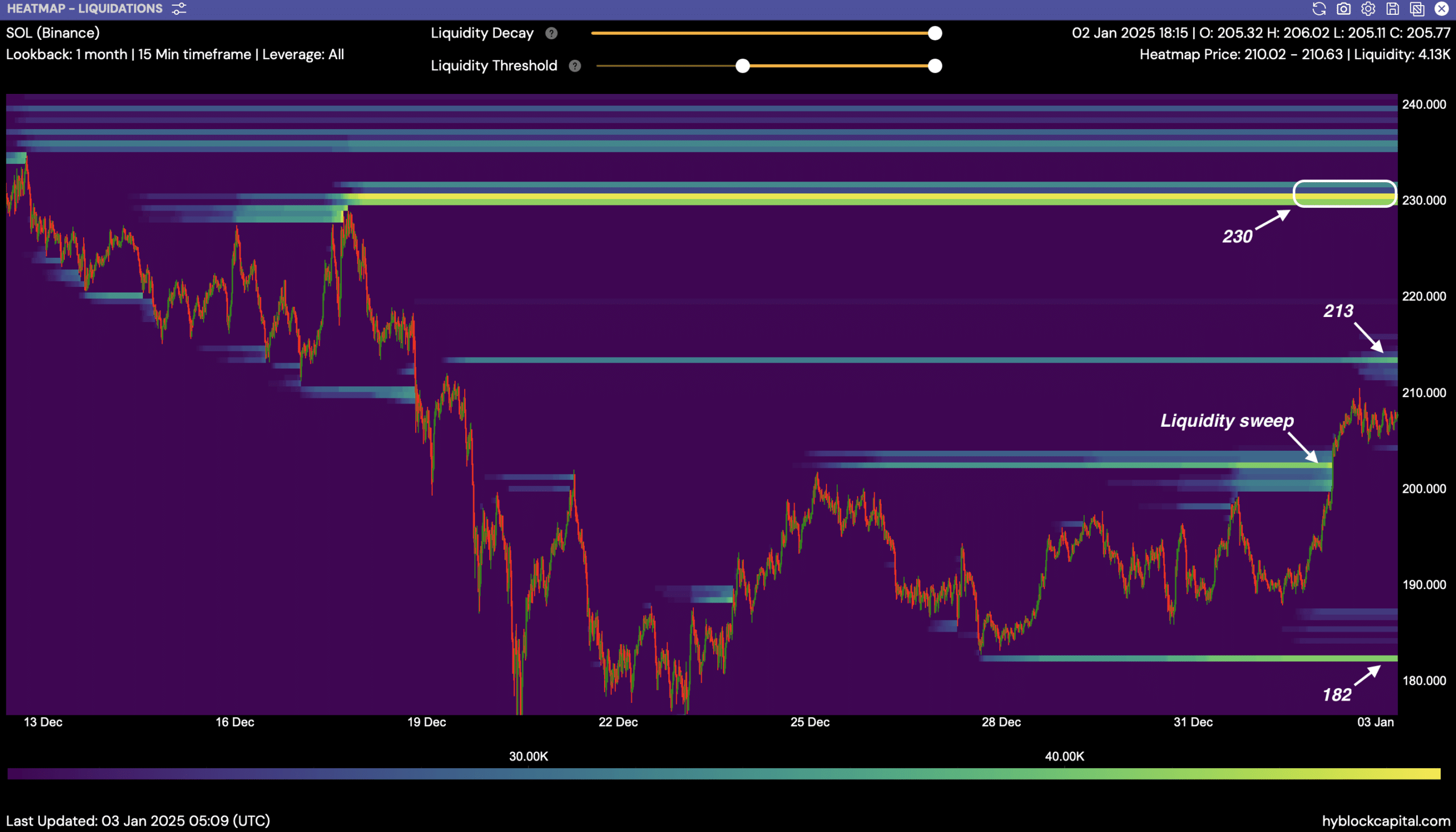

- Solana sweeps the liquidity after a bullish breakout from a consolidation pattern.

- Polymarket predicts a 77% probability of a Solana ETF approval in 2025.

Solana’s [SOL] saw a breakout from an ascending triangle pattern, leading to a swift upward movement. This breakout resulted in Solana sweeping through key liquidity zones marked earlier.

After crossing $182, SOL is rapidly approaching higher liquidity clusters near $213 and subsequently $230, with each zone representing potential resistance or support levels.

These liquidity clusters are areas where significant trading activity occurs, influencing future price action.

Should Solana breach these levels, it could either face sell-offs at resistance points or find strong buying support if it dips to lower zones.

