- Two whales exited at a $7M loss as PEPE failed to break resistance.

- Rising NVT and negative MVRV suggest ongoing bearish pressure despite oversold conditions.

Pepe [PEPE] has experienced back-to-back exits by two separate whales, each depositing 600B tokens back to Binance. Combined, these exits represent over $12M in liquidations, both at a loss of approximately $3.5M.

The exits occurred shortly after a failed rebound attempt and may reflect growing caution among large holders.

The whale movements also reflect potential weakness in the memecoin’s long-term conviction, especially as broader metrics and technicals also shift bearish.

Can PEPE be afloat amid mounting pressure?

PEPE recently formed a classic Cup-and-Handle pattern, typically a bullish setup. However, the pattern failed to ignite a breakout above $0.00001200, and the price retreated inside a falling channel instead.

Despite this, the descending structure remained intact at press time, with the bulls continuing to defend the $0.00001014 level.

Meanwhile, the Stochastic RSI has entered the oversold zone, hinting at a possible short-term bounce.

Still, the price must break above $0.00001280 to confirm a bullish continuation and invalidate further downside risk.

Investor apathy and reduced activity

Investor activity on the network has weakened, with all four major on-chain metrics flashing bearish signals at the time of writing.

Net network growth was just 0.70%, while “In the Money” wallets dropped by 7.07%, suggesting that many holders were underwater.

Large transaction volumes have also declined by 5.18%, indicating reduced interest from high-value players. Furthermore, concentration levels were stagnant, highlighting limited accumulation by top wallets.

These trends aligned with the broader sentiment shift as both retail and institutional interest faded away.

At the same time, PEPE’s NVT ratio surged to 137, a level not seen in recent months. This spike means that the network valuation far exceeds its on-chain activity, typically a warning sign for possible overvaluation.

When transaction volume lags behind market cap expansion, the likelihood of a price correction increases. Therefore, unless on-chain usage picks up sharply, PEPE may remain exposed to downside pressure.

Historically, such NVT spikes have preceded pullbacks, especially during sentiment-driven rallies.

PEPE losses mount

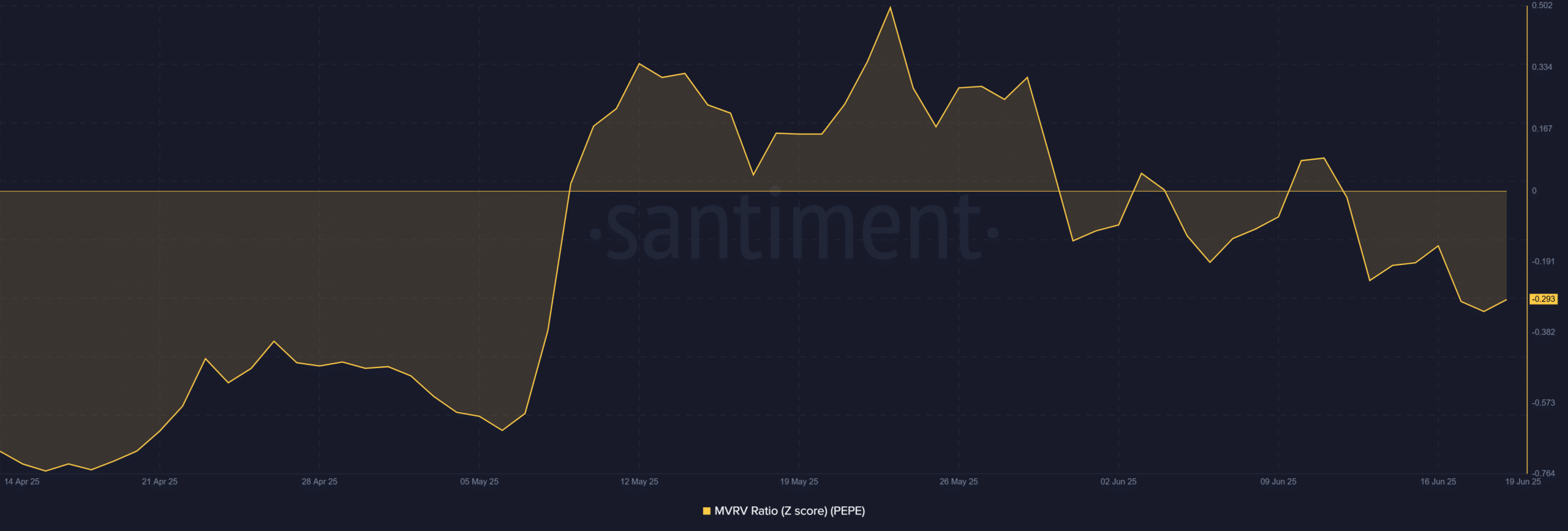

The MVRV Z-score has continued to fall, now reaching -0.29. This metric shows that, on average, PEPE holders are sitting on unrealized losses.

While this suggests the asset is undervalued, it also reflects diminished holder confidence. In many cases, prolonged negative MVRV can indicate potential capitulation or long-term accumulation.

However, in the current context—with bearish on-chain data and failed technical breakouts—it more likely leans toward ongoing weakness unless a strong reversal catalyst emerges.

Can PEPE regain strength, or is more pain ahead?

While PEPE displays oversold conditions and a possible bounce setup, broader metrics continue to reflect weakening momentum. Whale exits, rising NVT, and negative MVRV suggest that sentiment remains fragile.

Unless bulls reclaim key resistance levels near $0.00001280 with rising participation, any recovery could be short-lived.

Therefore, the risk of further downside remains elevated despite technical setups hinting at a temporary relief rally.