In the world of cryptocurrency, the courtroom is just as chaotic as the market itself. While Bitcoin and Ethereum were built on the promise of decentralization—cutting out middlemen and regulations—governments aren’t giving up control without a fight. In 2022 alone, the four main U.S. federal agencies overseeing crypto—the SEC, CFTC, FinCEN, and OFAC—launched 58 crypto enforcement actions, a staggering 65% increase from the previous year. This rise in SEC crypto enforcement has had a ripple effect across the industry, from exchanges to individual developers.

However, not all blockchain lawsuits are about fraud or financial crimes. Some are downright bizarre. Imagine being sued just for writing a piece of code or discovering that your exchange is accused of running like a digital cartel overnight. These crypto legal cases don’t just impact the future of blockchain—they redefine what’s legal in a decentralized world.

From high-stakes crypto exchange lawsuits against industry giants to cases that blur the line between innovation and deception, let’s explore the most shocking, unusual, and game-changing legal battles in crypto history.

High-Profile Lawsuits Against Crypto Projects

Legal battles have become a defining feature of the cryptocurrency industry, influencing how digital assets are classified and traded. Some of the most notable crypto legal cases have not only shaped industry regulations but also set precedents for future rulings.

SEC vs. Kraken – Staking Services Under Attack

In February 2023, the U.S. Securities and Exchange Commission (SEC) took direct action against Kraken, one of the largest cryptocurrency exchanges. The SEC alleged that Kraken was operating an unregistered crypto staking program, which it deemed a securities offering. Kraken agreed to shut down its U.S. staking services to settle the case and paid a $30 million fine in what became known as the Kraken staking settlement.

This Kraken staking settlement sparked intense debate over whether staking services should be considered securities, potentially affecting how Ethereum staking and yield-bearing crypto products are regulated.

Binance vs. U.S. Regulators – The Largest Crypto Settlement

The world’s largest exchange, Binance, found itself at the center of a major crypto exchange lawsuit. Accused by the U.S. Department of Justice (DOJ), the SEC, and the Commodity Futures Trading Commission (CFTC). Authorities accused Binance of money laundering, sanctions violations, and illegal trading activities. In November 2023, the company reached a historic $4 billion settlement. This Binance $4 billion fine was the largest penalty ever levied against a crypto entity. As part of the agreement, Binance’s CEO, Changpeng Zhao (CZ), stepped down after pleading guilty to financial crimes. The outcome of the Binance $4 billion fine sent a clear message about rising cryptocurrency regulation and the costs of non-compliance.

Ripple Labs vs. SEC – Defining XRP’s Legal Status

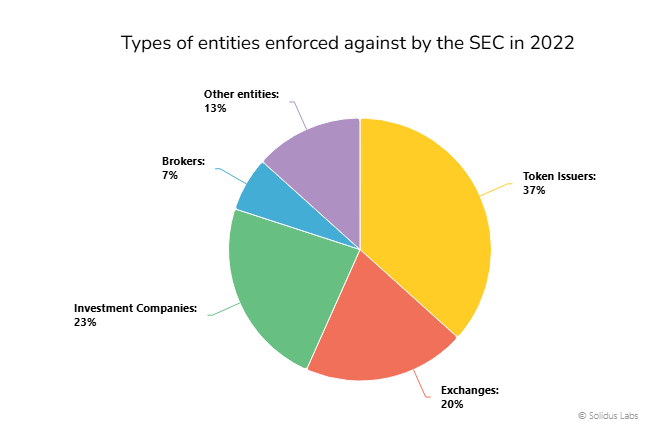

The SEC has aggressively pursued enforcement actions against the crypto industry, ramping up its efforts in recent years. In 2022 alone, the agency announced 30 crypto-related enforcement actions—up 36% from 2021—imposing $242 million in penalties and filing civil cases that resulted in nine arrests. More than half of these actions targeted token issuers and crypto exchanges, reinforcing the SEC’s stance that most cryptocurrencies qualify as securities.

One of the most pivotal cases in crypto history emerged from this regulatory crackdown: the SEC vs. Ripple Labs. In December 2020, the SEC sued Ripple, alleging that its sale of XRP amounted to an unregistered securities offering. The case became a defining battle over whether XRP—and, by extension, other cryptocurrencies—should be classified as securities.

