Key Takeaways:

- Digital stable currencies draw increasing interest amid wider user adoption.

- Policy makers are defining clearer oversight paths for these digital assets.

- The evolving market reshapes monetary flows in our interconnected system.

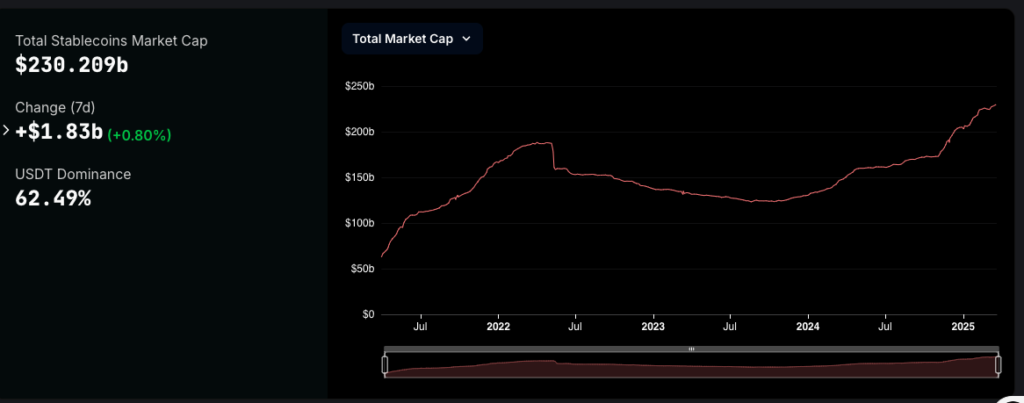

The stablecoin market crossed the $230 billion mark this week, driven by rising adoption and renewed regulatory efforts in the U.S., according to data from DefiLlama.

Stablecoins’ Role in Finance Amid Surging Adoption and Regulatory Developments

Data shows the stablecoin market cap now stands at $230.2 billion, adding $1.83 billion over the past week.

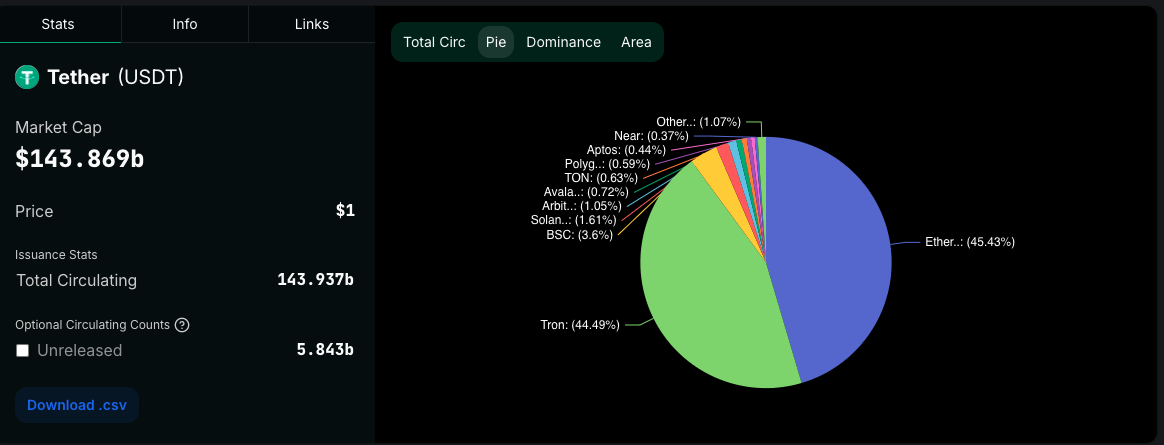

This marks a 72% year-to-date increase from last year’s $133.25 billion valuation. Tether’s USDT leads the sector, holding 62.5% of the market with nearly $144 billion, followed by Circle’s USDC at $59 billion.

The stablecoin market had previously peaked at $187.9 billion in April 2022 before declining due to the collapse of the Terra-Luna ecosystem and crises at major crypto firms like FTX and Celsius.

The sector began rebounding in mid-2023 and has maintained steady growth since.

This rebound has also reflected in rising user adoption and wallet activity. A joint report by Artemis and Dune revealed that active stablecoin wallets have surged by over 50% in the past year.

Active addresses grew from 19.6 million in February 2024 to 30 million in February 2025, marking a 53% year-on-year increase.

Tether’s dominance has extended beyond crypto markets. The company has become the seventh-largest buyer of U.S. Treasuries in 2024.

According to Tether CEO Paolo Ardoino, the company purchased a net $33.1 billion in U.S. Treasuries last year, surpassing countries including Germany, Canada, and Mexico.

Ardoino also noted that USDT’s global adoption now exceeds 400 million users, with notable growth in developing nations.

U.S. Stablecoin Regulation and Political Support

The latest expansion of the stablecoin market aligns with heightened institutional interest and regulatory progress.

On March 20, U.S. President Donald Trump urged Congress to pass stablecoin regulations during the Digital Assets Summit in New York, emphasizing the U.S. role in the digital asset space.

Trump highlighted the need for clear rules that balance growth with security.

Just a week prior, the Senate Banking Committee advanced the Generating Necessary Information for Uncovering Stablecoins (GENIUS) Act to the full Senate.

The bill passed with an 18-6 vote and proposes that stablecoin issuers with over $10 billion in market cap fall under Federal Reserve oversight, while smaller issuers remain regulated at the state level.

Senator Cynthia Lummis expressed support for the dual oversight structure, citing its potential to offer regulatory clarity without stifling innovation.

Stablecoins’ Growing Role in the Financial System

A February 2025 report from OurNetwork indicated that stablecoins now account for over 1% of the U.S. dollar M2 money supply, underscoring their growing role in global finance.

Federal Reserve Governor Christopher Waller noted that U.S. dollar-pegged stablecoins strengthen the dollar’s dominance by streamlining cross-border payments and offering access to USD in high-inflation economies.

Speaking during a Senate hearing on February 11, Federal Reserve Chair Jerome Powell reaffirmed support for a regulatory framework governing stablecoins.

He emphasized the need for clear oversight to ensure financial stability as the stablecoin market continues to expand.

Charting a Clear Regulatory Path

Recent actions on Capitol Hill provide a framework that many see as the starting point for a more defined market.

The debate over stablecoin oversight now occupies a central role in discussions about financial security and growth.

This regulatory progress offers a context where every investment decision takes on added meaning.

Observers are invited to reflect on the balance between risk and reward in this emerging field.

Think about how these new measures could shape your approach to digital assets in the coming years.

Frequently Asked Questions (FAQs)

An increase in stablecoin adoption may ease international trade by reducing conversion friction and speeding up transactions. Shifting regulatory standards and market adjustments will likely influence future commerce practices significantly.

New policy measures are encouraging closer ties between digital currencies and conventional banking. This integration may lead to smoother payment processes and a gradual reshaping of established financial interactions.

Investors may face uncertainties tied to rapid policy shifts and inherent market volatility. A detailed review of evolving legal frameworks and asset performance is strongly advised to manage potential financial and tech-related risks effectively.

The post Stablecoin Market Capitalization Reaches $230 Billion Amid Regulatory Efforts to Increase Adoption: Data appeared first on Cryptonews.

(@paoloardoino)

(@paoloardoino)