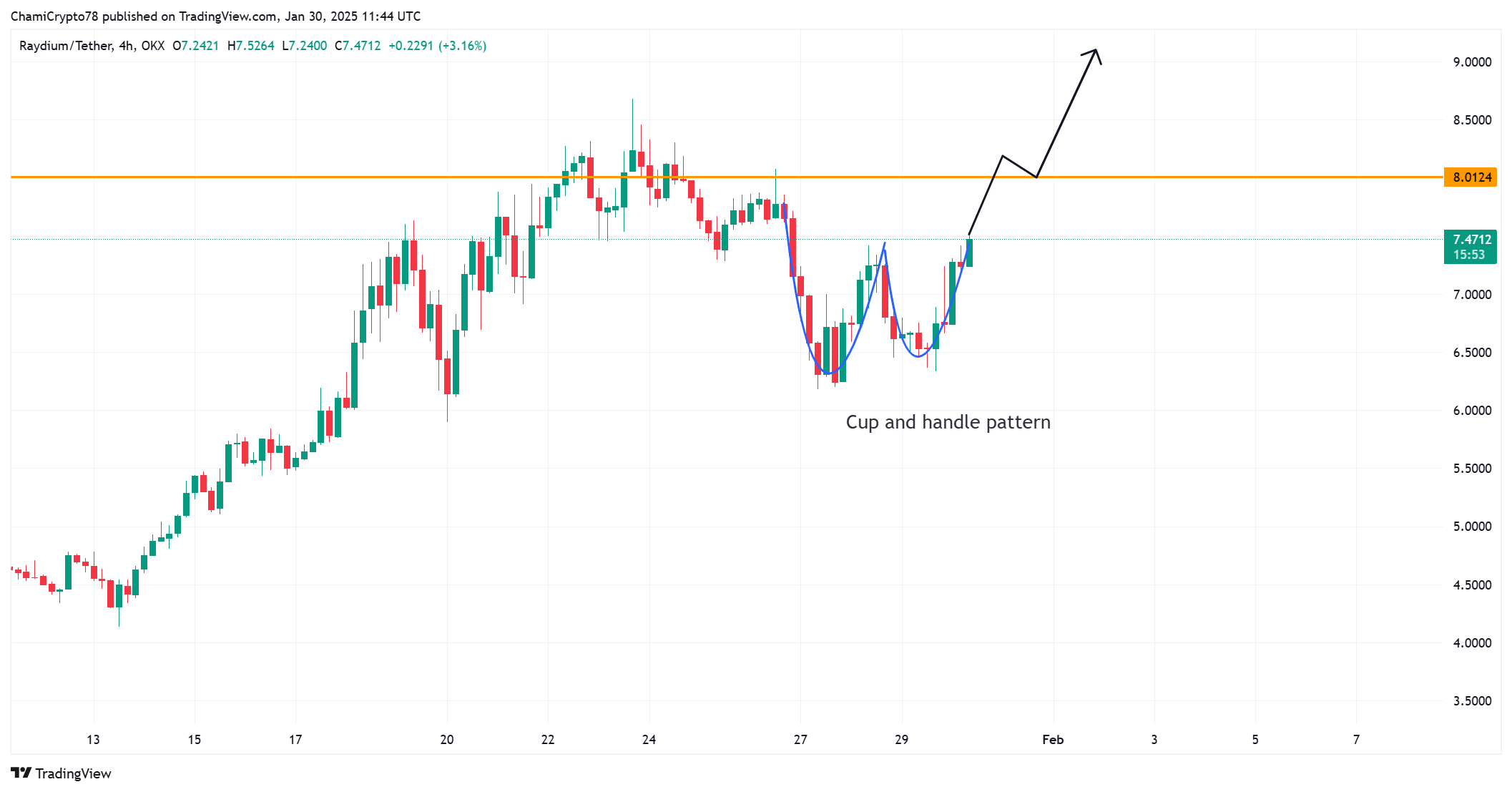

- The cup-and-handle pattern signaled a bullish breakout as RAY tested the crucial $8 resistance.

