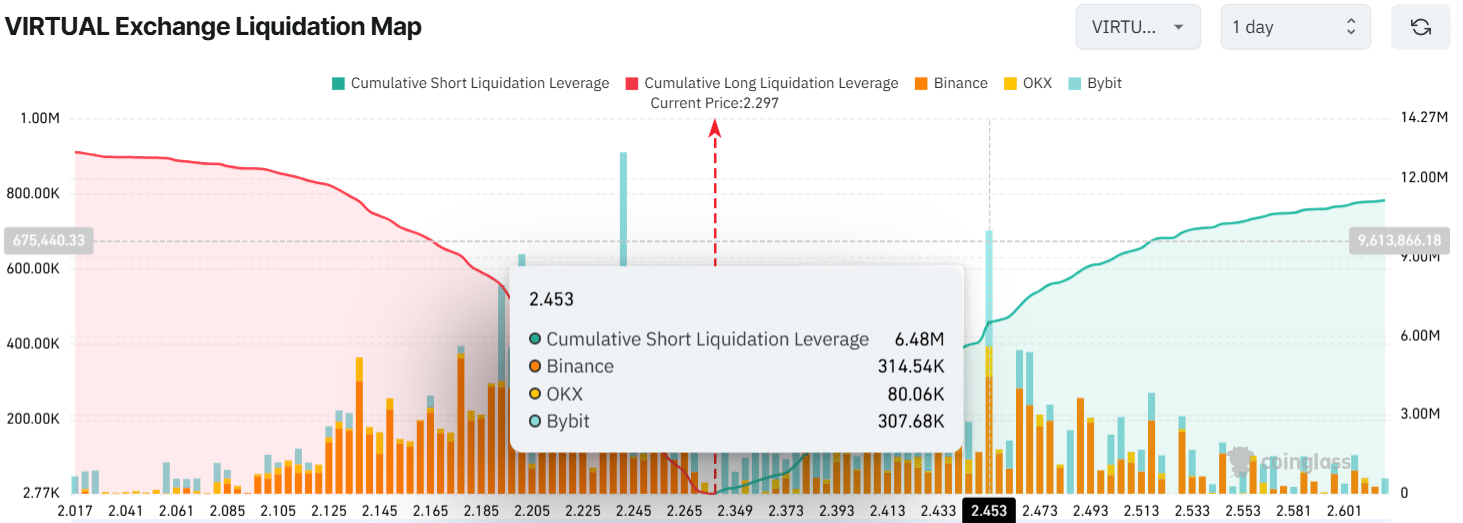

- At press time, VIRTUAL traders looked over-leveraged at $2.24 on the lower side and $2.45 on the upper side

- Recent activity from whales, investors, and traders hinted at bearish dominance

Virtual Protocol (VIRTUAL) made waves in the cryptocurrency market today after a significant price rally of over 50% on the charts. And yet, the asset soon failed to sustain these gains as long-term holders saw it as a perfect sell-off opportunity and dumped a significant amount, according to CoinGlass.

Why is VIRTUAL’s price falling?

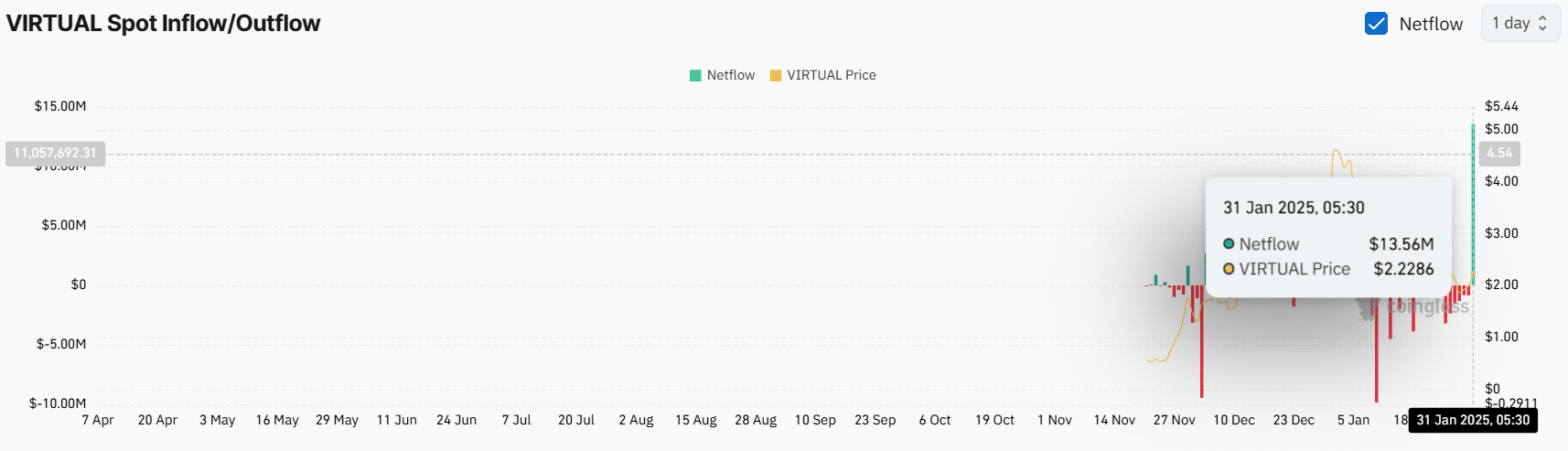

Data on spot inflows/outflows revealed that as the price of VIRTUAL skyrocketed, exchanges worldwide saw significant inflows of $13.5 million. This marked the highest recorded inflows since the token’s launch.

