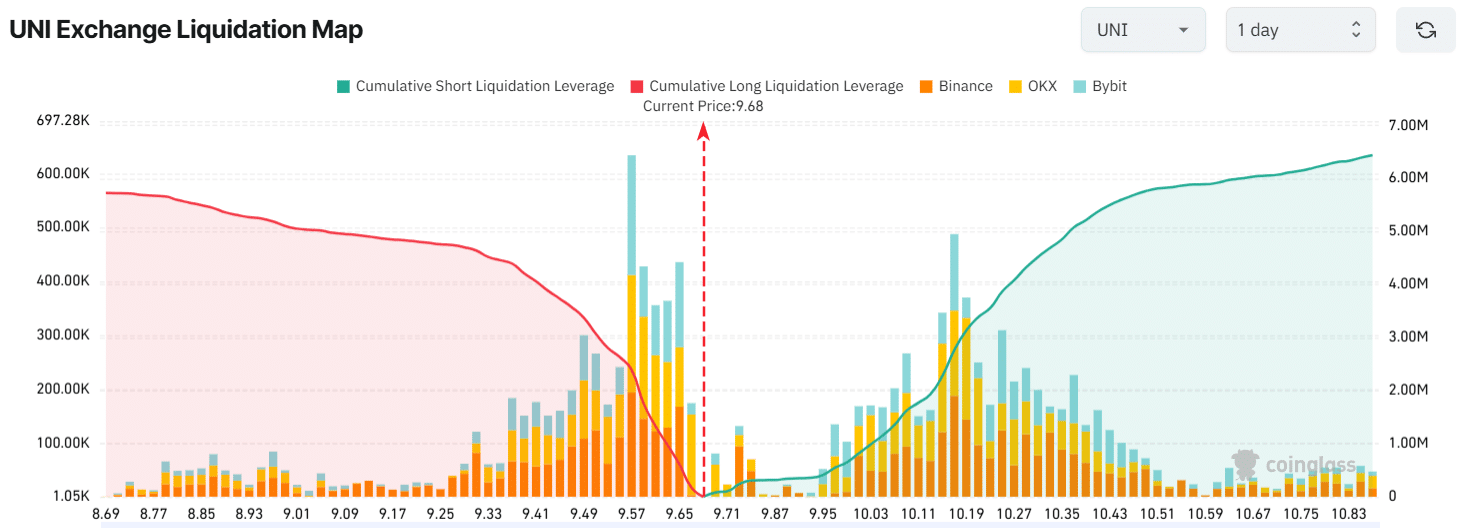

- Uniswap traders were over-leveraged at the $9.57 level on the lower side and the $9.73 level on the upper side.

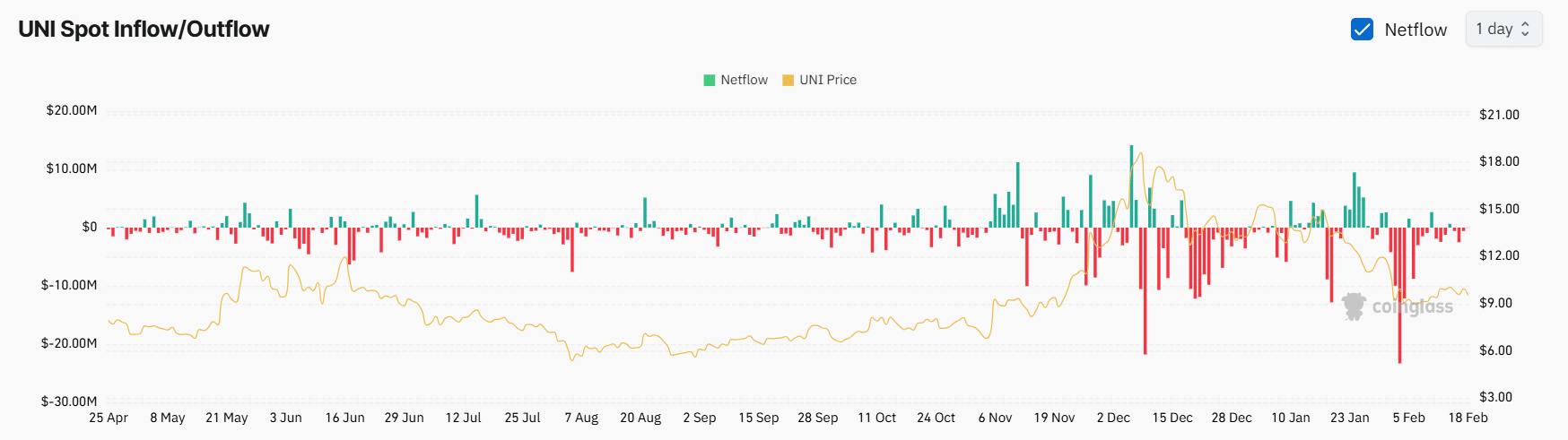

- On-chain metrics revealed that exchanges have recorded an outflow of $3.10 million worth of UNI tokens.

Uniswap [UNI] holders might face a tough time due to ongoing market uncertainty. During the recent market decline, the token has reached a crucial level, creating a make-or-break situation.