After years of legal wrangling, Ripple secured a major victory in March 2025, when the SEC withdrew its appeal against a ruling that determined XRP sold on public exchanges does not qualify as a security. However, the court found that Ripple’s $728 million in XRP sales to institutional investors did fall under securities laws, resulting in a $50 million settlement.

This case remains a landmark moment in crypto regulation, setting a precedent for how digital assets are classified and shaping the SEC’s enforcement approach moving forward.

Coinbase and Regulatory Scrutiny

As a leading cryptocurrency exchange, Coinbase has faced continuous regulatory scrutiny. In June 2023, the SEC filed a lawsuit against the company, alleging that it operated as an unregistered broker, exchange, and clearing agency. The Coinbase SEC lawsuit 2025 took a surprising turn when the SEC dropped the charges in February 2025. This decision indicated a possible shift in regulatory approaches toward crypto platforms and highlighted the ongoing struggle between crypto firms and U.S. regulators in defining legal compliance for digital assets.

Fraud Cases and Ponzi Schemes in Crypto

Despite its promise, the crypto space has become a breeding ground for crypto fraud cases and Ponzi schemes. Some of these cases have exposed the risks associated with unregulated digital assets and underscored the need for greater transparency and oversight.

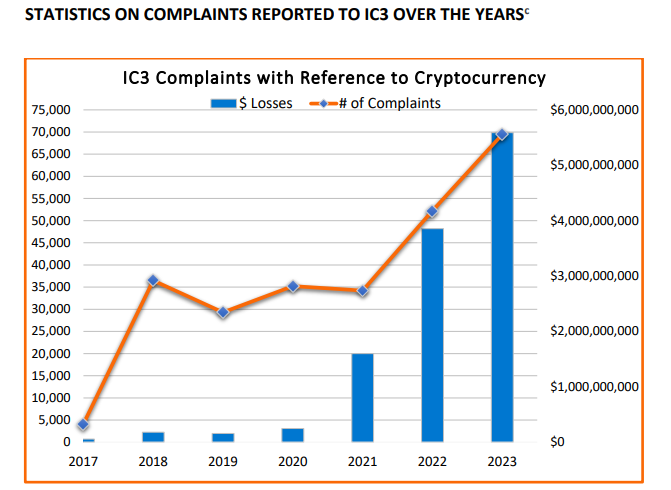

According to the Internet Crime Complaint Center (IC3) 2023 Report, 69,468 complaints with a cryptocurrency nexus were filed in 2023. Estimated losses linked to cryptocurrency exceeded $5.6 billion.

These crypto fraud cases have intensified the push for tighter cryptocurrency regulation and better safeguards for investors.

Roman Storm and the Tornado Cash Crackdown

The arrest of Roman Storm, co-founder of the crypto mixer Tornado Cash, in August 2023 underscored the growing conflict between financial privacy and regulatory enforcement. U.S. authorities accused Storm of facilitating money laundering, alleging that Tornado Cash enabled illicit actors, including North Korea’s Lazarus Group, to launder over $1 billion in stolen assets. However, Storm defended his work, arguing that Tornado Cash was a non-custodial privacy protocol designed to protect users’ financial privacy, not a tool for illicit activity. In a tweet, he stated:

“ I am being prosecuted for writing open-source code that enables private crypto transactions in a completely non-custodial manner. This prosecution represents a terrifying criminalization of privacy,”

His case raises critical questions about the legal risks faced by developers who create decentralized tools. Storm argues that the charges against him set a dangerous precedent, potentially criminalizing software development itself.

Despite strong support from the crypto community, his prosecution highlights the broader debate over whether developers should be held responsible for how their open-source software is used, especially in an era where privacy-preserving technologies are increasingly scrutinized.

FTX – The Biggest Crypto Exchange Collapse

The collapse of FTX in November 2022 sent shockwaves through the entire cryptocurrency industry. Once considered one of the most reputable crypto exchanges, FTX, led by founder Sam Bankman-Fried (SBF), was revealed to have misappropriated customer funds to support its trading firm, Alameda Research. When the company collapsed, it left an $8 billion hole in customer funds. Bankman-Fried was arrested and, in 2023, was convicted of fraud and conspiracy. He was later sentenced to 25 years in prison in one of the largest financial fraud cases in U.S. history. The FTX scandal underscored the dangers of poor exchange oversight, lack of financial transparency, and the misuse of customer deposits in the crypto world.

