Pippin [PIPPIN] continued its explosive rally, holding an ascending channel since successfully holding $0.15. PIPPIN has closed at higher highs for six consecutive days, touching a high of $0.65, clearing all 2026 losses.

At press time, Pippin [PIPPIN] traded at $0.600, up 22.4% on the daily charts, adding to its 225% gain on weekly charts. This sustained uptick reflects consistent demand across all market participants, supporting higher levels.

PIPPIN buyers show sustained conviction

While most crypto assets have bled significantly in recent weeks, PIPPIN has made substantial gains. The memecoin’s uptrend has held, as buyers have continued to enter the market despite emerging weak points.

In fact, the memecoin’s Net Buy volume climbed to 201 million as of writing, with buy volume rising to 94.4 million on the daily charts. At the same time, its trading volume fell to 88 million, according to Coinalyze data, a clear sign of buyer dominance on the spot market.

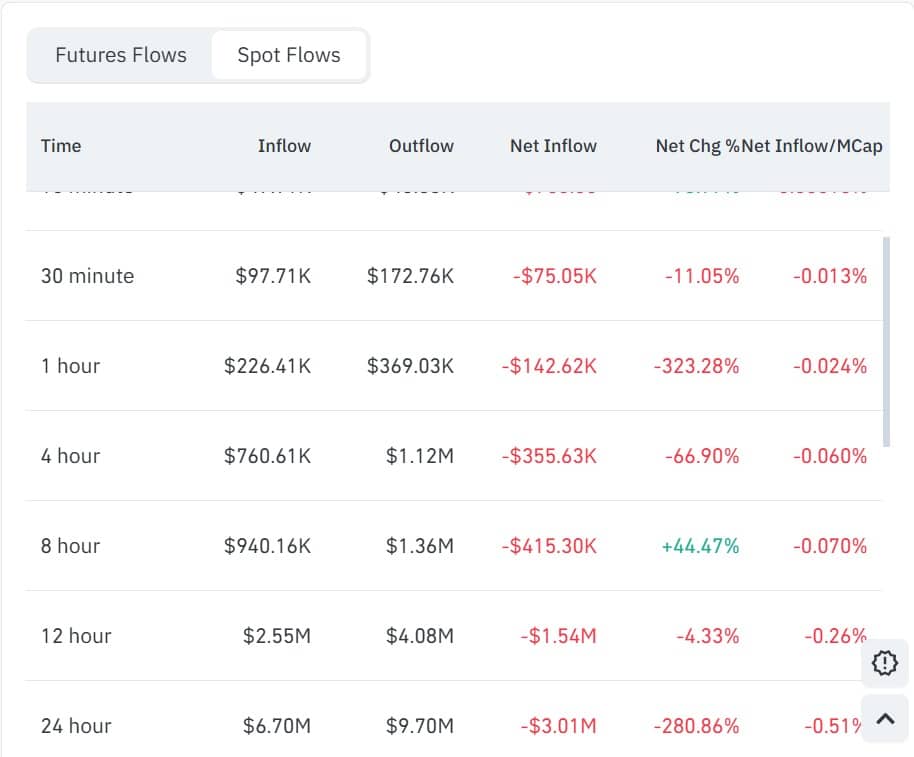

Moreover, exchange activity also echoed this accumulation trend. According to Coinglass data, $9.7 million in PIPPIN flowed out of exchanges, compared with $6.7 million in inflows.

As a result, the memecoin’s Spot Netflow fell 280% to -$3.01 million. Often, lower net flow indicates a higher accumulation rate.

With buying pressure dominating the market, it suggests healthy market sentiment, often a prelude to higher prices if sustained.

The memecoins shorts squeezed

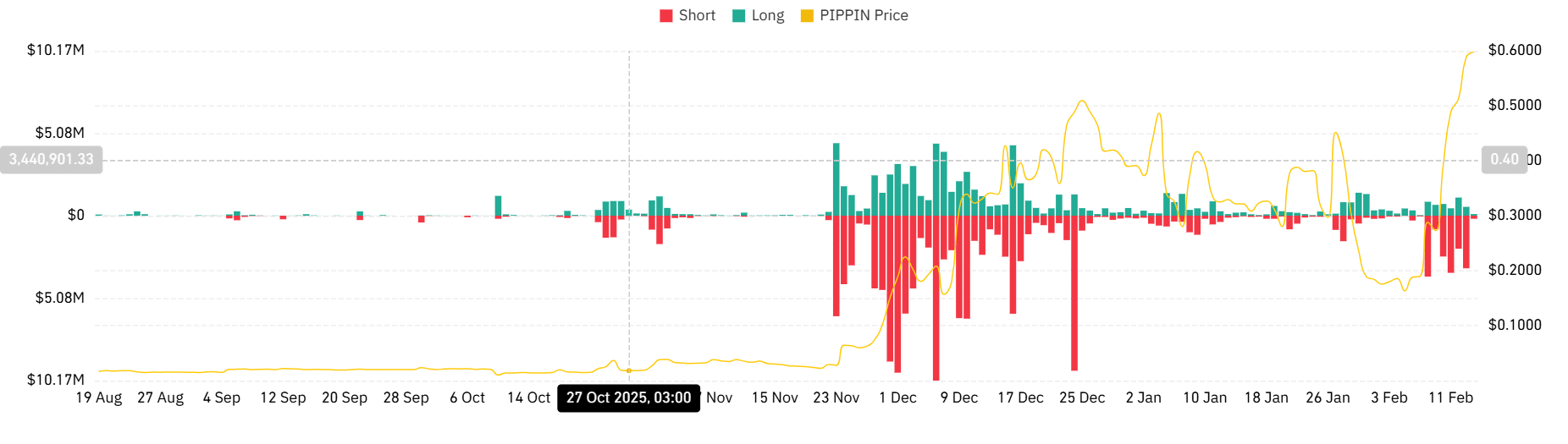

As the memecoin rally continued, demand for futures positions also skyrocketed significantly. Those shorting the market were forced to close their positions and flip to longs.

As they attempted to buy back, their buying pressure drove prices even higher, causing more shorts to close. Short position holders experienced a bloodbath with short position liquidations dominating for six consecutive days.

Over this period, short positions worth $15.7 million have been liquidated. Amid these dramatic shifts, capital began to flow into longs, with the Long-Short Ratio rising to 1.089 as of writing, driven by a 10.6% increase in Open Interest.

Often, when shorts are squeezed, while capital flows into longs, it strengthens upside momentum, leading to higher prices.

Can bulls flip $0.72?

PIPPIN showed strong, sustained bullish momentum as buyers continued to accumulate on the spot while shorts chased the rally.

In doing so, the memecoin’s Relative Strength Index (RSI) surged to 71, at press time, indicating near-total buying dominance. At the same time, it continued to hold above its short- and long-term moving averages, further validating upside strength.

With momentum indicators elevated to such levels, this indicates a healthy market structure and a high likelihood of bullish continuation.

Thus, if demand continues to dominate the market, PIPPIN will retest $0.65 and target the $0.72 resistance level. However, if sellers take the rally as an opportunity to cash out, the memecoin will retrace to $0.40 with EMA20 at $0.36 acting as key support.

Final Summary

- Pippin extended its rally, hiking to a high of $0.65 before slightly retracing to $0.600 at press time.

- The memecoin’s uptrend persisted as spot buyers continued to defend higher levels, while shorts were squeezed.