- Agency’s crypto task force met with Jito labs CEO and Multicoin capital CEO over crypto staking

- Jito surged by 16% to a 2 month-high of $3.5 following the SEC’s meeting

The SEC’s newly established Crypto Task Force is in the news today after it met with Jito Labs and Multicoin Capital’s CEOs. As per the meeting’s memo, the three parties met to discuss adding staking in crypto exchange-traded products (ETPs).

According to reports, the meeting discussed two major points. First of all, they discussed if staking could be part of crypto ETPs and ways to implement it. The SEC argued that adding staking in ETPs will benefit investors while helping native networks grow.

With staking, the task force is considering allowing a portion of the assets to be staked through service providers running validators, while allowing timely redemptions. Also, the task force is considering minting a liquid staking token for assets that are staked.

Now, the SEC has largely been cautious over staking in ETFs or ETPs so far because of the “unbonding period.” This could slow down the redemption process for investors and cause tax issues. Even so, this development is good news for crypto assets that have faced much regulatory uncertainty under the previous administration.

Any impact on JTO?

As expected, the meeting had a massive impact on Jito’s native token JTO. After the meeting, Jito [JTO] hiked by 16.67% to hit a 2-month high of $3.58.

At the time of writing, Jito had retraced somewhat to trade at $3.1. This marked a 28.87% hike on the weekly charts, extending its bullish outlook by 20.04% on the monthly charts.

Thanks to the latest price pump, strong upward momentum is on JTO’s side now, with buyers dominating the market too.

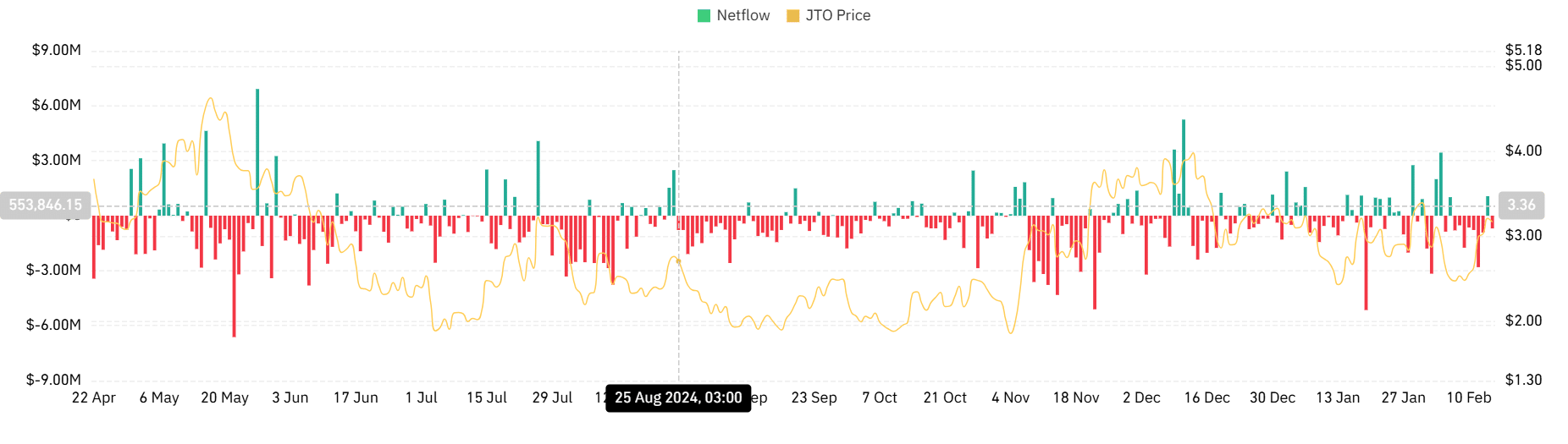

We can see buyers’ dominance as Jito’s spot netflows turned negative over the past 24 hours.

When the netflows dropped to -880.8k, it suggested that there were more exchange outflows than inflows. Higher outflows imply that investors are actively accumulating the asset as they store JTO in private wallets or cold storage.

