- A revenue surge on the TRON chain hinted at active participation across the network, indicating a potential price run

- Selling pressure in the derivatives market may dampen the possibility of a rally for TRX

TRX has been on a bearish trajectory lately, with a single-digit drop of 8.62% over the past month and a 24-hour price decline of 1.47%. At the time of writing, this decline, compared to the broader cryptocurrency market, remained minimal.

In fact, AMBCrypto’s analysis revealed strong fundamentals behind TRX’s minimal drop, with the potential for a price pump in the coming trading sessions. However, selling pressure from the derivatives market might threaten the likelihood of a rally.

Spot traders drive accumulation, keeping TRX stable

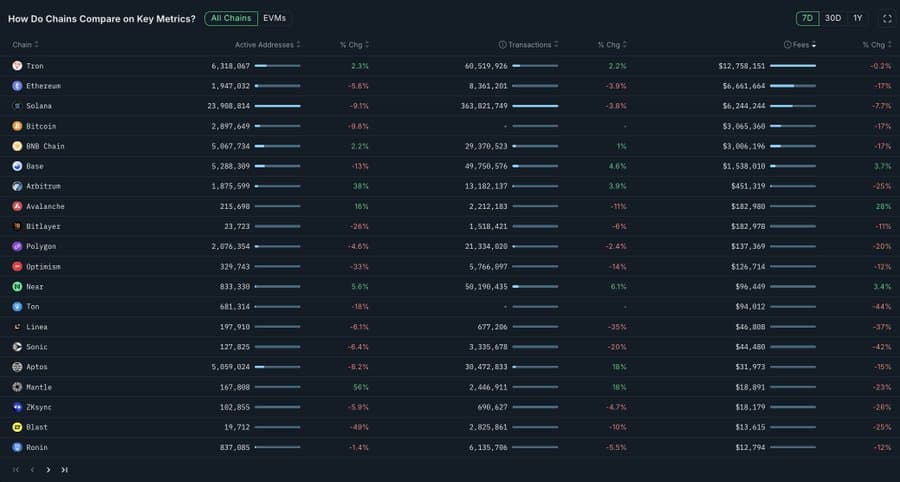

According to this analysis, TRON has hit a new revenue milestone, surpassing other notable chains in the market over the last seven days. These include Ethereum, Solana, Bitcoin, and BNB Chain.

During this period, TRON recorded $12.75 million in revenue, with the number of completed transactions rising by 2.2% to 60.5 million.

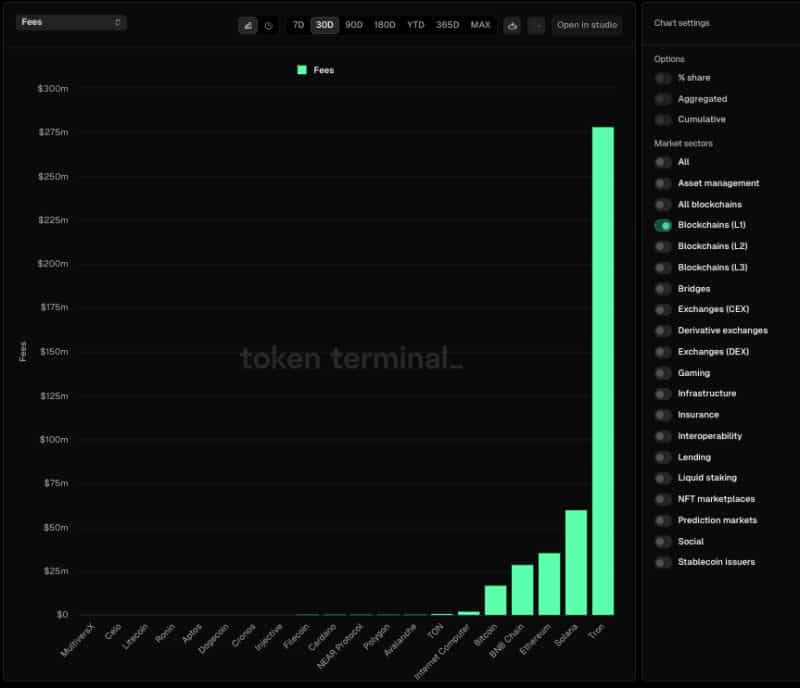

That’s not all though as Token Terminal’s data revealed that the network also generated the most fees among blockchains by a significant margin. This could be attributed to the influx of stablecoins now available on its chain, with a press time stablecoin market cap of $62.27 billion.

This growth seemed to correlate with the number of active addresses hitting a new peak. Right now, active addresses, which track user interactions with the chain, have hit a record high of 127.5 million.