This dynamic sets the stage for potential further gains if SOL successfully consolidates above these critical levels and maintains its upward trajectory.

This pattern suggests that SOL could sustain its rally, with a potential push past $230 if conditions remain favorable.

Price action and prediction

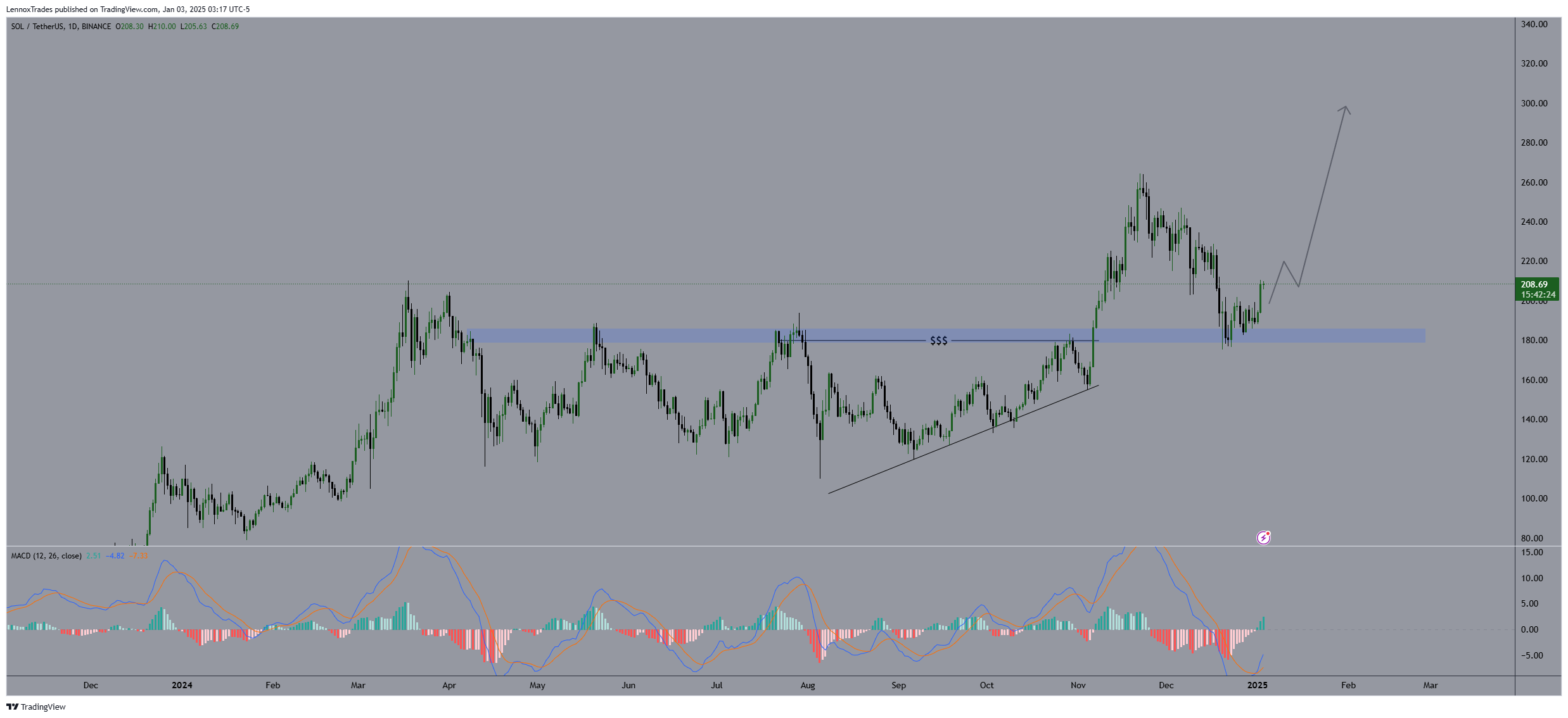

After Solana broke above the $200 level, it confirmed a bullish continuation from its previous consolidation below this threshold, as noted in an earlier AMBCrypto analysis.

This breakout aligns with the formation of an ascending triangle pattern, signaling accumulation and suggesting potential for further upward movement.

Notably, the price touched a high of $208.69, consolidating gains and setting the stage for further advances.

The next key resistance level is around $230, based on previous highs within the consolidation zone.

If the bullish momentum continues, Solana could challenge these levels, potentially sparking a rally that may extend into mid-year.

This indicates the strength and continuation of the current bullish trend, with $182 serving as significant support and $230 as the upcoming target.

SOL ETF, market cap and TVL

According to Polymarket’s prediction, there is a 77% chance that a Solana ETF will be approved in 2025. This strong sentiment toward regulatory approval could positively impact Solana’s price.

