its much-anticipated “Jupuary” AirDrop.

Over 2 million wallets are eligible to receive a share of 700 million JUP tokens, valued at approximately $500 million.

As of the 23rd of January, 578,657 wallets—representing 61% of eligible participants—have successfully claimed their tokens, per Dune data. This leaves nearly 39% of wallets yet to engage with the AirDrop.

JUP declines amid heavy trading volume

JUP’s price stood at $0.7849 at press time, reflecting an 11.29% decline over the past 24 hours. Over the last week, the token has experienced a 3.65% decline, with its market capitalization now at $1.86 billion.

Trading volume remained robust, hitting $816 million over the last 24 hours.

The token’s recent price decline is linked to increased sell-offs following the distribution of AirDropped tokens. Profit-taking behavior has been observed as recipients liquidate their holdings.

At the same time, the AirDrop has contributed to higher liquidity and trading activity, which may help stabilize the market in the near future.

Reduced leverage after volatility

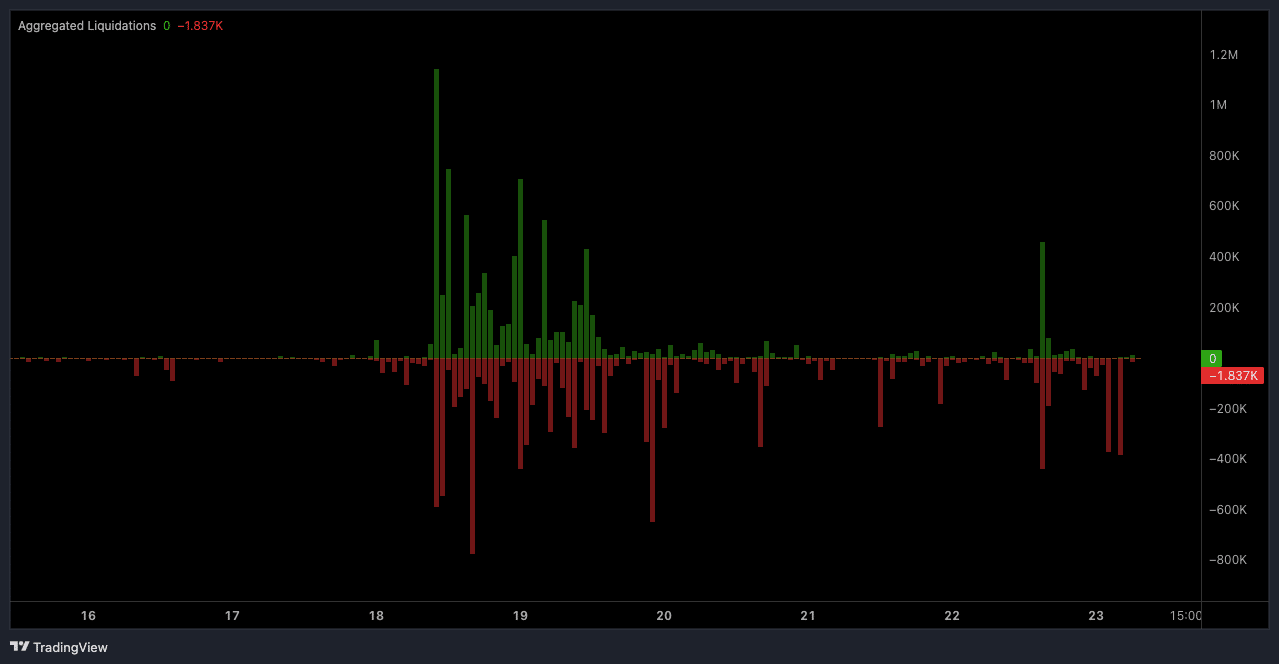

According to Coinalyze data, liquidation trends indicated a high-volatility event on the 18th of January.

During this period, long liquidations peaked at over 1.2 million, followed closely by short liquidations exceeding 800,000.

This activity reflects intense trading pressure, likely driven by sharp price fluctuations or market speculation.

