- Solana’s proposal, which aims to cut SOL inflation by up to 80%, has reached quorum with 71.85% voting in favor.

- Will it make SOL more deflationary over time?

Solana [SOL] is deep in its most bearish cycle, sliding from its $270 all-time high to $213 at press time.

To counter this, developers are advancing the proposal SIMD-228, which seeks to slash SOL inflation by up to 80%. With 71.85% of votes in favor, the proposal has already reached quorum.

A successful implementation could tighten SOL’s supply dynamics. But will this be enough to reverse market sentiment?

Solana’s deflationary model under focus

Solana’s tokenomics follow a semi-deflationary model, where a portion of transaction fees is permanently burned, gradually reducing the total supply.

This mechanism helps counterbalance inflation and supports long-term price stability.

However, Solana’s transaction fees have plunged to a six-month low, as per an AMBCrypto report, signaling a significant drop in on-chain demand.

Since Solana’s deflationary pressure is directly tied to network activity, lower transaction volumes mean less SOL burned – weakening its ability to offset inflation.

To address this, the SIMD-228 proposal aims to reduce SOL inflation by cutting staking rewards. It is the primary way new SOL tokens enter circulation.

Currently, new SOL is issued at an annual rate of 6.8%, primarily through staking rewards for validators.

SIMD-228 proposes slashing this rate by up to 80%. In response, it would significantly limit the number of new tokens entering circulation.

Price impact and market sentiment

At press time, Solana’s circulating supply stands at 509.38 million SOL, with its price trading at $124.78.

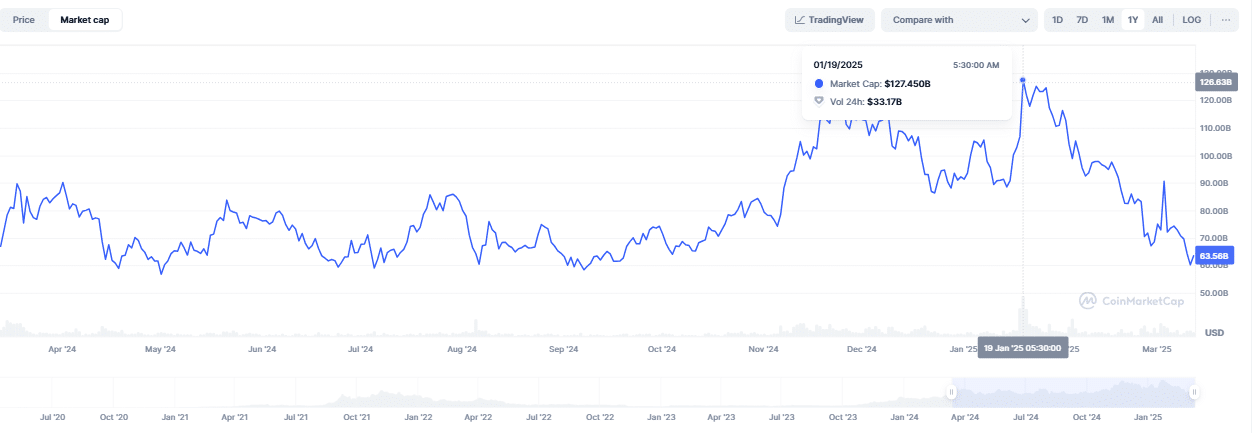

This translates to a market capitalization of $63.56 billion, marking a sharp decline from its $123 billion all-time high (ATH) during the mid-January rally.

Solana’s declining valuation is largely due to reduced on-chain activity and a risk-off investor mindset.

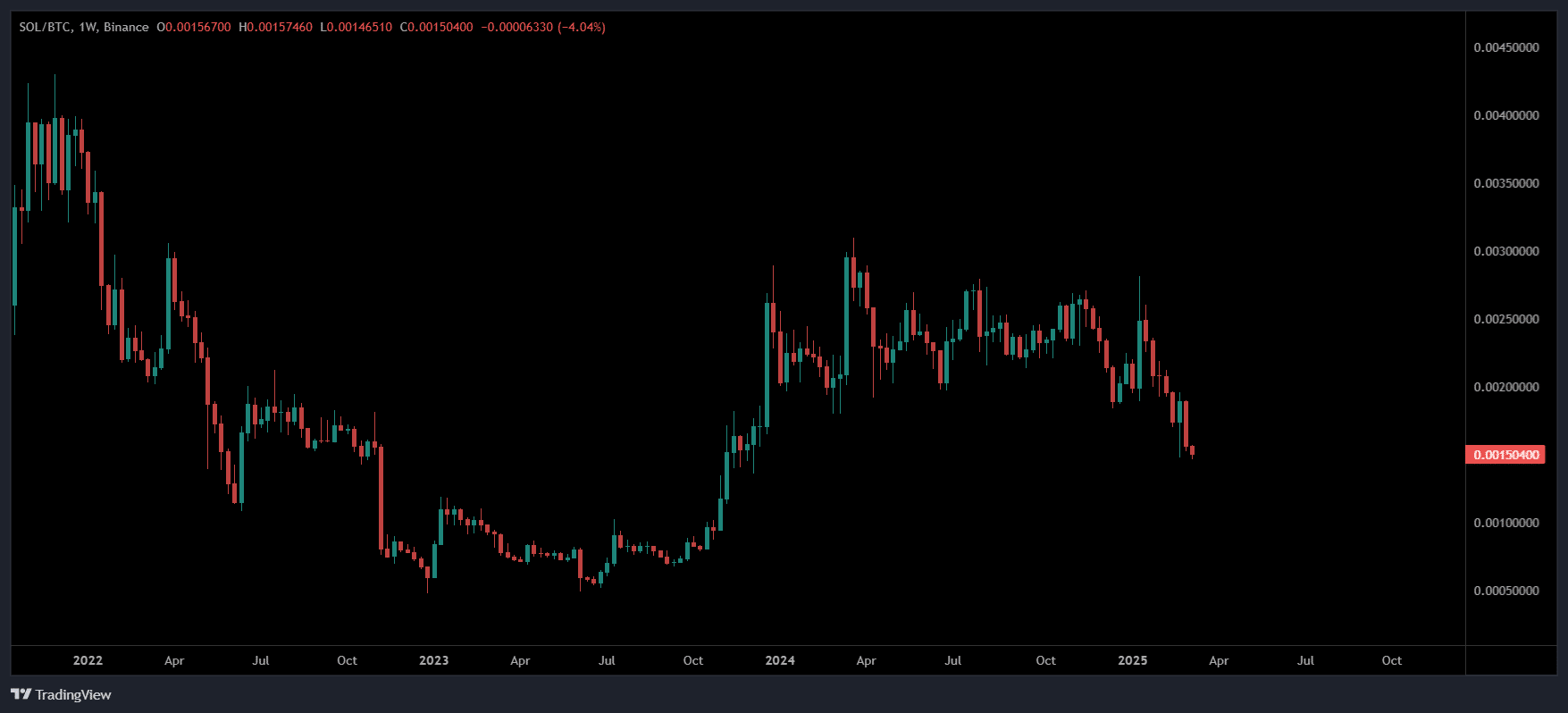

The SOL/BTC pair has dropped to a two-year low, signaling that traders still perceive SOL as a high-risk, high-volatility asset.

With transaction fees at a six-month low, fewer SOL tokens are being burned, weakening its deflationary model and adding pressure to the price.

If SIMD-228 successfully lowers inflation while keeping validators incentivized, it could boost confidence, improve supply dynamics, and set the stage for SOL’s next rally.

However, adoption and network usage will remain critical in determining its true impact.