Africrypt – The South African Crypto Scam

In 2021, two South African brothers, Raees and Ameer Cajee, orchestrated one of the largest crypto scams in African history. The brothers, founders of the crypto investment platform Africrypt, disappeared with $3.6 billion in Bitcoin after claiming that their platform had been hacked. Investors were locked out of their accounts, and the stolen funds were never recovered. Despite ongoing investigations, the Cajee brothers remain at large, and Africrypt stands as a cautionary tale about the lack of regulatory safeguards in emerging crypto markets and the challenges of recovering stolen digital assets.

Smart Contract Disputes and Legal Ambiguities

Smart contracts, which automate transactions on blockchain networks, have revolutionized financial agreements but have also led to unique legal disputes. Unlike traditional contracts, smart contracts operate without human oversight, making them vulnerable to loopholes, code exploits, and unforeseen consequences.

The DAO Hack: When Code Became Law

In 2016, The DAO (Decentralized Autonomous Organization), an Ethereum-based investment fund, raised $150 million from investors through smart contracts. However, a hacker exploited a flaw in the contract, siphoning $60 million worth of Ether. The incident raised a fundamental legal question: Was the hack a crime, or was it merely the execution of the contract as written? The Ethereum community ultimately decided to hard fork the blockchain to recover the stolen funds, a move that sparked a heated debate about the immutability of blockchain transactions and the ethics of reversing transactions.

The Mango Markets Exploit: A Self-Proclaimed “Legal Trade”

In October 2022, Avraham Eisenberg manipulated Mango Markets, a decentralized finance (DeFi) platform, by exploiting its price oracle system. By artificially inflating the value of Mango’s native token, Eisenberg was able to borrow massive amounts of crypto and drain $116 million from the platform. Instead of hiding, he publicly claimed that his actions were a “highly profitable trading strategy” and that his use of the smart contract was entirely legal. Authorities disagreed, arresting him in December 2022 on fraud and market manipulation charges. This case reignited debates on whether exploiting vulnerabilities in smart contracts constitutes a crime.

The Evolving Legal Landscape for Blockchain Technology

In November 2024, a coalition of 18 U.S. state attorneys general, led by Kentucky’s AG Russell Coleman, along with the DeFi Education Fund (DEF), filed a lawsuit against the Securities and Exchange Commission (SEC). The suit alleges that the SEC has overstepped its authority by regulating the cryptocurrency industry through enforcement actions rather than clear regulations, infringing upon state sovereignty and stifling innovation in the digital asset space. This lawsuit underscores the growing tension between state and federal authorities over the regulation of digital assets.

The SEC has faced multiple lawsuits challenging its regulatory approach toward digital assets. Cases such as Bitnomial Exchange, LLC v. SEC, which challenges the classification of XRP futures contracts as securities, exemplify the ongoing legal battles shaping the crypto regulatory landscape. These cases reflect the industry’s push for more straightforward guidelines and the contention surrounding the SEC’s current enforcement strategies.

The political landscape has also influenced the regulatory environment for blockchain technology. The nomination of cryptocurrency advocate Paul Atkins as the chair of the SEC signals a potential shift toward a more balanced regulatory approach. Atkins has emphasized the need for clear, transparent guidelines and has criticized the SEC’s previous methods of regulation by enforcement. This change in leadership could lead to a more favourable environment for digital assets, though it also raises concerns about the potential for speculative bubbles and the need for investor protection.

These developments illustrate the dynamic and complex nature of the legal landscape for blockchain technology. As the industry continues to evolve, stakeholders must navigate a shifting terrain of regulatory actions, legal challenges, and legislative changes that collectively shape the future of digital assets.

The Ongoing Tug-of-War: Crypto, Courts, and the Future of Regulation

Crypto’s legal battles are as unpredictable as the market itself, blurring the lines between innovation, regulation, and outright fraud. From billion-dollar settlements to smart contract exploits defended as “legal trades,” these cases reveal that blockchain isn’t just disrupting finance—it’s challenging the very foundations of law. As regulators tighten their grip and developers push the boundaries of decentralization, one thing is clear: the courtroom is now just as much a battleground for crypto’s future as the blockchain itself. Whether this leads to clearer rules or even wilder legal showdowns, only time will tell.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”