- Solana’s price teeters on critical support at $125–$110, with futures sentiment declining 19% since March

- The next move hinges on holding support; failure may trigger deeper correction towards $100

Solana [SOL] is teetering on a critical support range between $125 and $110, a zone that could dictate its next major move.

With the broader crypto market in flux, SOL’s ability to hold this level will be a key test of investor confidence.

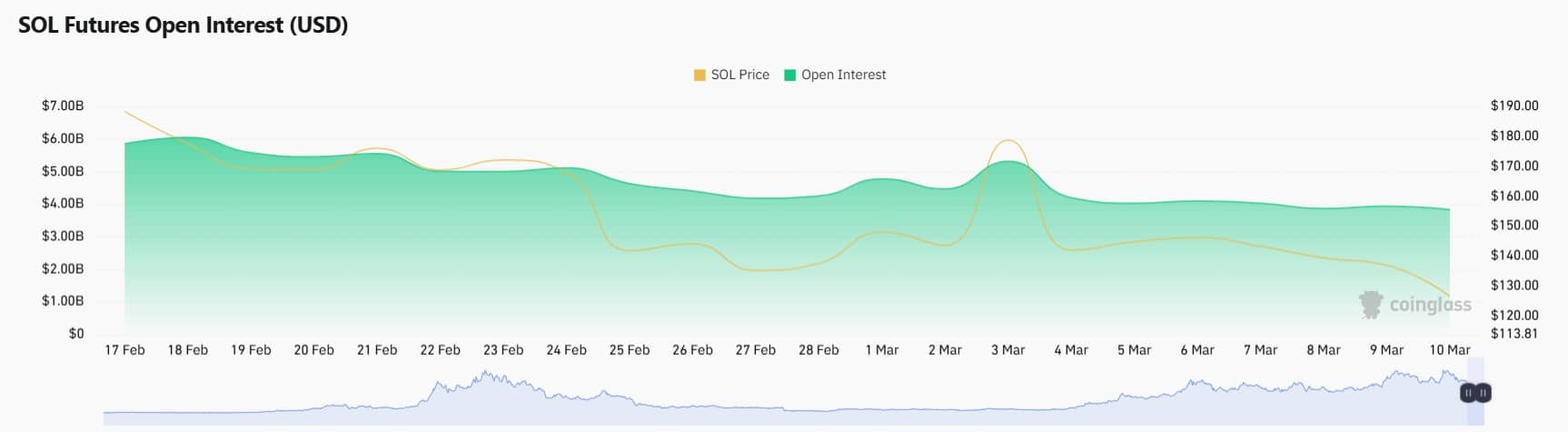

Meanwhile, Futures traders are losing conviction — Open Interest in Solana Futures has dropped 19% since March began, signaling a shift in sentiment.

As volatility grips the market, will SOL stabilize and stage a recovery, or is a deeper correction on the horizon?

