- Spot traders have continued to accumulate the asset, with the same corresponding with hike in market interest

- Binance derivatives traders are in on the move too

Over the last 24 hours, TRUMP has fallen by 3.25% on the charts. Owing to the same, its monthly price performance was down 32.62% too. Despite this bearish sentiment, however, the market may potentially be gearing up for a major rally. Especially as accumulation metrics surface across the board.

According to AMBCrypto’s findings, spot traders have been consistently buying lately. And, this has led to TRUMP trailing within a bullish pattern. For this to materialize though, it needs to overcome a major hurdle.

Spot and Binance traders could profit TRUMP investors

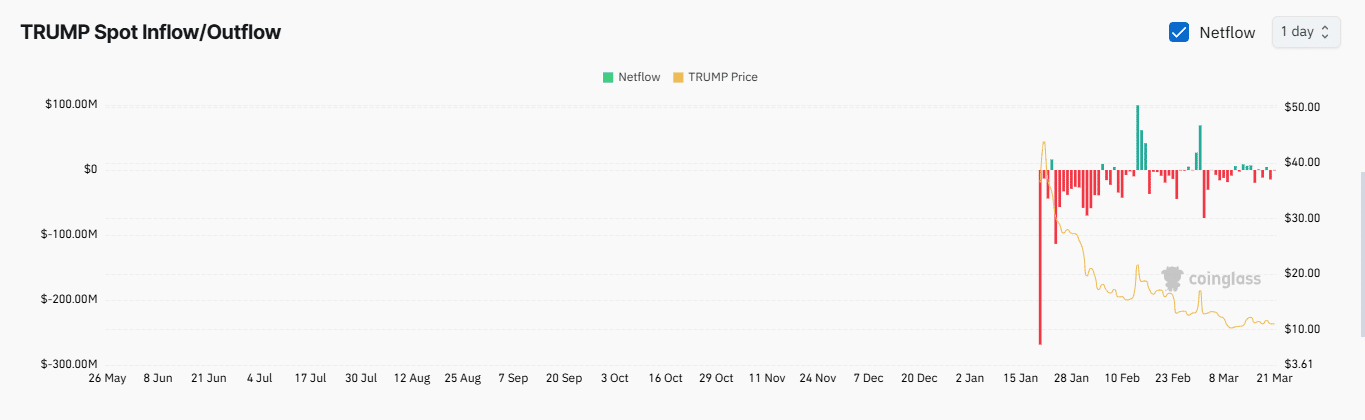

In the spot market, there’s been a consistent accumulation trend as traders continue to buy TRUMP.

Coinglass’s exchange netflows, which track buying or selling of an asset in the spot market, alluded to this. Since 16 March, a total of $41.92 million worth of TRUMP has been purchased as buyers’ interest heightened.

A significant purchase such as this, with no positive price surge, could be suggestive of market participants currently buying at a discount—Otherwise known as accumulation.

While this accumulation highlighted the broader market’s sentiment, in the derivatives market, Binance traders seem to be leading the wave. The long-short ratio, which compares buying and selling volume to determine market direction, highlighted that the market is in the buy phase.

The long-short ratio indicates buying once it has a reading above 1. The farther it moves upwards, the more bullish the market is. At the time of writing, Binance traders had a reading of 3.95. This implied that these derivatives traders have several long positions open on the asset, which could lead to a price pump.

