- PEPE was trading in an accumulation phase, a bullish technical pattern.

- Technical indicators confirmed the bullish sentiment, along with the consistent purchase of PEPE.

In the past month, Pepe [PEPE] has been on a downward streak, recording a 47.78% loss. In the past 24 hours, PEPE has continued on that path with a 1.89% decline.

New market developments suggest that PEPE could likely reverse, as several bullish sentiments are beginning to surface, particularly the current accumulation. However, some segments of the market remain bearish.

A path to a major price rally

On the 4-hour chart, PEPE is trading within an ascending channel, a consolidation phase with defined support and resistance zones.

At the time of writing, PEPE has just reacted off the support level and is moving toward the upper resistance level at $0.00001056. A breach of this resistance level would confirm bullish strength in the market.

From the base of support to the peak of the rally at $0.00001477, PEPE would have recorded a gain of 54.22%.

However, the asset could encounter resistance along the rally path at $0.00001137, $0.00001217, and $0.00001331.

Further analysis indicates a rally is in motion as more buyers step in.

Ongoing accumulation of PEPE

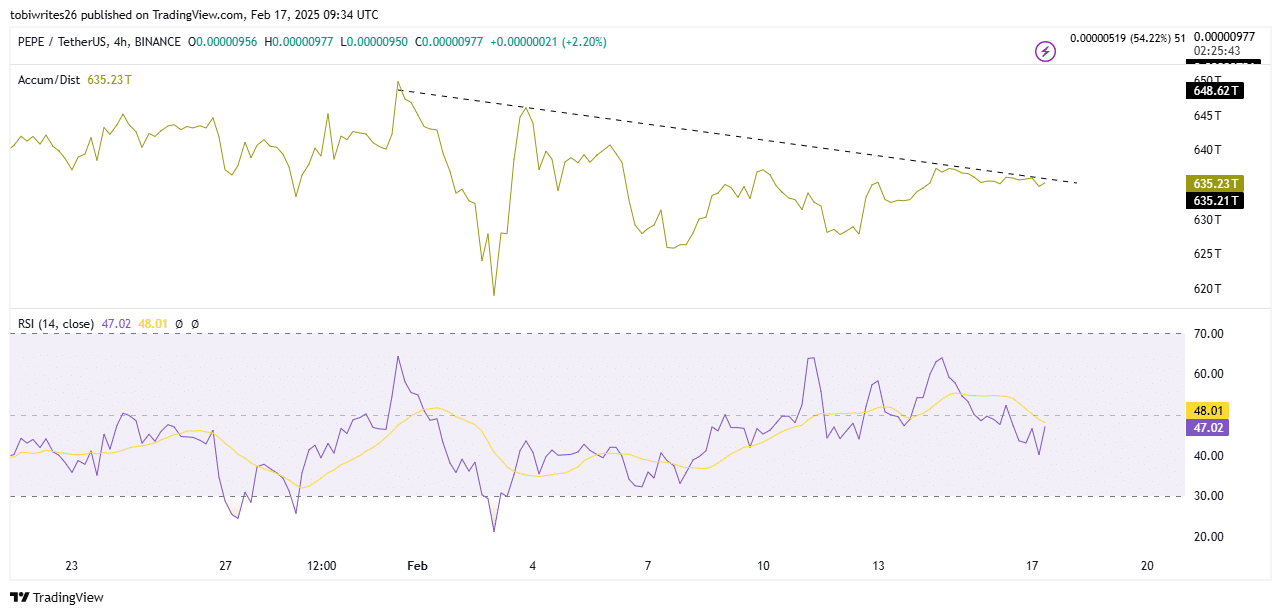

Using the Accumulation/Distribution Ratio on the chart, AMBCrypto found ongoing accumulation in the market, with a potential 635.23 trillion PEPE traded at that level.

While this is a bullish sign, as its trend is facing upward, the formation of a descending line pattern marked by the dotted line suggests that significant accumulation may occur in the coming trading sessions.

Should this happen, it would indicate increased buying activity, potentially pushing PEPE past major resistance levels ahead.

At the time of writing, the Relative Strength Index (RSI) showed buying activity resuming. With a current reading of 47.02 and the line trending upward, if RSI crosses above 50, the presence of bulls in the market would be confirmed.

Exchange Netflow data from Coinglass adds to this bullish sentiment. Typically, a negative exchange netflow (red) indicates buying activity, while a positive netflow (green) suggests selling.

Since the first week of 2025, consistent buying activity has been observed in the spot market. Last week, a total of $30 million worth of PEPE was purchased from exchanges.

The largest purchase this year reached $148.86 million. If this buying activity continues, PEPE could continue to surge.

Minor selling pressure remains

The Open-Interest Weighted Funding Rate, which combines data from the derivatives market’s Open Interest (OI) with the Funding Rate to determine potential price direction and sentiment, currently shows a bearish sentiment.

Data shows that after the OI-Weighted Funding Rate peaked at 0.0101% on the 14th of February, it has since declined to 0.0002, remaining in the negative region. This indicates there are more sellers in the market, which could impede PEPE’s potential rally.

If the OI-Weighted Funding Rate begins to trend higher, it would further strengthen the overall bullish sentiment.