- PEPE has recorded one of the most significant market declines, but still holds key support levels.

- Rrising accumulation in the spot market increases the likelihood of a PEPE rebound.

In the past 24 hours, Pepe [PEPE] has experienced one of the steepest market drops, falling by 9.37%.

This decline comes amid a broader market correction, with the memecoin sector seeing an overall drawdown of 3.03%, while trading volume surged by 67% to $9 billion.

Currently, market analysis indicates that PEPE has a strong potential to rebound, returning profits to investors, as key market conditions shift toward a bullish outlook.

Bullish bounce ahead of PEPE

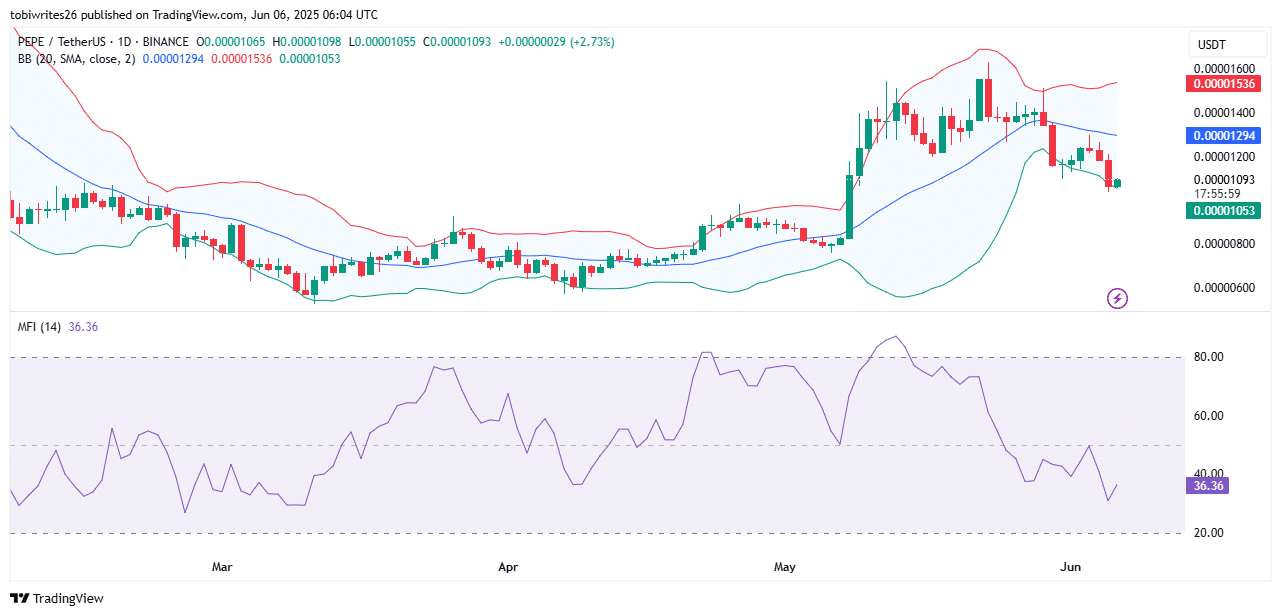

Chart analysis using technical indicators suggests the possibility of a major rally remains intact, supported by the Bollinger Bands (BB) and the Money Flow Index (MFI).

The Bollinger Bands identify key support and resistance zones, using the upper band (red) and the lower band (green).

At present, PEPE is trading at the lower band, forming a green candlestick. If additional green candles form, it would signal that bulls are entering the market.

At the same time, the Money Flow Index confirmed that liquidity was flowing into the market as well.

Liquidity inflows indicate that investors are currently buying. However, the overall liquidity level remains low, which adds caution to the outlook.

The MFI was 36.36 at press time. A reading below 50 confirms a low-liquidity environment, reinforcing the cautious sentiment.

Accumulation and long bets add momentum

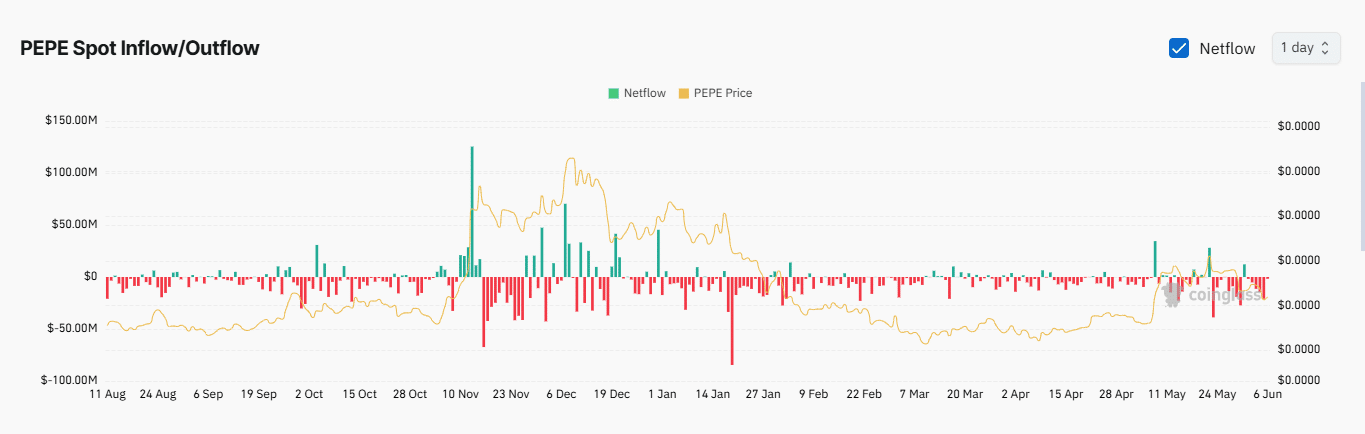

Analysis reveals consistent accumulation of PEPE in the spot market.