- Market indicators showed strong momentum, but RAY must hold key levels to sustain the uptrend.

Raydium [RAY] has recorded an impressive 15% surge in the last 24 hours, pushing its price to $7.50, at press time. This bullish momentum follows a cup-and-handle pattern, signaling a potential breakout.

However, the $8 resistance level remains a key barrier that must be broken for further gains. Therefore, traders closely monitor whether RAY can sustain this uptrend or face a rejection.

RAY’s price action shows a bullish breakout setup

RAY has been forming a cup-and-handle pattern, typically a continuation signal. The price has steadily recovered from its recent dip, pushing towards $8.01, the major resistance level.

If buyers maintain control, a breakout towards $9.00 could occur, driving further bullish momentum. However, failure to hold above $8.01 may trigger a pullback towards $7.20, where short-term support lies.

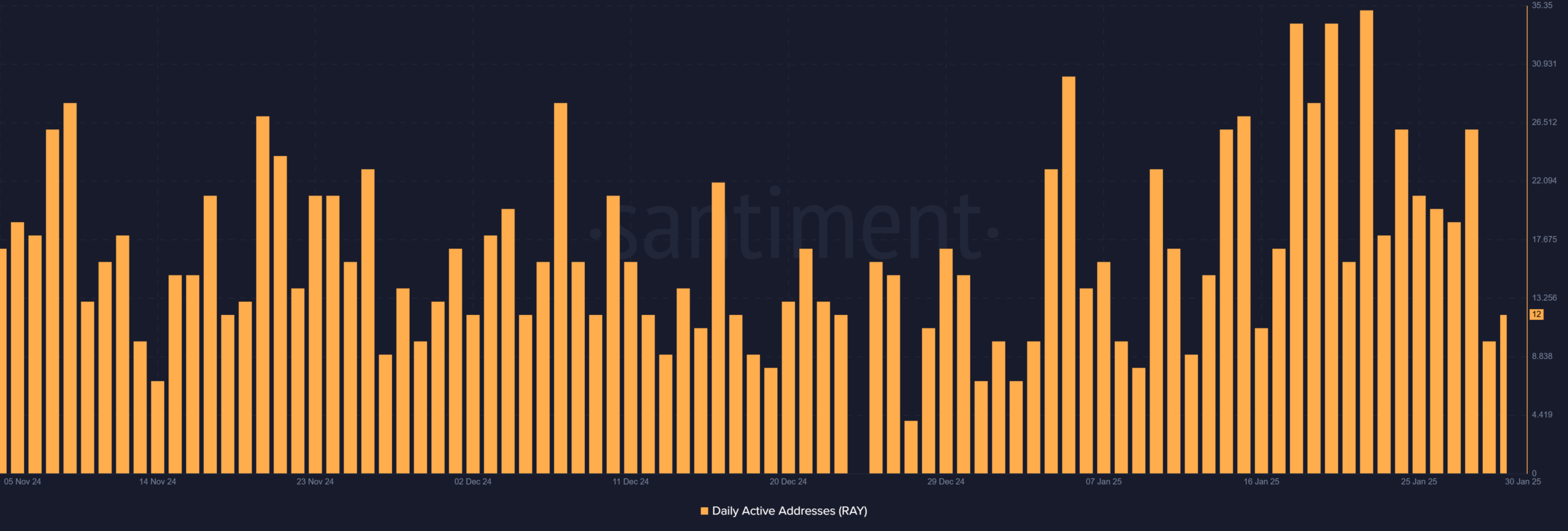

Are active addresses supporting Raydium’s rally?

On-chain data shows daily active addresses have risen to 12, suggesting increased market engagement.

Although fluctuations occur, steady growth in active addresses is generally a bullish sign, reflecting higher network usage.

If this number continues rising, it could indicate stronger demand for RAY, supporting further price appreciation. However, any sudden drop in active addresses might suggest weakening interest.

