- Solana’s 12.5% price hike has fueled investor optimism amid strategic U.S. digital reserve discussions

- Trump’s “America First” proposal positions Solana as a key player in crypto adoption across the United States

Could this development mark a pivotal moment in the evolution of U.S. crypto policy?

Trump’s strategic digital reserve proposal sparks debate

While Trump’s expected pro-crypto executive orders are being celebrated by many, the concept of an “America First” strategic digital reserve is polarizing. The plan reportedly prioritizes U.S.-originated assets such as Solana, USDC, and XRP. In fact, insider sources have revealed that Trump is engaging with the founders of these projects and is receptive to the idea.

“It’s a radical shift – America is so back in business for crypto founders.”

However, some others worry that focusing on U.S.-centric coins might undermine Bitcoin’s role in the broader crypto ecosystem. Despite these concerns, others are optimistic about the potential for this policy to usher in a “crypto golden age,” signaling a radical shift in U.S. digital asset strategy.

Solana’s performance post-report

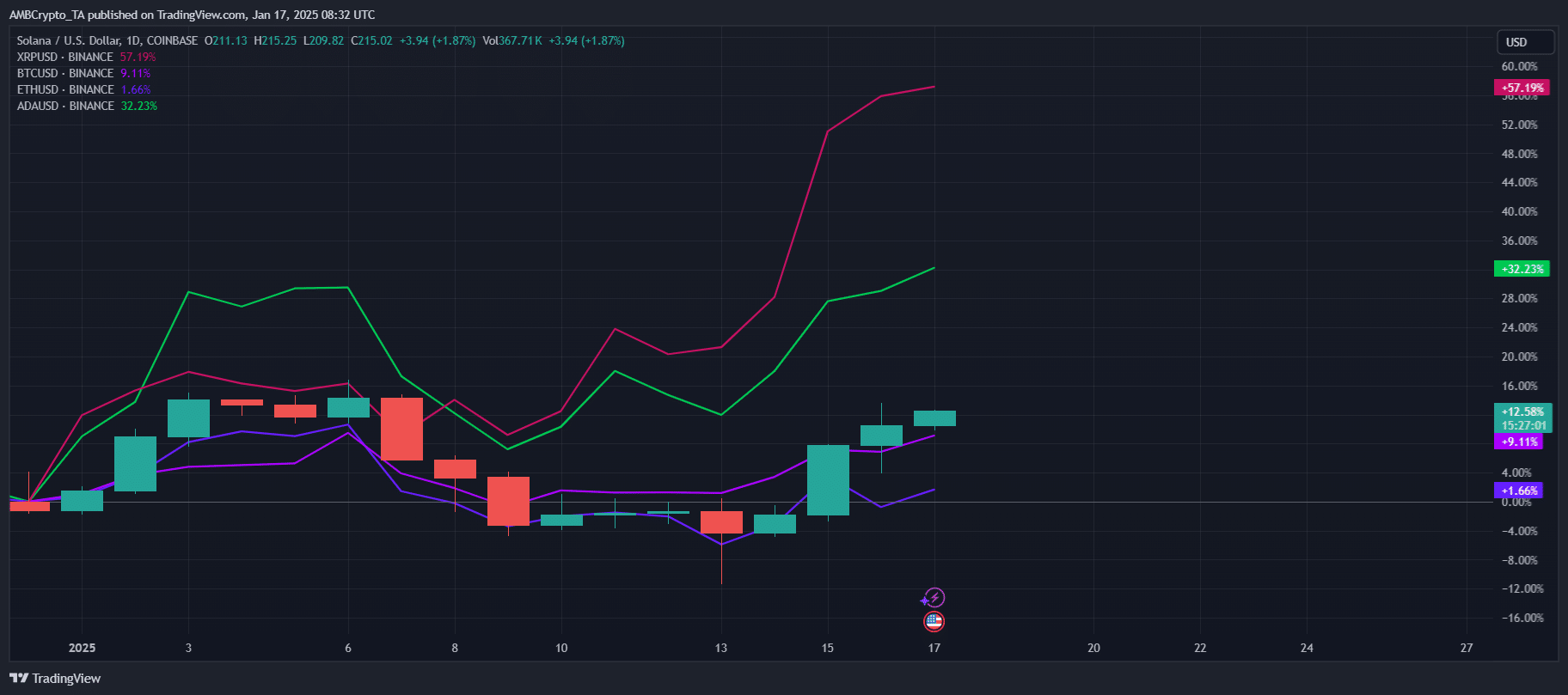

Since the report surfaced on 16 January, Solana’s price has gained by over 12.5%, outperforming major assets like Bitcoin and Ethereum. While XRP saw an extraordinary 57% spike, Solana’s rise can easily be attributed to investor optimism about its potential role in U.S. policy.

