- PEPE’s whale activity surged 170% this week, fueling 63% recovery gains in March.

- Weak market interest and technical indicators suggested bulls weren’t out of the woods yet.

Pepe [PEPE] has attracted renewed whale interest and could have partly fueled the recent rebound. According to Spot On Chain, a newly created wallet withdrew 500B PEPE worth $4.3M from Binance.

A few hours earlier, the analytics firm also noted that an early PEPE buyer, who minted 110% on the memecoin, was bidding again. He withdrew 506.2B tokens worth $4.4M, increasing his long bet to 699.8B ($5.11M).

Can whales reverse quarterly loss?

AMBCrypto established that PEPE whale activity exploded triple-digit to 170% this week as they scooped a whopping 14.5 trillion tokens.

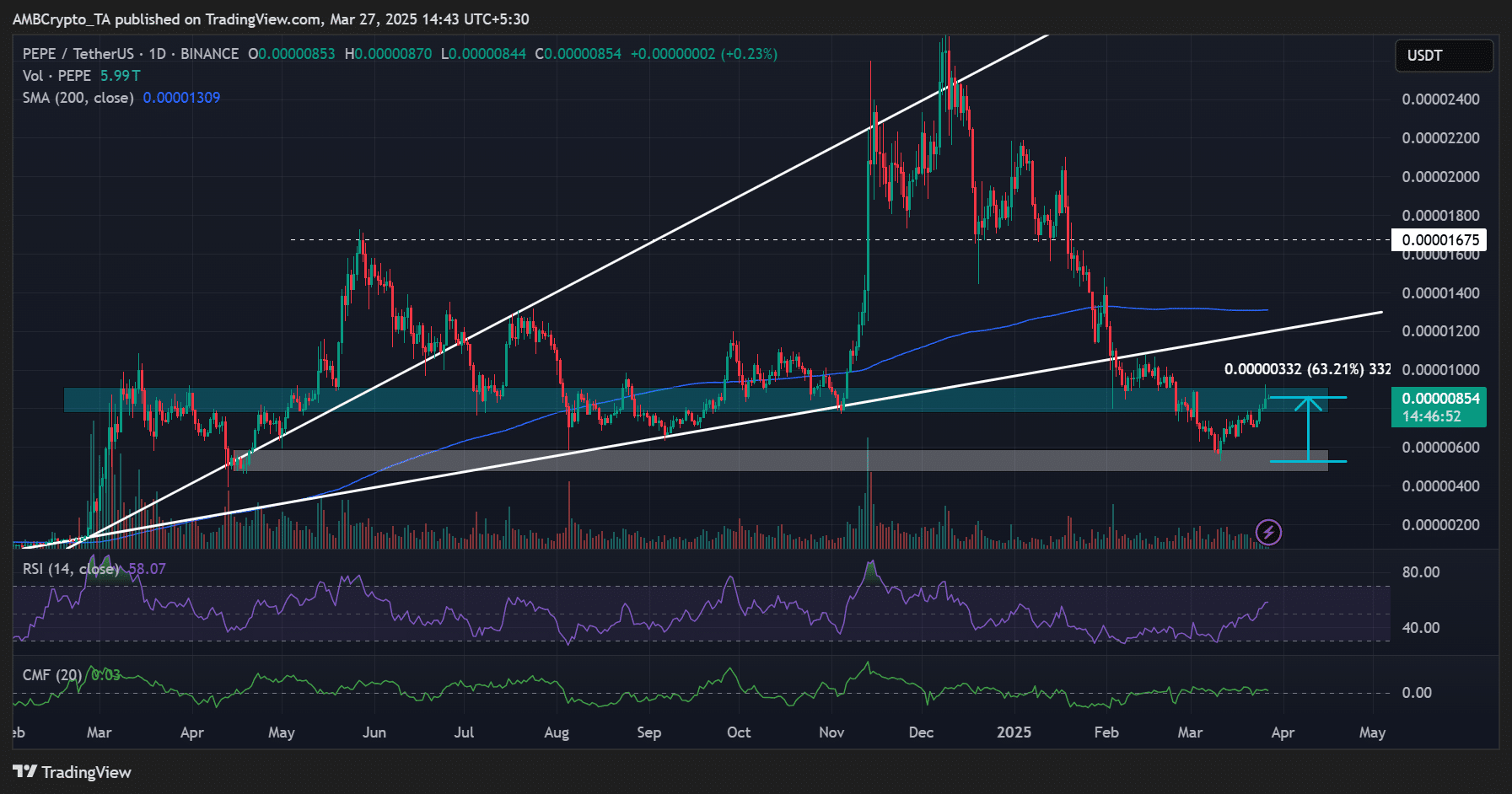

The impact of large players was evident on the price chart. PEPE was up 63% from March lows of $0.0000056.

However, the memecoin was still far away from its record high of $0.000028, which it hit last December.

In fact, PEPE tanked over 80% during Q1 drawdowns, and current levels had reduced the decline to about 70%. Simply put, those who bought the top were still in maximum pain.