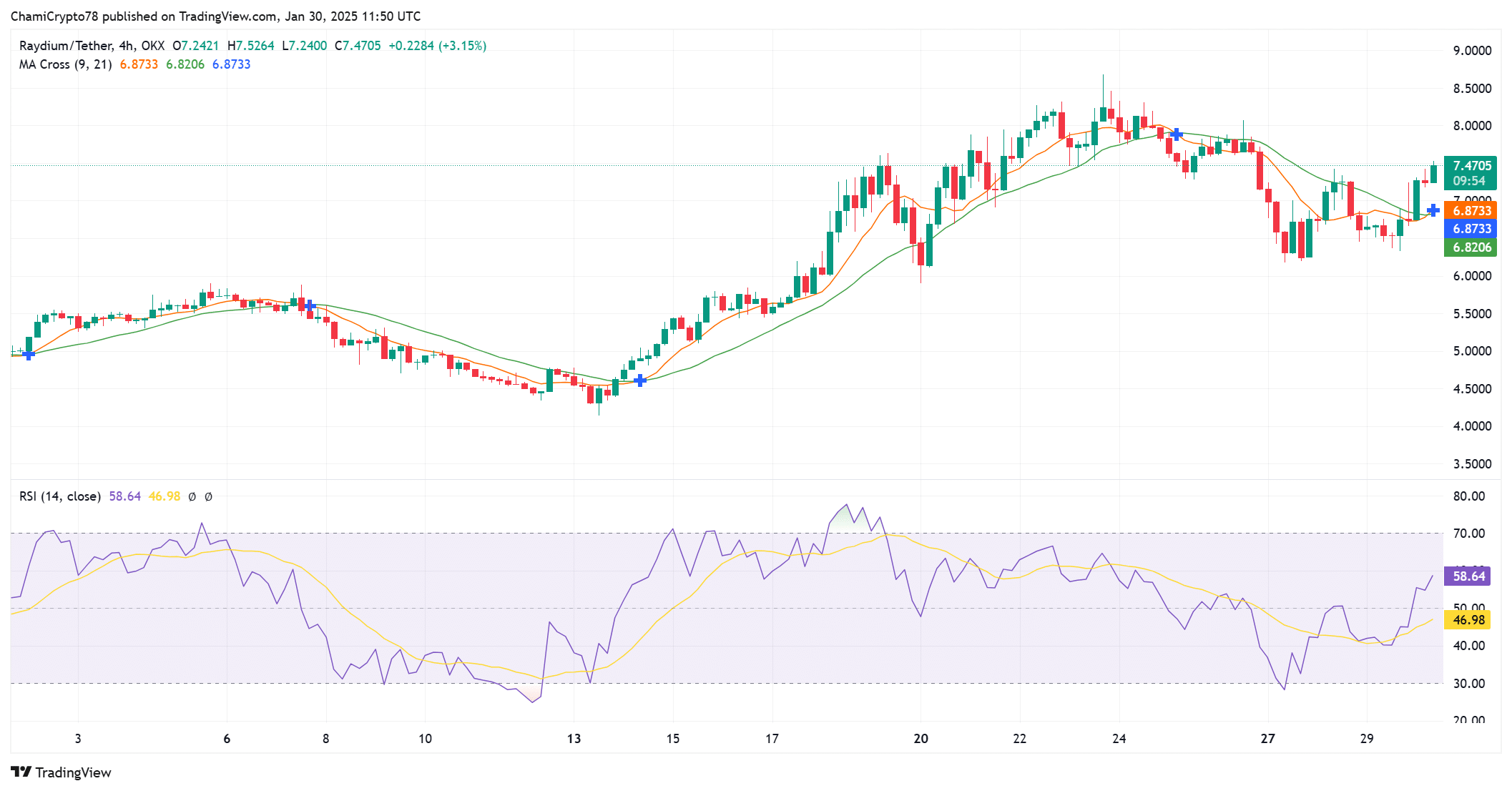

Technical indicators confirm bullish momentum

Momentum indicators suggest further upside, with the Relative Strength Index (RSI) at 58.64, indicating a strong but not overbought market.