At the time of writing, UNI experienced a price drop of 2.25% in the past 24 hours and was trading near the $9.60 level.

Despite the decline, traders and investors have shown strong participation, resulting in a 70% jump in trading volume.

Investors withdrew $3.10 million worth of UNI

Data shows that the rise in participation appears to be favoring the asset, as traders and investors are accumulating and betting on the long side, according to the on-chain analytics firm Coinglass.

Spot Inflow/Outflow data reveals that exchanges across the crypto landscape have witnessed consecutive outflows, indicating potential token accumulation.

In the past 48 hours, exchanges have recorded an outflow of $3.10 million worth of UNI tokens, at press time.

Experts and investors see these exchange outflows as a bullish sign and believe they could create buying pressure and further upside momentum.

$5.4 million worth long bet

Besides the interest and confidence of long-term holders, intraday traders are following the same trend, according to Coinglass data.

At press time, traders holding long positions dominated the asset, being over-leveraged at the $9.57 level with $5.4 million worth of long positions.

Conversely, the $9.73 level is another over-leveraged level where traders holding short positions accumulated $1.15 million worth of short positions.

Long and short traders’ over-leveraged positions indicate the dominant side and which side could be liquidated more easily if the UNI price moves.

Traders and investors are making bullish moves, driven not only by the recent price drop but also by the recent price action.

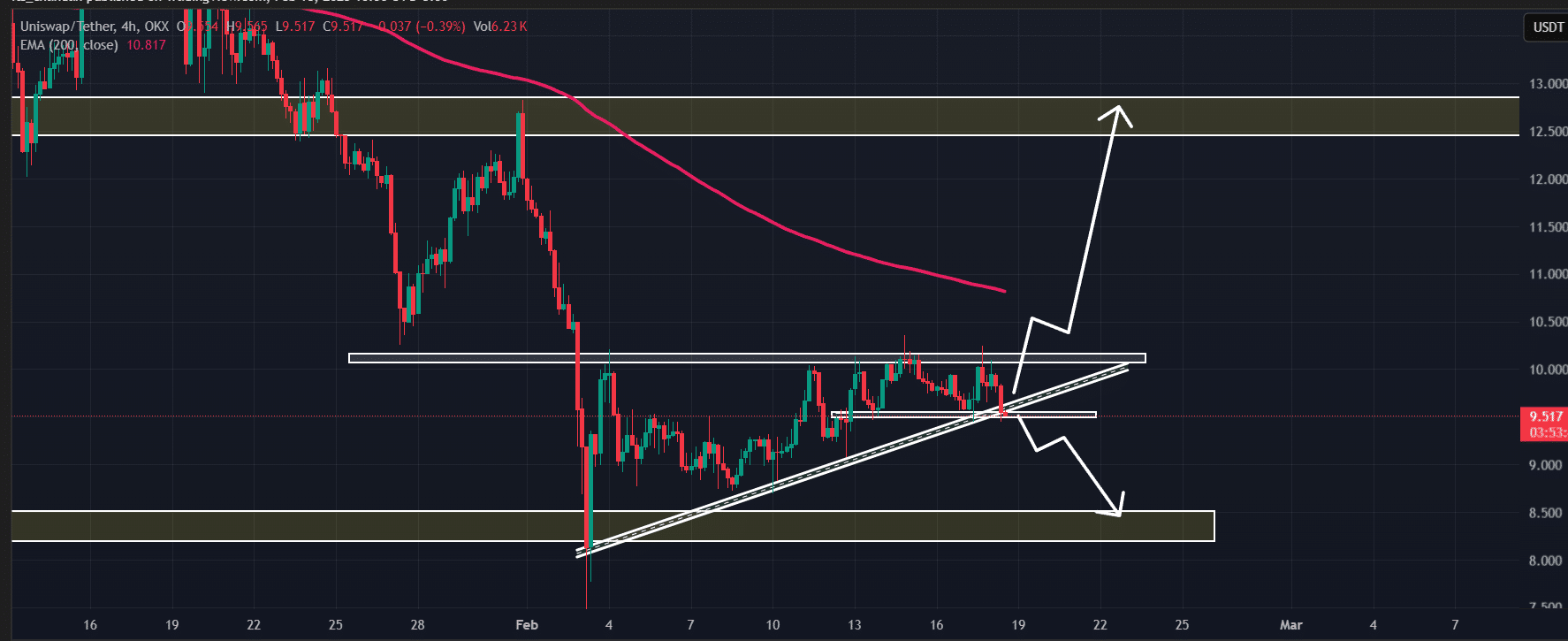

Uniswap price action and key levels

According to AMBCrypto’s technical analysis, UNI has formed an ascending triangle pattern and is currently finding support from a trendline.

This ongoing support from traders and investors suggests that UNI could hold this ascending trendline support and stay above the $9.55 level.

If this happens, there is a strong possibility that the asset could soar by 30% to reach the $12.60 level.

If UNI fails to sustain this level and closes a four-hour candle below $9.45, it could drop by 15%. This would bring the price down to $8.15 in the future.