As the broader market begins to recover, Siren [SIREN] has broken its prolonged resistance and appears to be opening the door for a further upside rally.

Despite the bullish outlook, intraday traders seem to be betting against the trend, believing the asset could repeat past declines. However, the overall bullish momentum remains intact.

At press time, SIREN was up 2.65% over the past 24 hours and was trading at $0.216 after reaching an intraday high of $0.249.

Market participation appeared lower compared to the previous day, as trading volume declined by 55% to $18.70 million. The falling volume suggests that traders and investors are currently hesitant or fearful about participating.

SIREN: Price action and key levels

Looking at the daily chart, SIREN appeared bullish after breaking and closing a daily candle above the key resistance level of $0.21.

The asset previously broke out above the same resistance but failed to sustain the move, resulting in a significant decline.

Based on past performance and current price action, if SIREN remains above the key $0.21 level, it has strong potential to rally 42% and reach $0.30 in the coming days.

The asset’s bullish thesis would be invalidated only if the price falls below the $0.21 level.

As of now, the technical indicator Average Directional Index (ADX), which measures trend strength, has reached 56.90—well above the key threshold of 25—indicating that SIREN is in a strong directional trend.

Despite recent price fluctuations, SIREN has surged more than 115% over the past week, allowing many investors to make substantial profits.

Recently, crypto tracking platform Onchain Lens disclosed that a newly created wallet withdrew a massive 71.84 million SIREN tokens worth $6.54 million ten days ago.

That holding is now valued at approximately $15.52 million—reflecting an impressive profit of $8.98 million.

Traders eye a potential reversal

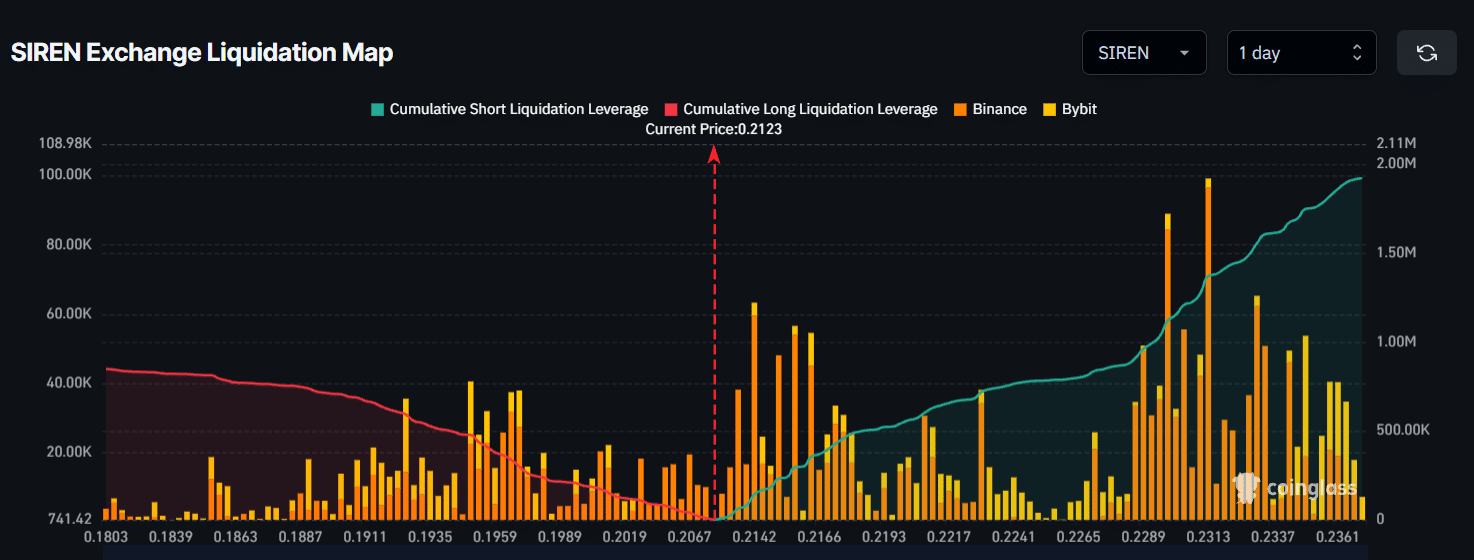

Despite SIREN’s bullish momentum, derivatives analytics platform CoinGlass indicated that intraday traders were maintaining a bearish outlook.

According to the latest data, traders were overleveraged at $0.195 on the downside and $0.231 on the upside.

At these levels, they have built approximately $476,000 worth of long-leveraged positions and $1.37 million worth of short-leveraged positions.

These trader bets reflect a bearish outlook, suggesting they believe the SIREN price will not cross the $0.2313 level anytime soon.

However, if the price does break above this level, the $1.37 million worth of short positions could be liquidated.

Final Summary

- SIREN’s current price action hints that another 45% upside move could be on the horizon.

- Intraday traders are betting against the trend by building $1.37 million worth of short positions.