- PEPE showed a bullish signal but remained in a downtrend, facing key resistance.

- Declining active addresses and transaction volumes hindered PEPE’s potential rebound.

Pepe [PEPE] recently showed a buy signal on the weekly chart, courtesy of the TD Sequential indicator. While this suggests a potential reversal, PEPE has been trading in a downtrend for an extended period.

At press time, PEPE was trading at $0.00009926, reflecting a 3.90% increase over the past 24 hours. However, can this bullish signal reverse the current downtrend and trigger a sustained rally?

Can PEPE break through key resistance levels?

The price action indicated that the cryptocurrency was testing key levels, but it still faced significant resistance. PEPE was consolidating around $0.000099, with the next resistance zones at $0.0001395 and $0.0002108.

The TD Sequential indicator’s buy signal suggested a potential reversal, but PEPE’s ability to break through these resistance levels will determine the next course of action. If it fails to push higher, the downtrend could continue.

Moreover, the Relative Strength Index (RSI) reading of 35.56 indicated that the memecoin was nearing oversold territory, adding further uncertainty to the potential rebound.

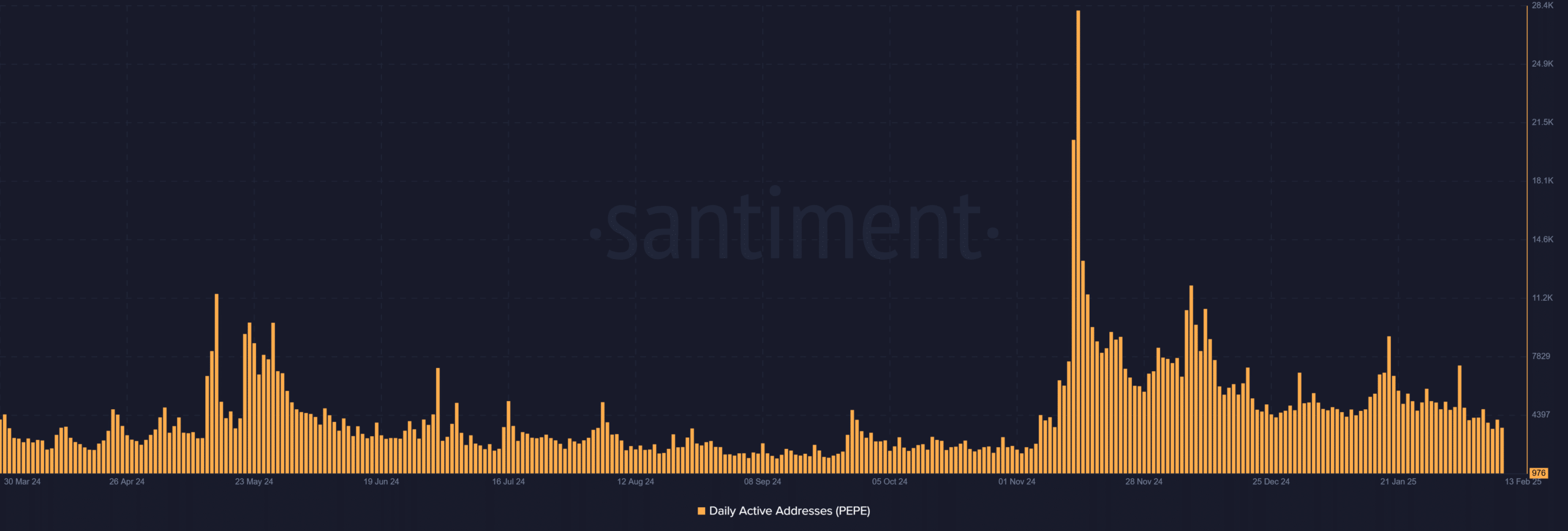

What’s behind the declining daily active addresses?

Despite the buy signal, daily active addresses were showing a concerning decline. As of the 13th of February, PEPE had only 976 active addresses, a notable drop from previous months.

This decline suggested waning interest from retail investors, which could further hinder its recovery. If the cryptocurrency fails to reignite interest from users, the potential for a sustained rally becomes increasingly unlikely.

PEPE must address this decline in activity to avoid further pressure on the price.