ADA followed with a 32% hike, indicating heightened interest in U.S.-associated assets.

This bullish momentum alluded to growing confidence in Solana’s long-term utility. Especially since strategic discussions position it as a critical player in domestic crypto adoption.

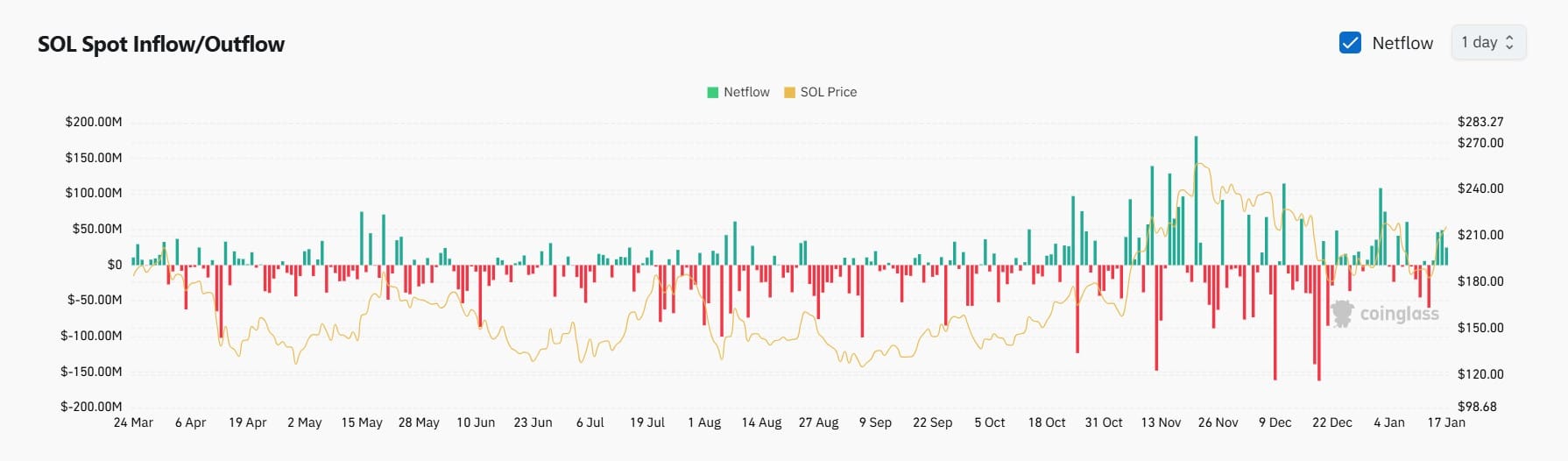

Analyzing SOL spot inflows and outflows

The aftermath of the 16 January report has sparked noticeable changes in Solana’s market dynamics.

According to data from CoinGlass, for instance, SOL has seen a sharp hike in net inflows over the last 24 hours – Signaling a strong shift in market sentiment. While outflows continue to highlight selling activity, the overwhelming inflows suggested heightened interest from buyers eager to capitalize on the potential policy implications.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Potential implications and market sentiment

The speculation surrounding Solana’s inclusion in a U.S. strategic digital reserve has already sparked a wave of optimism, but the broader implications could be transformative. If realized, such a move would position Solana as a cornerstone of U.S. crypto policy, potentially accelerating its adoption across institutional and retail markets. This aligns with Solana’s roadmap for 2025, which includes the roll-out of significant network upgrades, such as improved scalability through Firedancer, a validator client designed to enhance throughput and reliability.

Furthermore, developments like Solana’s growing dominance in DeFi and its expanding ecosystem of real-world applications could bolster its strategic value. However, market sentiment remains mixed, with some investors expressing caution over the broader impact of U.S.-centric crypto policies on global decentralization efforts.