A need for caution

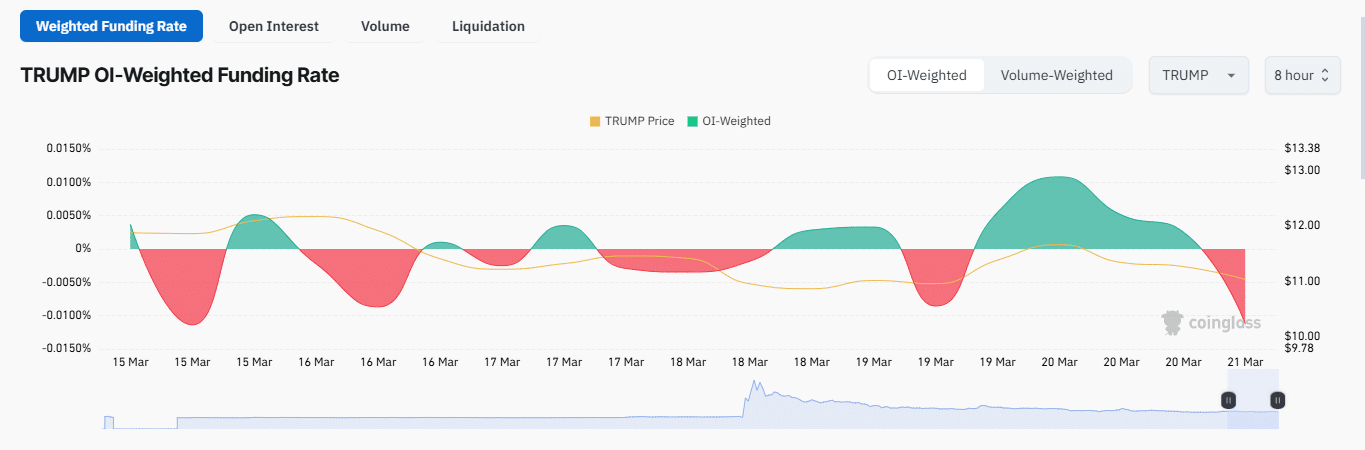

Certain market metrics hinted at caution though, especially as TRUMP could still decline further from its press time level.

At press time, the Open Interest-weighted funding rate had a negative reading of -0.0112%. This metric lends insight into market sentiment based on derivatives traders’ activity. With such a negative reading, TRUMP could likely trend lower on the charts.

This potential movement may be supported by the overall market long-to-short ratio, with the same currently below 1 with a reading of 0.9128. This indicated that there are more unsettled sell contracts in the market, which could force TRUMP’s price even lower.

AMBCrypto also found that TRUMP is still maintaining its bullish phase. And, a further decline is likely part of the market’s accumulation process.

Market in an accumulation phase

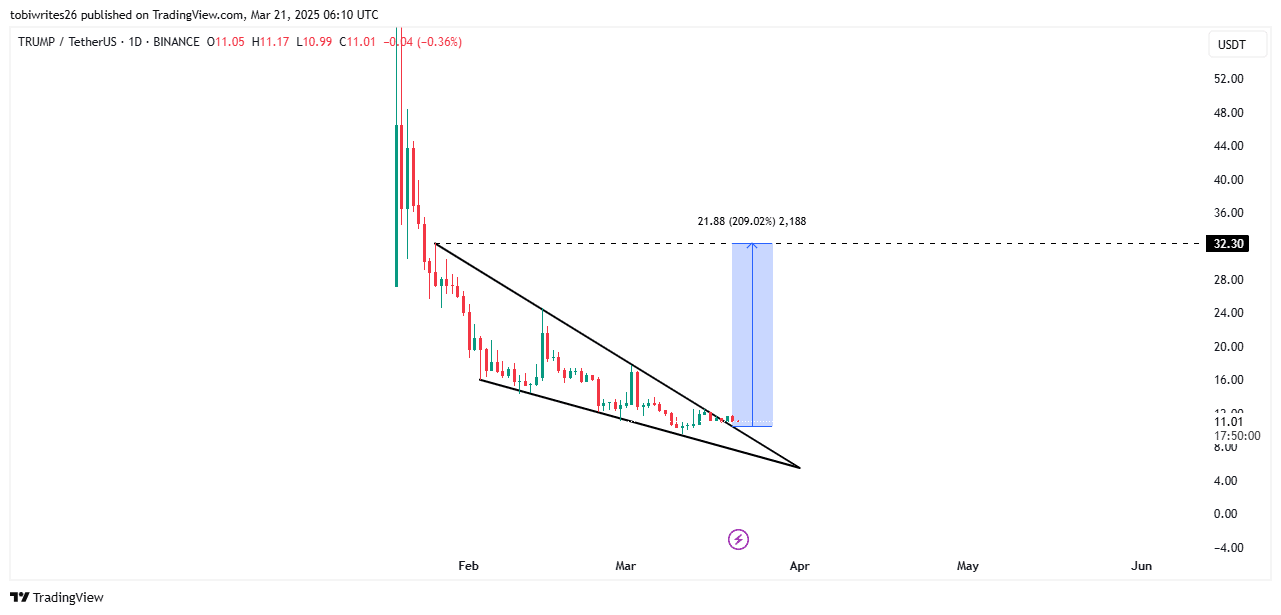

On the charts, TRUMP has been trading within a bullish accumulation pattern known as the descending triangle. When an asset trades within this structure, it means that a market rally is imminent and it could ignite anytime soon.

At the time of writing, TRUMP seemed to have slightly breached this pattern, heading towards using the resistance as its base for a rally. Should that happen, TRUMP could potentially rally to $32.30.

If the downtrend extends, it would mean that spot traders remain interested in buying at lower levels. And, accumulation would continue ahead of the major rally to the target of $32.30.