Analysts and experts view this bout of inflows as a sign of a sell-offs – Indicating that whales and investors moved their assets from their wallets to exchanges. Such significant inflows have the potential to create selling pressure and lead to a further price decline, which VIRTUAL has already registered.

As a result of these inflows, the asset’s initial gains were significantly reduced, dropping from 50% to 14% in less than an hour. VIRTUAL, at the time of writing, was trading near $2.32. Worth pointing out, however, that at the same time, the asset also recorded a remarkable 138% surge in trading volume – With figures of $755 million.

Bearish on-chain metrics

Amid this heavy price fluctuation, intraday traders actively participated in the market. In fact, VIRTUAL’s Open Interest (OI) surged by 25% – Hinting at the formation of new positions.

At press time, the major liquidation areas were $2.24 on the lower side and $2.45 on the upper side, with traders over-leveraged at these levels.

If sentiment shifts and the price soars to $2.45, nearly $6.5 million worth of short positions will be liquidated. Conversely, if sentiment remains unchanged and exchanges continue to see inflows, there is a strong possibility that the price could drop to $2.24 – Liquidating $3.72 million worth of long positions.

These on-chain metrics, together, suggested that bulls currently seem exhausted, while bears have been dominating – A potential bearish signal.

Virtual Protocol (VIRTUAL) price action

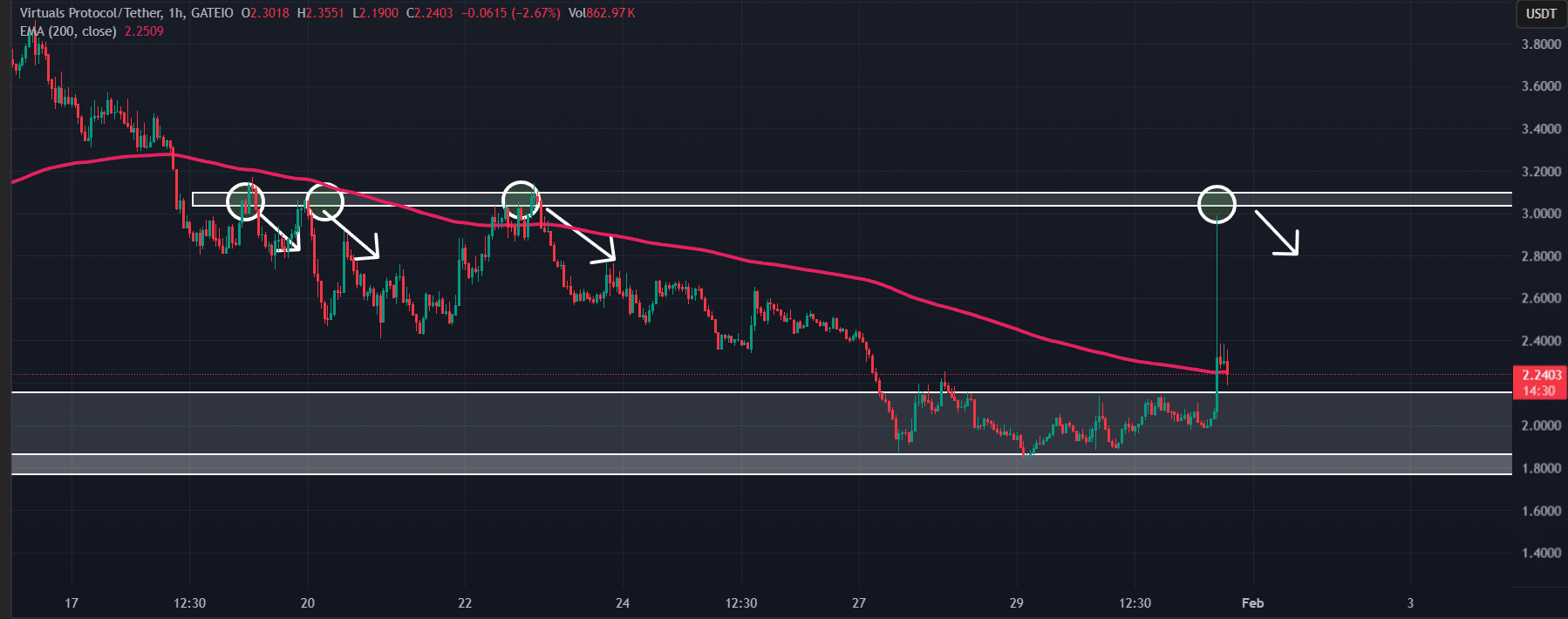

Besides these on-chain metrics, AMBCrypto’s technical analysis revealed that with the latest upside rally, VIRTUAL achieved its breakout target from the inverted head and shoulders pattern. However, this price reversal occurred after the asset hit the strong resistance level of $3 – A significant selling zone.

VIRTUAL’s four-hour chart also revealed that since 19 January 2024, it has hit this level three times, each time facing selling pressure and a significant price drop.

However, the current market sentiment, along with recent activity from whales, investors, and traders, suggested that VIRTUAL may be likely to see further price corrections on the charts.