Historically, the anticipation of an ETF, such as for Bitcoin [BTC] and Ethereum [ETH], has led to price surges due to increased mainstream acceptance and broader investment inflows.

While Matthew Sigel from VanEck believes the probability could be underpriced, suggesting an even higher potential for approval, the market sentiment has already priced in a substantial likelihood.

Source: Polymarket/X

If approved, Solana could experience a robust increase in value, attracting both retail and institutional investors eager to leverage the ETF’s market entry.

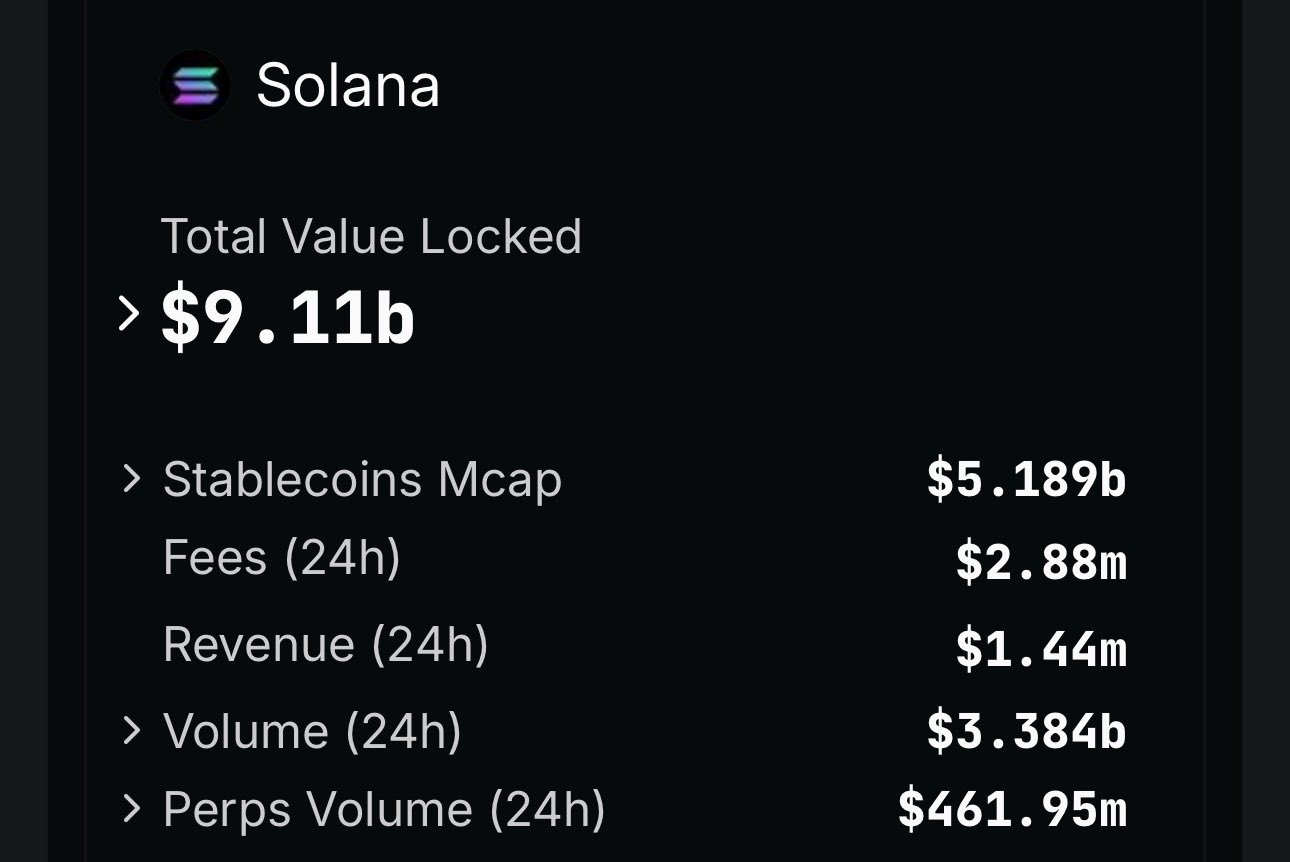

The Solana network has reclaimed a market cap of over $100 billion. This rebound is notable given the volatile market conditions, illustrating strong backing and utility within the ecosystem.

Concurrently, the $9 billion Total Volume Local (TVL) highlighted increased adoption and utilization of Solana’s capabilities, signaling the potential for further expansion and integration across DeFi applications.

Read Solana’s [SOL] Price Prediction 2025–2026

This could potentially usher in higher valuation tiers for Solana, impacting its market position positively.