Exchange Netflow—which tracks spot trader activity across platforms such as Binance and Bybit—confirms this trend.

Over the past 48 hours, these traders have accumulated $22.54 million worth of PEPE, a significant purchase.

This accumulation suggests strong bullish sentiment, as traders appear to view the recent price dip as a buying opportunity ahead of a potential rally.

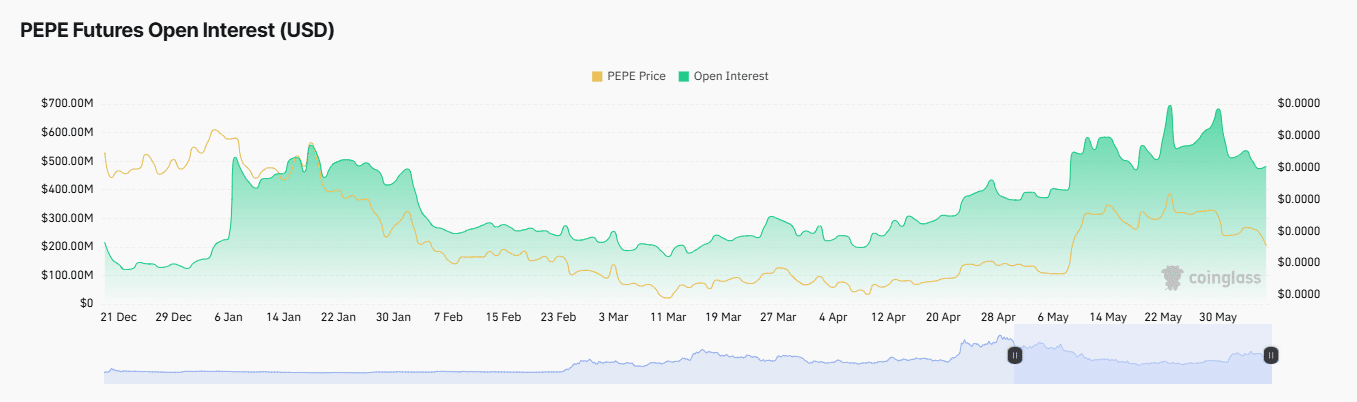

Derivative traders show a contrasting trend. While buying surged in the spot market, this group opened additional contracts.

Open Interest—which measures the number of active contracts—has reached $520.4 million. However, derivative volume currently favors sellers, with the sell volume dominance ratio at 0.937.

While this puts PEPE in a tight spot, continued accumulation could force short sellers into liquidation.

What does investor sentiment show?

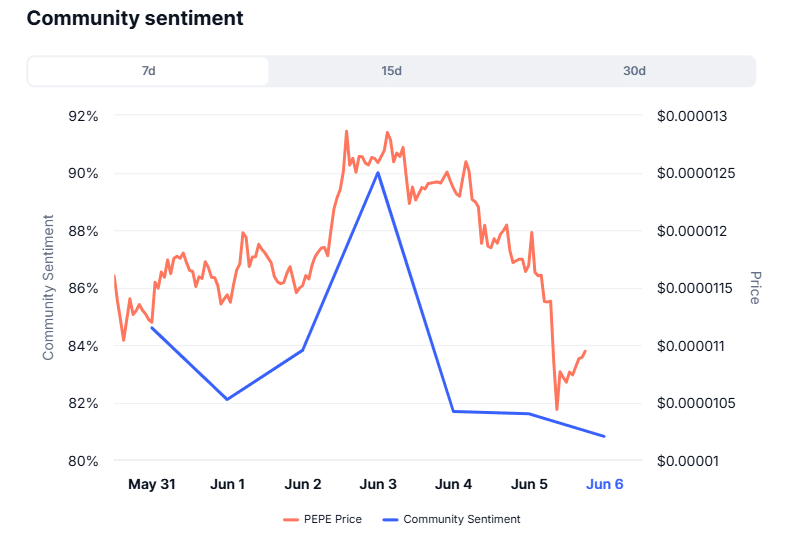

Investor sentiment remains high, despite the divergence between the spot and derivatives markets. This metric on CoinMarketCap reflects how PEPE holders position themselves—either bullish or bearish.

Currently, sentiment has dropped from 90% on the 3rd of June to 80.8%, marking a 9.2% decline. Despite this drop, the majority of investors remain strongly bullish on the asset.

Typically, a sentiment reading above 50% suggests that investors are willing to continue buying, even during downturns. If this persists, PEPE stands a strong chance of rallying further.