- MKR’s 4-hour Binance chart showed a strong uptrend, with a 50% gain since the iCrypto alert.

- If buying pressure persists, MKR could break resistance, but failure to do so may lead to a retracement.

The cryptocurrency market has seen heightened activity surrounding Maker [MKR], which surged 20% in recent hours, extending its 50% increase since the iCrypto alert.

This rapid price movement attracted investor attention, particularly from whales, whose transactions often signal potential trend shifts.

A significant whale trade has sparked debate—does this indicate profit-taking, or can MKR sustain its momentum?

Profit-taking or market signal?

A major whale, 0x637 (“inveteratus.eth”), sold 1,230 MKR for $1.78 million USDC, averaging $1,448 per MKR.

This transaction yielded a $418,000 profit, reflecting a 30.6% gain in less than a month. Such a move suggests caution, as large holders often exit near potential peaks.

However, this could also be a strategic profit-taking move, allowing room for continued market participation.

The sell-off aligns with historical whale behavior, where large trades often influence market sentiment and price direction.

MKR approaches key resistance

Further, MKR’s 4-hour Binance chart shows a strong uptrend, with a 50% gain since the iCrypto alert, nearing diagonal resistance at $1,448.

At press time, the 9-day EMA crossover suggested a bullish continuation, but the RSI at 85.45 signaled overbought conditions. This raises the possibility of a pullback or consolidation.

A notable spinning top candlestick has formed during the uptrend near the resistance zones, indicating further that a reversal is bound to take place.

The Whale Index at 143,385 confirms significant whale involvement, aligning with recent sell-offs.

If buying pressure persists, MKR could break resistance, but failure to do so may lead to a retracement.

Exchange outflows signal market sentiment shift

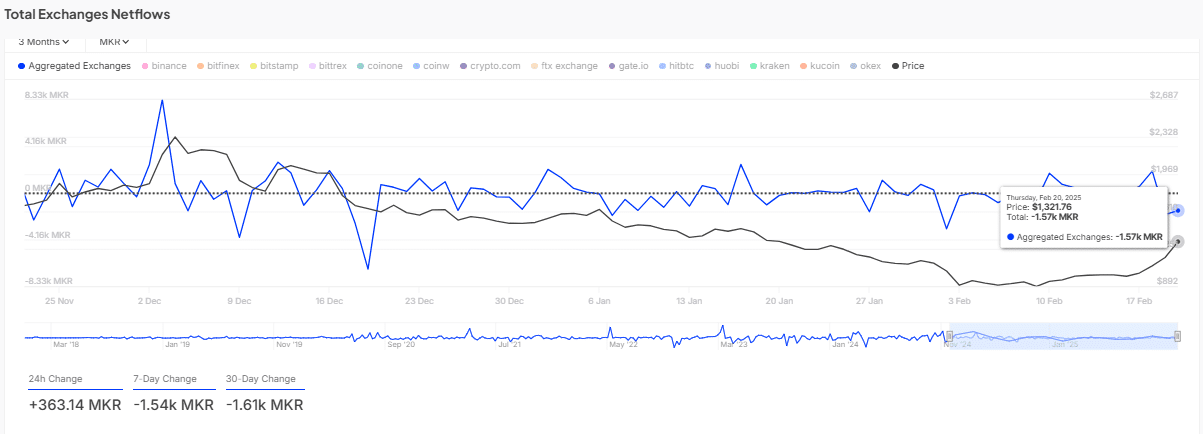

Furthermore, the three-month net flow analysis shows an uptick in activity, with a net outflow of -1.57K MKR, at the time of writing.

This indicates holders moving MKR off exchanges, possibly for long-term storage, reducing selling pressure.

Key observations include +363.14K MKR in the 24-hour net flow, indicating short-term inflows linked to whale sales.

Also, -1.54K MKR in the 7-day net flow suggests a slight net outflow over the week. Lastly, -1.61K MKR in the 30-day net flow reflects a steady decrease in exchange supply.

This mixed pattern suggests potential price stability if buying interest remains strong. However, large-holder movements could introduce volatility.

MKR: The battle between bulls and bears

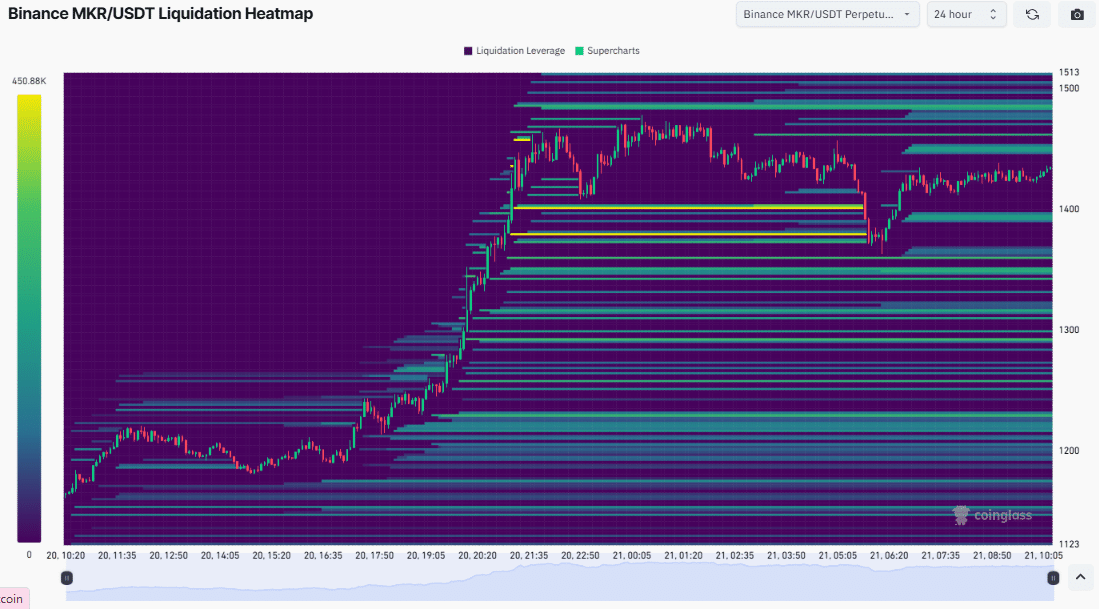

The 24-hour liquidation heatmap for MKR/USDT highlights critical levels that may trigger volatile price swings.

MKR’s price fluctuated between $1,123 and $1,513, with dense liquidation clusters near $1,400–$1,500.

Analysis shows long liquidations dominating above $1,450, indicating traders betting on price increases. This setup suggests that a failed breakout near $1,448 could trigger long liquidations, pushing prices lower.

Conversely, a break above $1,500 could force short liquidations, fueling further upside momentum.

If MKR breaks through resistance, it could extend its rally. Failure to do so may result in a correction driven by liquidations and profit-taking.

Historical patterns indicate that resistance tests often lead to consolidation. Traders should watch for key breakout signals before making strategic moves.