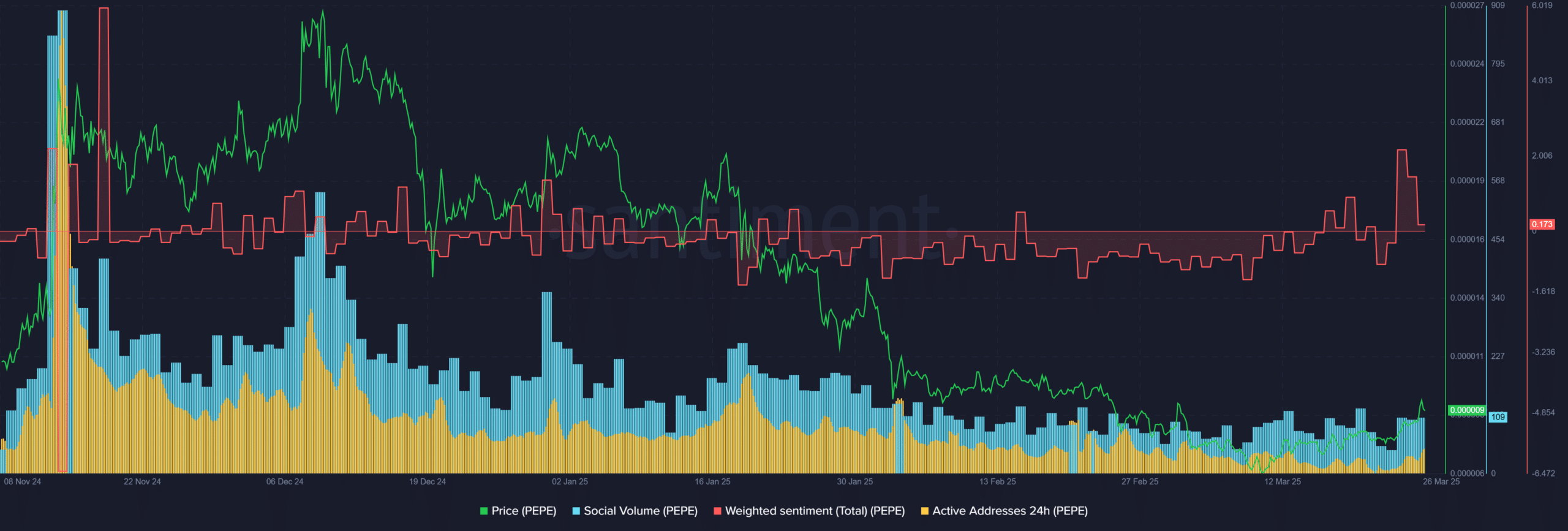

But could the renewed whale interest extend recovery? Well, key demand signals like social volume and address activity were still low, per Santiment data.

In addition, the recent positive sentiment retreated to a neutral level, suggesting that the market could go either way.

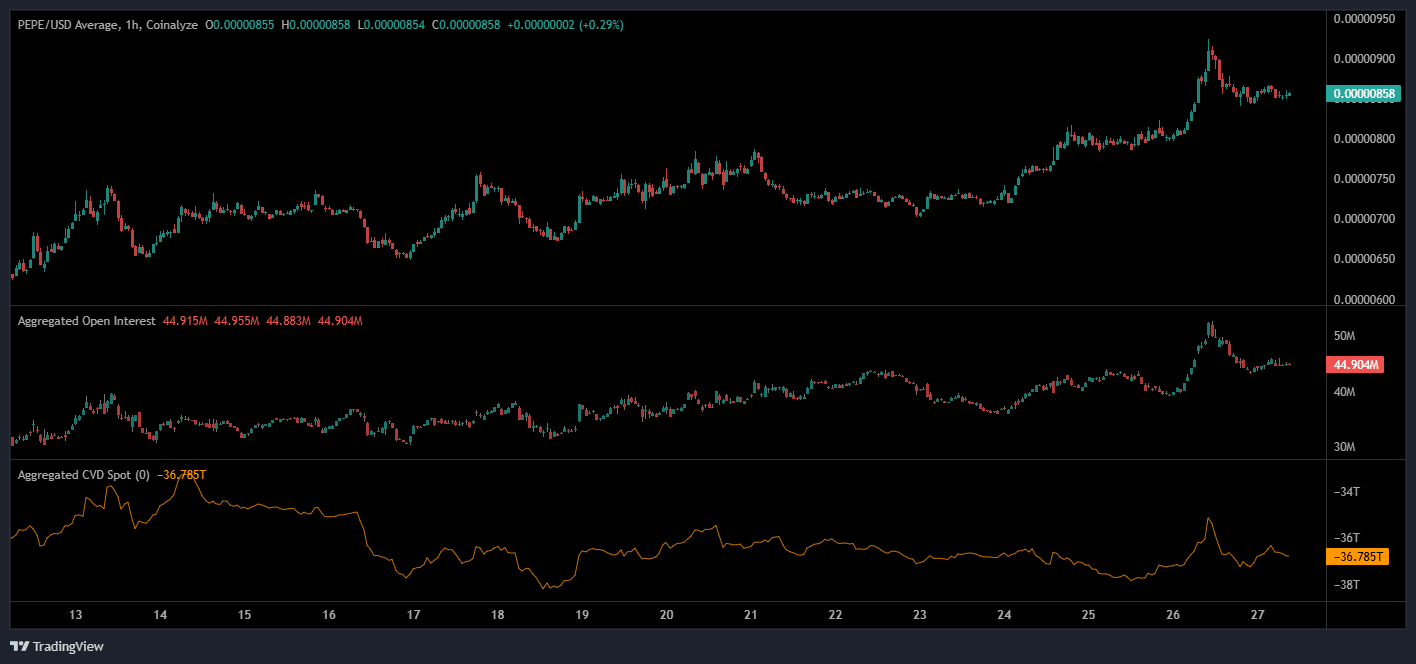

On derivative markets, PEPE’s OI (Open Interest) rates surged from $26M to $50M before easing below $45M at press time.

However, spot CVD (Cumulative Volume Delta) moved slightly, suggesting the pump might be heavily driven by leverage rather than organic spot demand.

On the price charts (3-day timeframe), PEPE’s recent 63% pump reversed all its March losses. But bulls were not out of the woods yet.

At the time of writing, price action was below the bull market trendline and 200DMA (daily moving average, blue). A surge above these hurdles would increase the chances of reversing the larger Q1 losses.