- Litecoin’s daily 24-hour volume and daily active address soared by 65% and 7.5%, respectively.

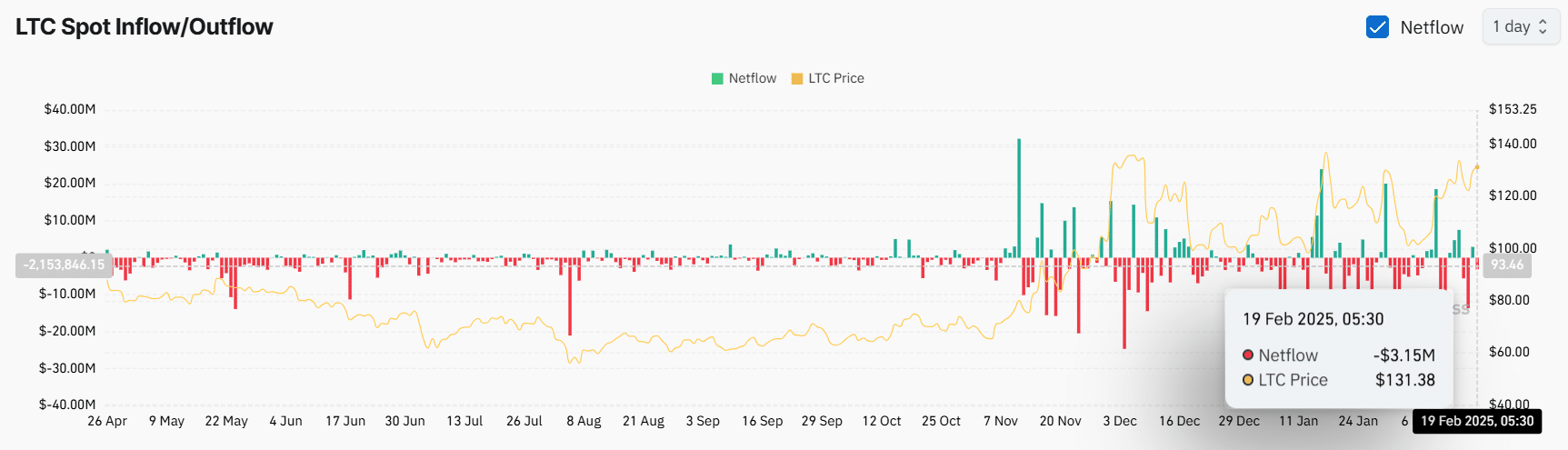

- Exchanges have seen an outflow of $3.5 million worth of LTC tokens.

In the current market sentiment, Litecoin [LTC] has been making waves with its impressive performance over the past 24 hours.

The asset has defied the market’s bearish trend and outperformed major assets like Bitcoin [BTC] and Ethereum [ETH] as well.

Litecoin flips AVAX and SUI

However, not only has Litecoin outperformed the majority of assets, but with a recent jump of over 8.50% in the past 24 hours, it has also flipped Avalanche [AVAX] and Sui [SUI].

With this price surge, LTC had started to trade near $131.50 at press time, gaining massive attention and participation from traders.

Data showed that trading volume and daily active addresses for the asset have soared by 65% and 7.5%, respectively, in the past 24 hours, according to reports from CoinMarketCap and IntoTheBlock.

Rising bullish activity by long-term holders

When examining this data, it appears that bulls were dominating the asset at the time of writing, as reported by the on-chain analytics firm Coinglass.

Given the bullish price momentum amid the bearish market trend, long-term holders and investors appeared to be accumulating tokens.

Data from spot inflow/outflow revealed that exchanges have witnessed an outflow of $3.15 million worth of LTC tokens, indicating potential accumulation.

In such market conditions, experts and analysts view this as a bullish sign, as it has the potential to create buying pressure and drive further upside momentum.

Traders’ over-leveraged positions

However, not only have long-term holders and investors been potentially accumulating the token, but intraday traders are also betting on the bullish side.

At press time, data showed that traders were going long are over-leveraged at $129.5, holding $7.60 million worth of open long positions.

