- LINK has stood out as a network with heavy key stakeholder dip buying, even as crypto takes a swing back down.

- Does this make it the right moment to scoop up the altcoin?

The market-wide correction has hit Chainlink [LINK] hard, with a double-digit weekly drop.

Now it’s nearing a key support zone that has sparked big rebounds before. But with uncertainty high, is this the perfect “dip-buy” – or a trap waiting to snap?

A short-term recovery or a long-term rebound?

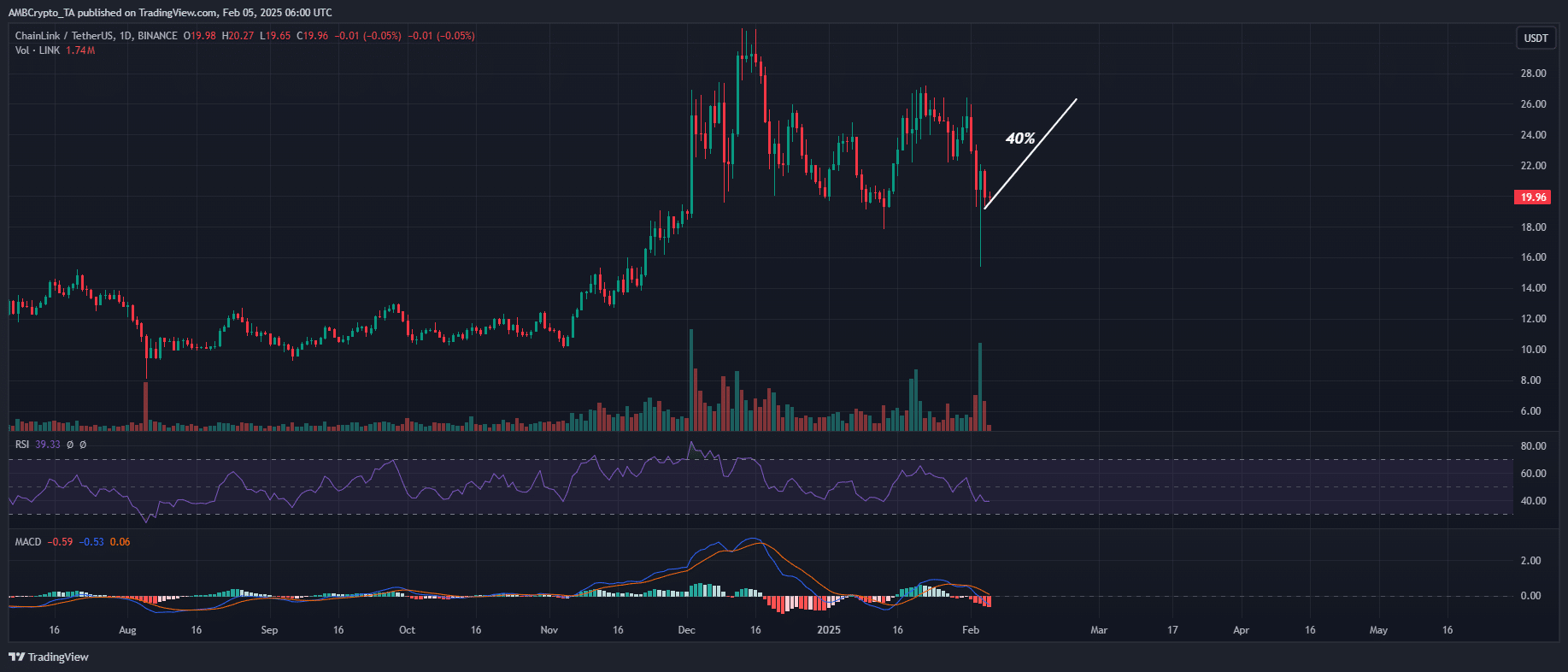

At press time, LINK is down 34.5% from its mid-December high of $30, with the RSI stuck in neutral.

The buying frenzy seen post-election, when volumes topped $8 billion, is nowhere to be found – trading has stayed below $1 billion all week.

A return to that high doesn’t seem likely for now. However, January has shown that LINK has bounced strongly around its current price. If history repeats, there could be a 40% upside potential on the horizon.

While trading has slowed as volatility rattled investors, whales have been quick to snap up the dip. The supply held by whales has hit an 8-month high of 611.3 million, marking a nearly 4% increase since mid-December, just as LINK started to recover.

In the past week, whale supply has increased by 0.54%. If this trend holds, the current $17-$19 price band could act as strong support, setting the stage for a 40% recovery. Keeping a close watch on this could be key.