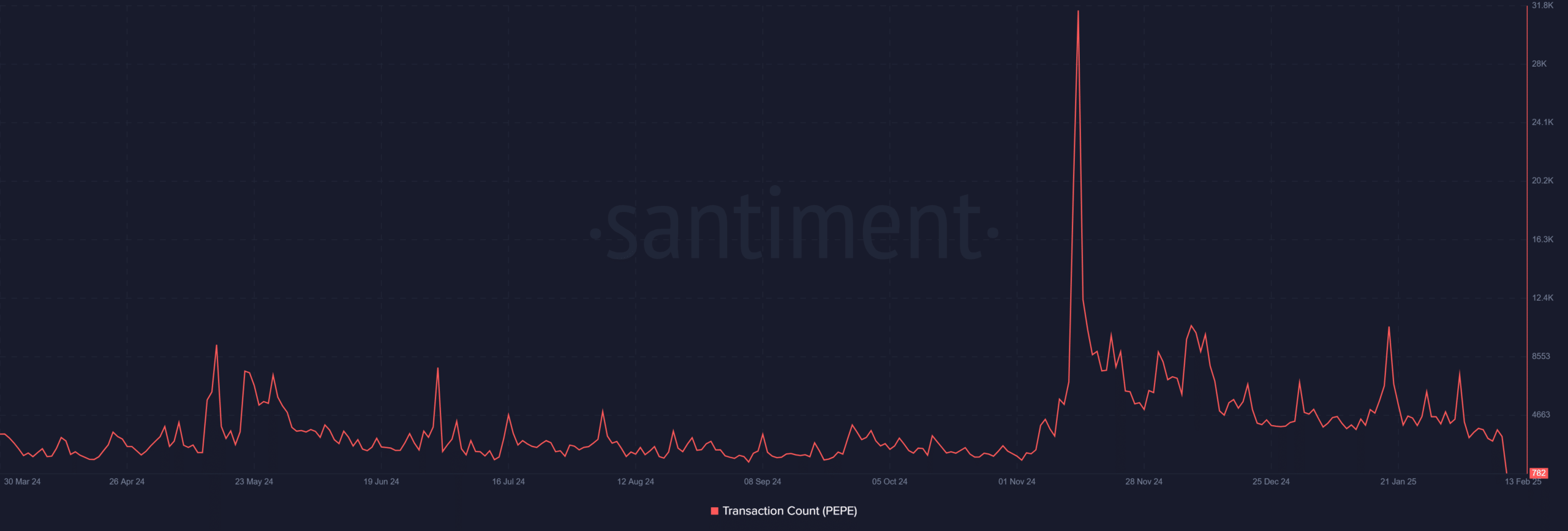

Are the transaction volumes signaling weakness?

The transaction count has also been on the decline. On the 13th of February, the cryptocurrency recorded only 782 transactions, significantly lower than its peak volumes.

This drop indicated that market participants were not as engaged, potentially limiting short-term growth.

Without an increase in transaction volume, PEPE may struggle to gain traction and could continue its downward movement.

If it manages to spark renewed interest, however, the transaction count could increase, supporting the potential for an upward move.

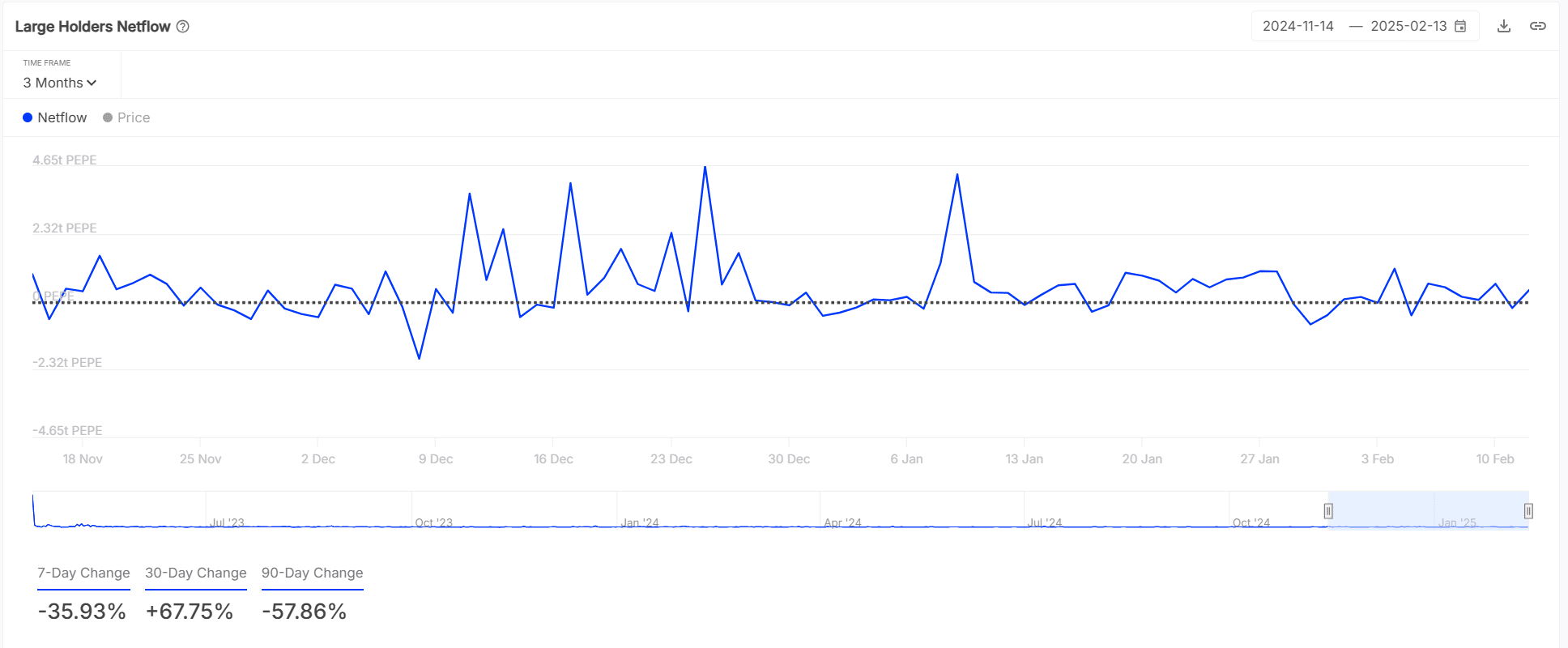

What do large holders think of PEPE’s future?

Large holders have displayed uncertainty regarding the cryptocurrency’s future. Net flows of tokens from large investors have fluctuated significantly, indicating that big players are not making strong, decisive moves.

The 7-day change for large holders shows a significant decline of -35.93%, while the 30-day change has increased by +67.75%.

However, the 90-day change shows a more considerable drop of -57.86%, reflecting a cautious long-term outlook.

This cautious stance among major holders could prevent the memecoin from sustaining any bullish momentum and may contribute to the ongoing downtrend.

Conclusively, despite the bullish signal from the TD Sequential indicator, PEPE continues to trade in a downtrend with declining active addresses and transaction volumes.

The RSI reading suggests that PEPE is nearing oversold conditions, and large holders remain cautious.

For now, the outlook remains uncertain, and the next few days will be critical in determining whether it can reverse its downtrend.