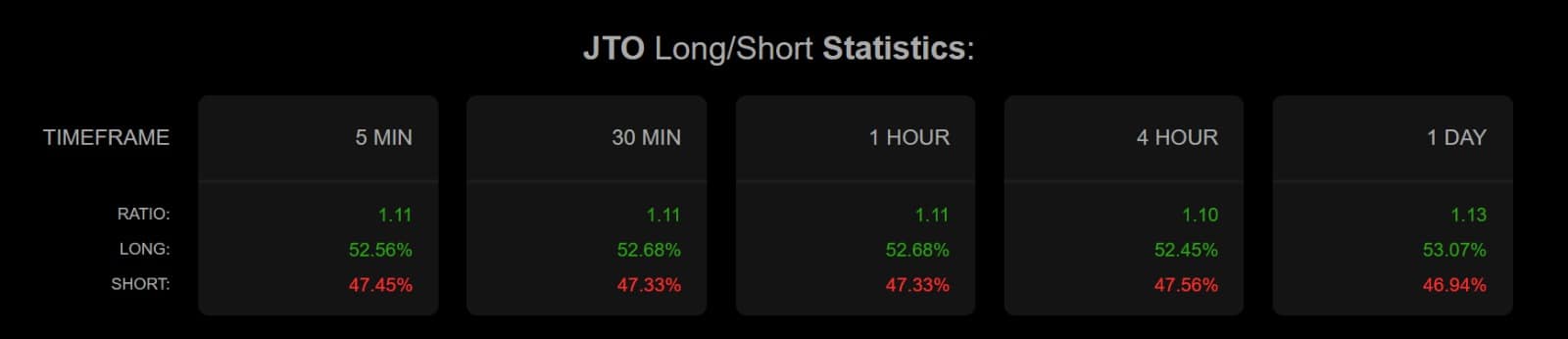

Additionally, among these active participants, most of them have been taking long positions.

As per Coinalyze data, JTO longs have been dominating with 53% of the futures contracts while shorts had a share of 46% at press time. When long positions are so dominant, it implies that most traders are bullish and expect the price to rise further.

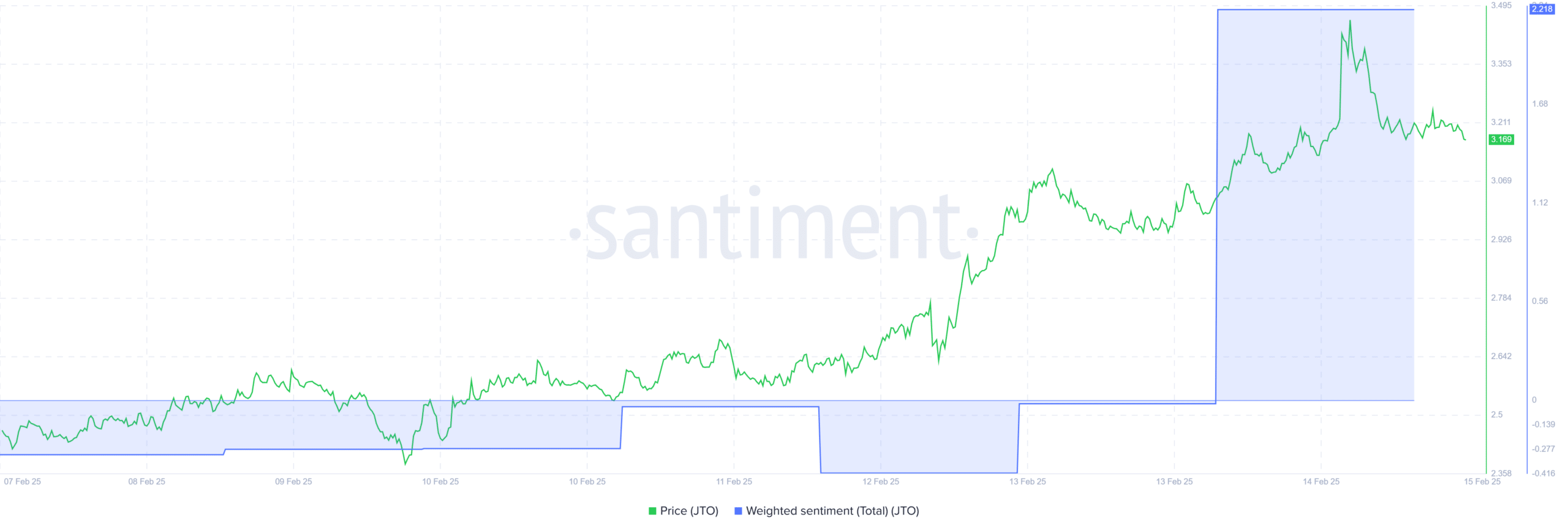

This bullishness can be further validated by the recent shift in weighted sentiment from bearish to bullish.

After being stuck within the negative zone over the last 6 days, weighted sentiment has finally turned positive. This shift is a sign that more participants are bullish about the cryptocurrency.

What’s next?

With the SEC now starting to build a healthy relationship with the crypto community, the markets are reaping the benefits. This advantage is evidenced by the sudden spike in Jito’s price.

Therefore, if the prevailing market conditions hold firm, JTO and other assets will continue to grow steadily on the charts.

For its part, JTO could reclaim $3.7 and attempt going as high as $4 too. However, if sellers take advantage of the price uptick to take profits, JTO could drop below $3 again.