However, this is a short-term play. For a long-term rebound, strong fundamentals matter, but broader market sentiment can’t be overlooked. Does this make LINK the “asset to watch” when the market rebounds?

LINK : The next big play?

With 1,659 daily $100K+ LINK transactions—the highest since 2023—and 9,531 active wallets, momentum is building. Once the sell-side pressure fades, Chainlink could target its $30 high again. But there’s one more key factor.

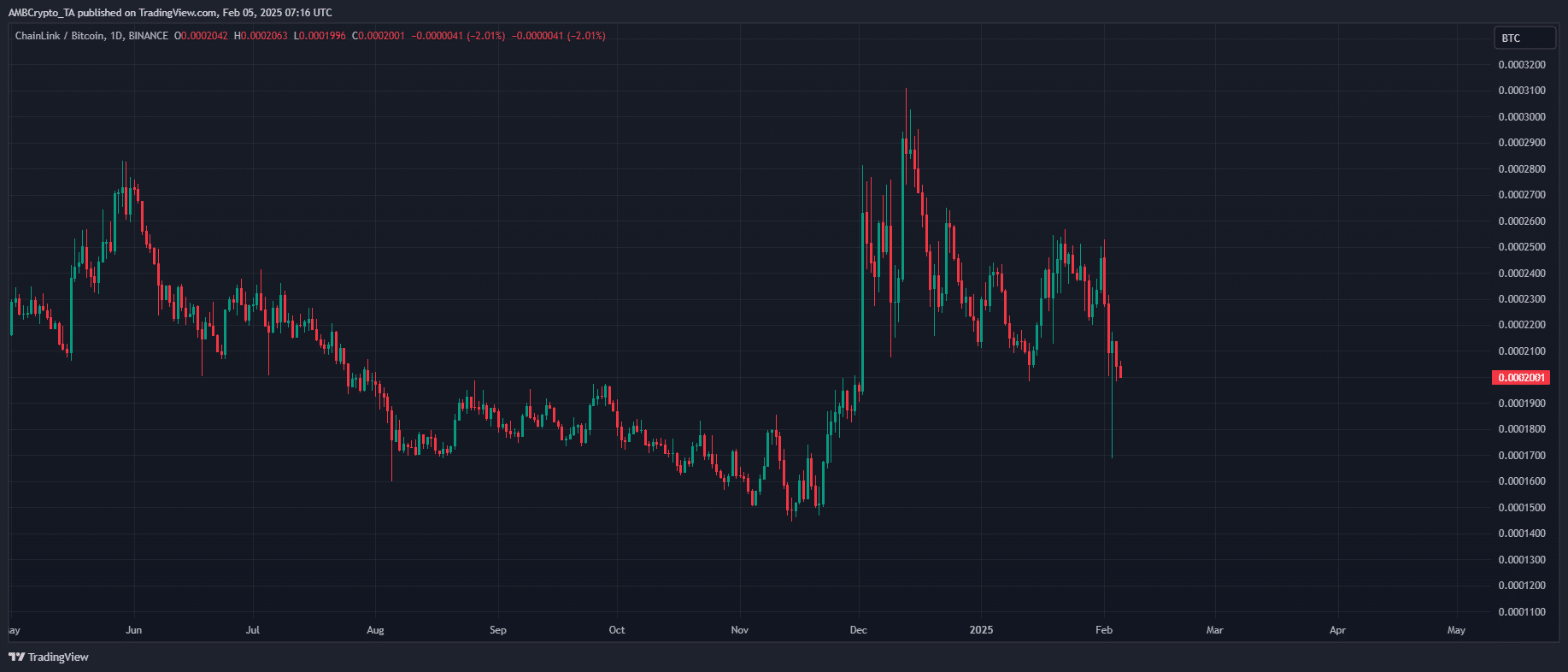

The LINK/BTC pair posted its longest green candlestick, with a 22% daily gain, matching LINK’s $30 high as BTC surged past $100K.

The broader bullish sentiment pushed investors toward Chainlink, boosting its market cap to a three-year high of $18.32 billion.

For a sustained rebound, the broader market must recover. The crypto market cap is currently 13% off its peak.

Read Chainlink’s [LINK] Price Prediction 2025–2026

In the meantime, Chainlink is showing strong fundamentals and could present a prime dip-buying opportunity for a potential 40% rebound.

Whale activity and daily transactions are breaking monthly lows, positioning LINK as the “asset to watch” once economic uncertainty clears.