In the previous couple of days, there have been huge adjustments in crypto land. In simply 24 hours, greater than $550 million was liquidated. When Bitcoin fell to its weekly low, it brought on a flood of sell-offs that brought on about 170,000 merchants to lose cash on their accounts.

Associated Studying

Coinglass reports such super losses to be positioned at $118 million in BTC longs, $54 million in ETH longs, and even $25 million in Dogecoin lengthy positions.

This surge in liquidations, at the side of a lower in market capitalization and buying and selling quantity, emphasizes the volatility that merchants have come to anticipate. That is perceived by analysts as a element of a extra intensive sample of corrections which have occurred within the wake of Bitcoin’s latest rally to near-record ranges.

Bitcoin Dominance & Liquidation Tendencies

Bitcoin’s dominance stays strong, with a present market capitalization of $3.23 trillion, which accounts for over 56% of the entire crypto market. The best liquidation of the day was a $4.67 million BTC/USDT alternate on Binance, which is indicative of the excessive stakes concerned in leveraged buying and selling.

Moreover, altcoins weren’t spared. Vital declines have been noticed in tokens with a smaller market capitalization, with the broader market dropping roughly $100 million.

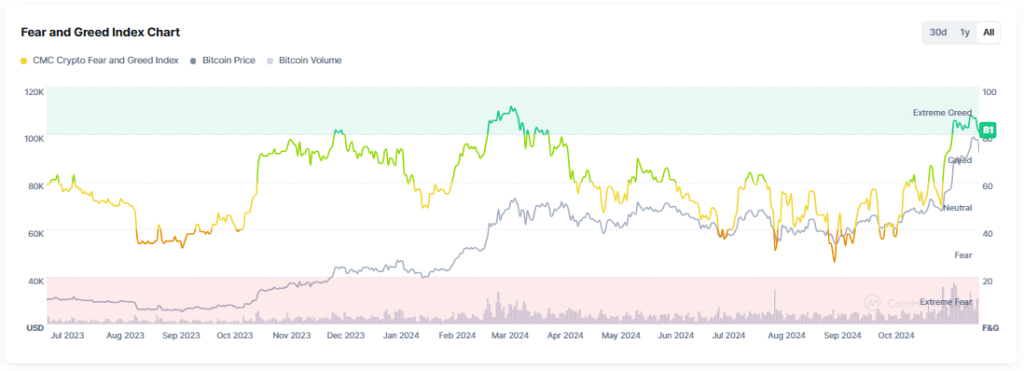

Some analysts assume that is simply one other traditional correction, following the hefty near 44% rise in Bitcoin value since early November. At current, the crypto Concern and Greed Index stands at 82, suggesting that the prevailing dominance available in the market continues to be “Extreme Greed.”

Ethereum And Altcoins Keep Their Poise

Ethereum stays resilient, even supposing it was not spared from the day’s losses. The unsure sentiment surrounding the second-largest cryptocurrency was underscored by a mixture of lengthy and quick liquidations in ETH positions.

Within the interim, altcoins similar to Dogecoin, which have been regularly bolstered by meme-driven enthusiasm, skilled the repercussions of market corrections, a warning to merchants who have been searching for speedy income.

An trade analyst named Miles Deutscher observed that extra merchants are reactivating their wallets after not utilizing them for months. They’re doing this as a result of they’re all in favour of the opportunity of altcoins and Bitcoin’s robust efficiency. Because the market continues to comply with its traditional developments, this enhance in exercise might result in each development and volatility.

Associated Studying

The Street Forward For Bitcoin

At $92,801, Bitcoin nonetheless lags considerably behind its all-time excessive of $99,750, attained earlier this month. The subsequent motion divides analysts; some consider the market is prepared for consolidation prior to a different surge past $100,000. Others warning that overlevers might trigger short-term better volatility.

Buyers are keenly monitoring market temper and macroeconomic components. Though present situations might promote bullish momentum, the crypto market’s extreme value volatility and large leverage dangers remind us of its unpredictable nature.

Featured picture from DALL-E, chart from TradingView