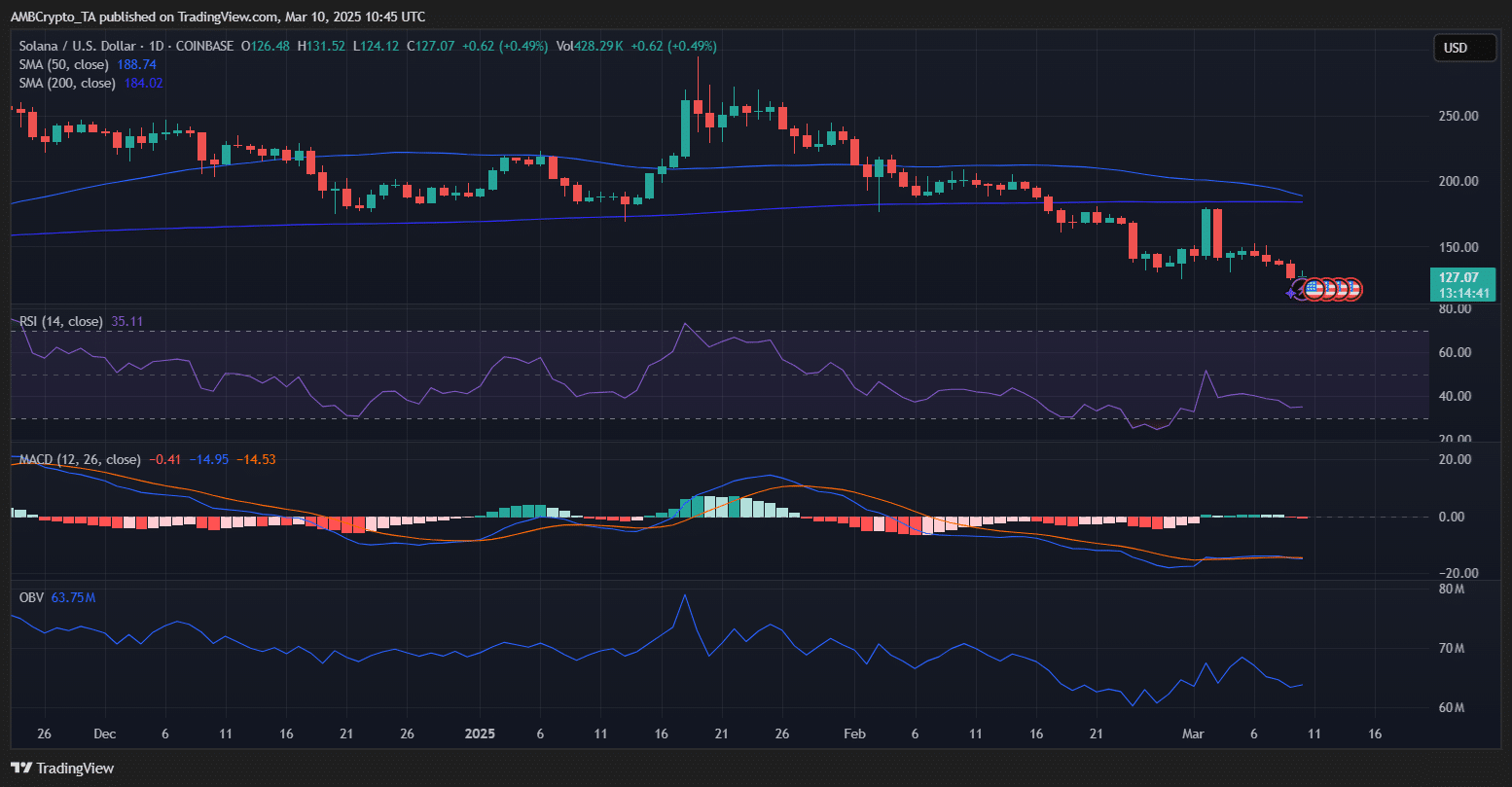

Solana’s technical outlook

Solana is currently teetering above its crucial $125–$110 support range, a level identified by crypto analyst Ali Martinez as key to determining its next move.

Holding above this zone could provide the foundation for a potential rebound, but a breakdown below $110 may trigger a deeper decline, possibly testing the $95–$100 range.

On the upside, immediate resistance lies at $140 and $150, where sellers have previously stepped in.

A stronger bullish signal would emerge if SOL can reclaim the 50-day SMA at $188.74, which could shift momentum in favor of the bulls.

However, the broader trend remains uncertain, with market sentiment still leaning bearish.

Technical indicators reinforced the cautious outlook. The RSI sat at 35.11, hovering just above the oversold threshold.

While this suggests the potential for a relief bounce, it also signals weak bullish momentum, with sellers still in control.

The MACD remained in bearish territory, with the signal line positioned below the histogram. This indicated sustained selling pressure and a lack of strong upside momentum.

Meanwhile, the OBV at 63.75M has been declining, reflecting waning buying interest and a lack of volume support for a meaningful reversal.

Futures market sentiment and OI decline

A 19% drop in Solana’s OI since early March signaled reduced speculative interest. This coincided with a sharp price decline, suggesting that traders were closing positions.

Several factors contributed to this decline. Solana faced rejection near $180, leading to profit-taking. The U.S. government’s crypto reserve plan disappointed traders, triggering a market-wide sell-off.

Additionally, the impending FTX estate token unlock raised concerns about excess supply.

Other top altcoins, including Ethereum [ETH] and XRP, have also seen OI drops, indicating a broader market trend. Overall, Solana’s OI decline reflects shifting sentiment amid key macro and crypto-specific developments.