Meanwhile, $134 is another key level where short traders were over-leveraged, holding $3.53 million worth of short positions at press time.

This on-chain data and the presence of over-leveraged positions indicate that bulls are currently in control and could support LTC in sustaining its upward momentum.

Price action and upcoming levels

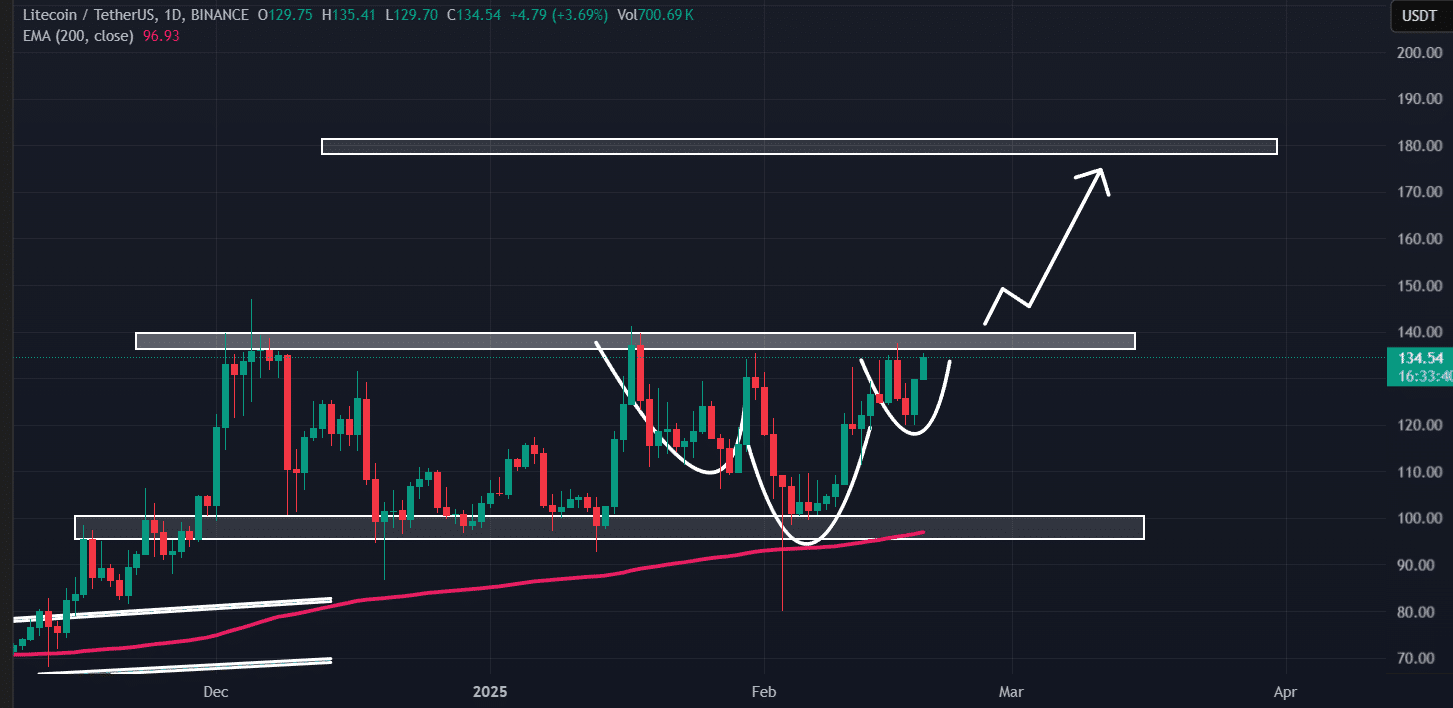

This rising interest from traders and investors, combined with the impressive price surge, has pushed LTC to a crucial resistance level of $140, which has historically triggered selling pressure and price drops.

Besides this resistance, the asset also appeared to be forming a bullish inverted head and shoulders pattern on the daily timeframe, with the same resistance level acting as the neckline.

Based on the recent price momentum, if LTC continues this upside movement and breaks the resistance level, closing a daily candle above $140, it could surge by 25% to reach $180 in the coming days.