A recent survey revealed a significant disconnect between European banks’ crypto adoption and the growing interest among investors.

As digital assets gain traction across the continent, traditional financial institutions appear unprepared to meet the rising demand, potentially leaving them behind in a rapidly evolving market.

Underestimating the Crypto Surge

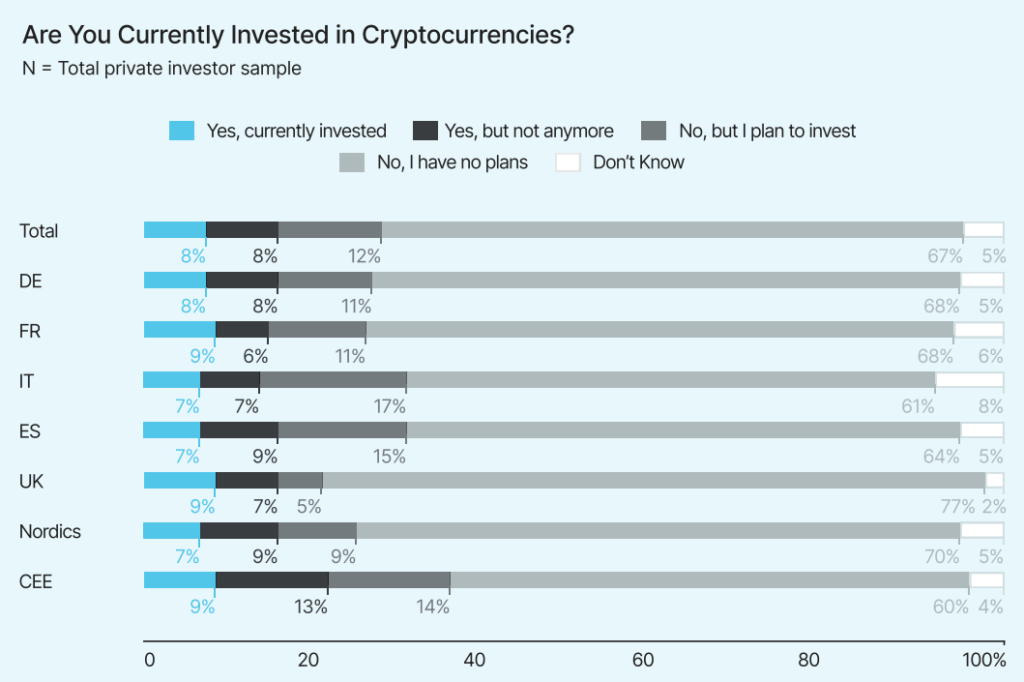

The Bitpanda survey by the crypto investment platform suggests that most EU banks underestimate the demand for crypto-related services.

Despite the growing popularity of Bitcoin, Ethereum, and other digital currencies, only a fraction of banks currently offer custody, trading, or investment options for these assets.

This hesitancy contrasts sharply with increasing retail and institutional European investors actively seeking exposure to cryptocurrencies.

For instance, Europe leads globally with 63 banks offering crypto services, including trading, custody, staking, and payments.

However, this figure represents only a tiny fraction of the total banking sector, suggesting a broader reluctance to adapt.

The Bitpanda report points to regulatory uncertainty and risk aversion as key factors holding banks back.

Many institutions remain cautious following years of mixed signals from EU regulators, even as frameworks like the Markets in Crypto-Assets Regulation (MiCA) begin to provide clarity.

A Growing Divide Between Innovators and the Status Quo

This careful approach contrasts with the proactive steps taken by some financial institutions.

Similarly, BBVA has received approval to offer Bitcoin and Ether trading services in Spain, allowing customers to trade crypto via its mobile app.

Despite these advancements, the overall adoption of crypto services among European banks remains limited.

This hesitancy could result in missed opportunities, especially considering that many investors prefer to engage with cryptocurrencies through traditional banking channels.

As the regulatory landscape evolves and investor interest grows, European banks may need to reassess their strategies to remain competitive in the rapidly changing financial ecosystem.

Signs of Momentum Among European Banks

Although many European banks are still cautious, some are starting to adapt as both investor demand and regulatory clarity improve.

Institutions like BBVA and Clearstream have already begun rolling out crypto services but are no longer alone.

Germany’s DekaBank is also making moves. The bank recently partnered with digital asset platform Metaco to launch a blockchain-based tokenization platform aimed at institutional clients seeking cryptocurrency exposure in a secure, compliant environment.

Zuger Kantonalbank has extended its crypto offering to include Cardano and Avalanche, along with several other tokens in Switzerland.

The expansion responds directly to growing client demand for broader digital asset options within conventional banking frameworks.

Meanwhile, smaller regional banks in Europe are quietly exploring pilot programs around tokenization and blockchain-backed financial products. This shift suggests crypto integration is gaining ground beyond just major institutions.

These developments, while still the exception rather than the rule, show early signs of a turning tide.

As new frameworks like MiCA take effect across the EU, banks that have taken early steps may find themselves better positioned to compete in the next phase of financial services.

The post Survey: Most EU Banks Lag Behind Growing Crypto Investor Demand appeared first on Cryptonews.