Since the 19th of January, liquidation activity has significantly reduced, with current readings showing a net liquidation dominance of -1,837 short contracts.

The stabilization in liquidations suggested a decline in leveraged trading activity, as traders appearing to be exercising more caution.

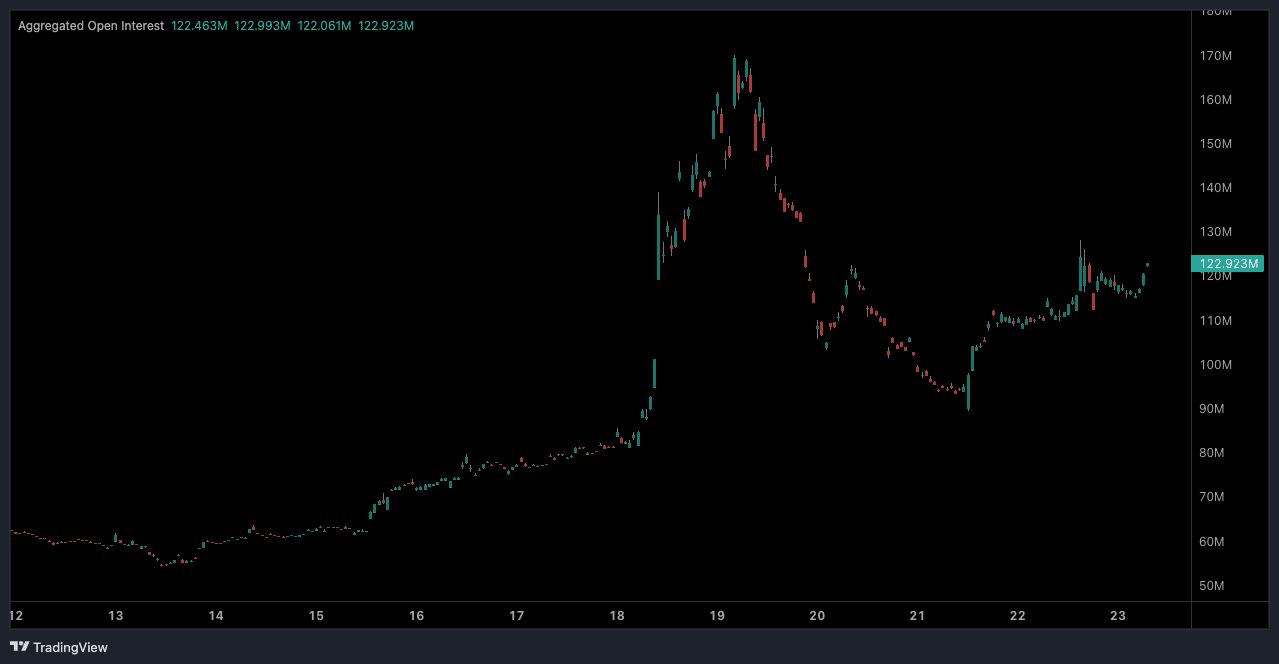

This calmer environment aligns with the observed gradual recovery in Open Interest (OI).

Open Interest, TVL show signs of recovery

On the 23rd of January, Jupiter’s Open Interest stood at 122.923 million, marking an 8.63% increase in 24 hours.

This indicated a moderate recovery following the sharp fluctuations observed between the 18th and the 19th of January.

OI held above the 110 million level after its decline, suggesting some stability in market activity despite ongoing sell-offs.

Additionally, data from DappRadar showed that Jupiter Exchange’s Total Value Locked (TVL) on Solana has grown steadily. As of the 23rd of January, the TVL sat at $2.85 billion, up from $2.5 billion in early January.

Read Jupiter’s [JUP] Price Prediction 2025–2026

The increase is attributed to heightened activity stemming from the AirDrop, which has drawn significant user engagement.

The market’s attention remains focused on whether JUP can recover in price following the AirDrop, with liquidation and trading trends serving as key indicators of future performance.