A rise in revenue, alongside high user engagement, is a sign that more active traders are accumulating the asset, buying from sellers, and preventing a major price decline.

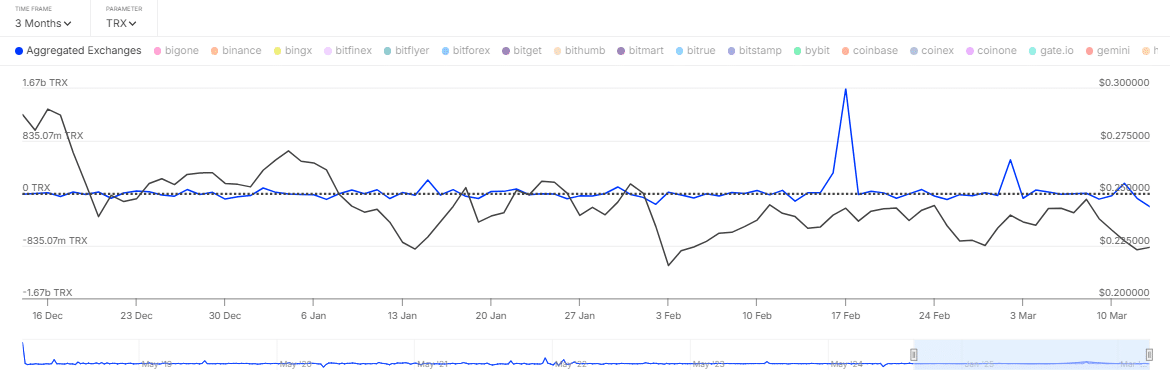

Analysis of exchange netflows on IntoTheBlock also revealed that spot traders are behind the recent accumulation of TRX, keeping its price stable. In the last 24 hours alone, this cohort of traders purchased 133.43 million TRX, worth approximately $29 million.

A significant purchase of this scale in a single day means strong buying interest. If this sentiment extends into the coming week, TRX could record new bullish gains.

Now, while spot traders are buying, not all market segments are aligned. On the contrary, derivatives traders might have adopted a selling position.

Sellers limits TRX’s upside potential

The latest 24-hour decline in TRX’s price was most likely driven by derivatives traders who were selling.

At the time of writing, the amount of unsettled derivative contracts had dropped notably, accompanied by a simultaneous decline in trading volume. For example – Open Interest fell by 3.38% to $156 million. A decline in both metrics is a sign that sellers are dominating the Futures market.

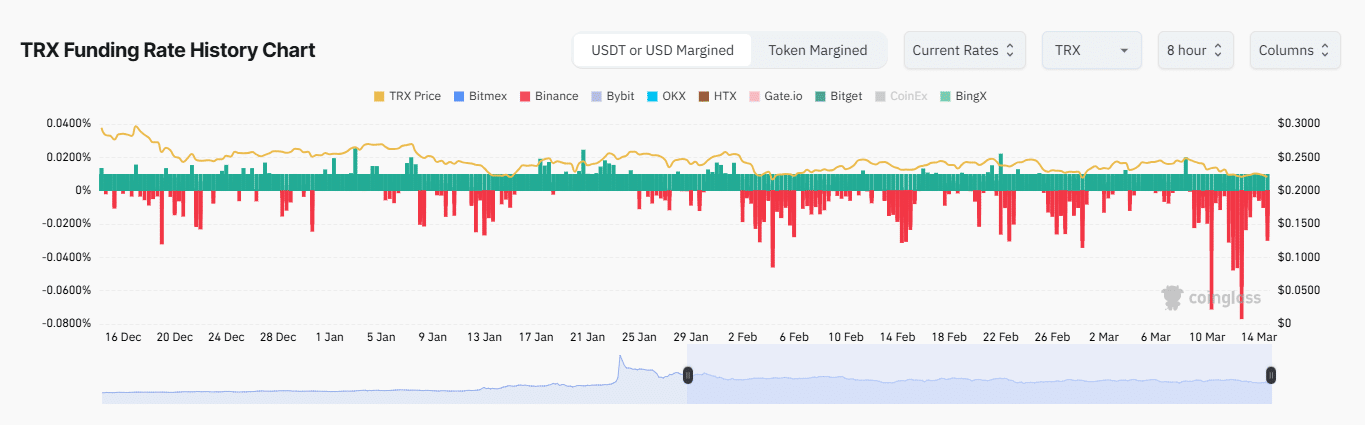

The funding rate also turned negative with a reading of -0.0086, suggesting that short traders are paying a premium periodically. This indicated that the market has been moving in their favor.

If sellers in the derivatives market continue selling, it could create more opportunities for spot traders to accumulate the asset at a discount ahead of a potential price boom.