Additionally, the 9-day Moving Average (MA) at 6.87 has crossed above the 21-day MA at 6.82, which points to a bullish crossover.

These indicators reinforce the cup-and-handle formation, supporting the case for an upward breakout. However, if RSI moves above 70, the market could become overbought, leading to a short-term correction.

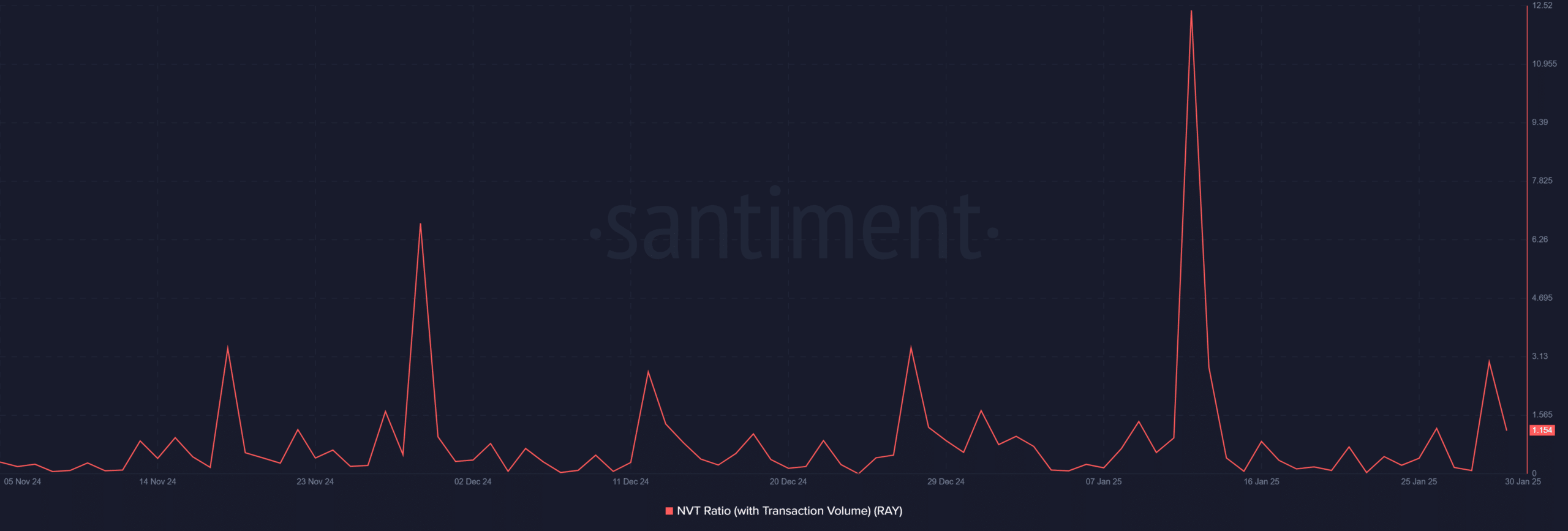

NVT ratio hints at a possible cooldown

While price action remains strong, the NVT ratio has dropped to 1.15, signaling higher transaction activity relative to the market cap.

Although a lower NVT ratio generally indicates healthy network usage, sharp declines can also suggest potential volatility.

If selling pressure rises, RAY might briefly retrace to $7.20 before attempting another breakout. However, stable transaction volumes could help sustain the rally.

Conclusion: Will Raydium break past $8?

RAY has strong bullish momentum, with rising active addresses, positive RSI, and a bullish moving average crossover. However, the $8.01 resistance level remains a major hurdle.

Read Raydium [RAY] Price Prediction 2024-2025

If buyers push through, $9.00 could be the next target. But, if resistance holds, a retracement to $7.20 is likely before another breakout attempt.