Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

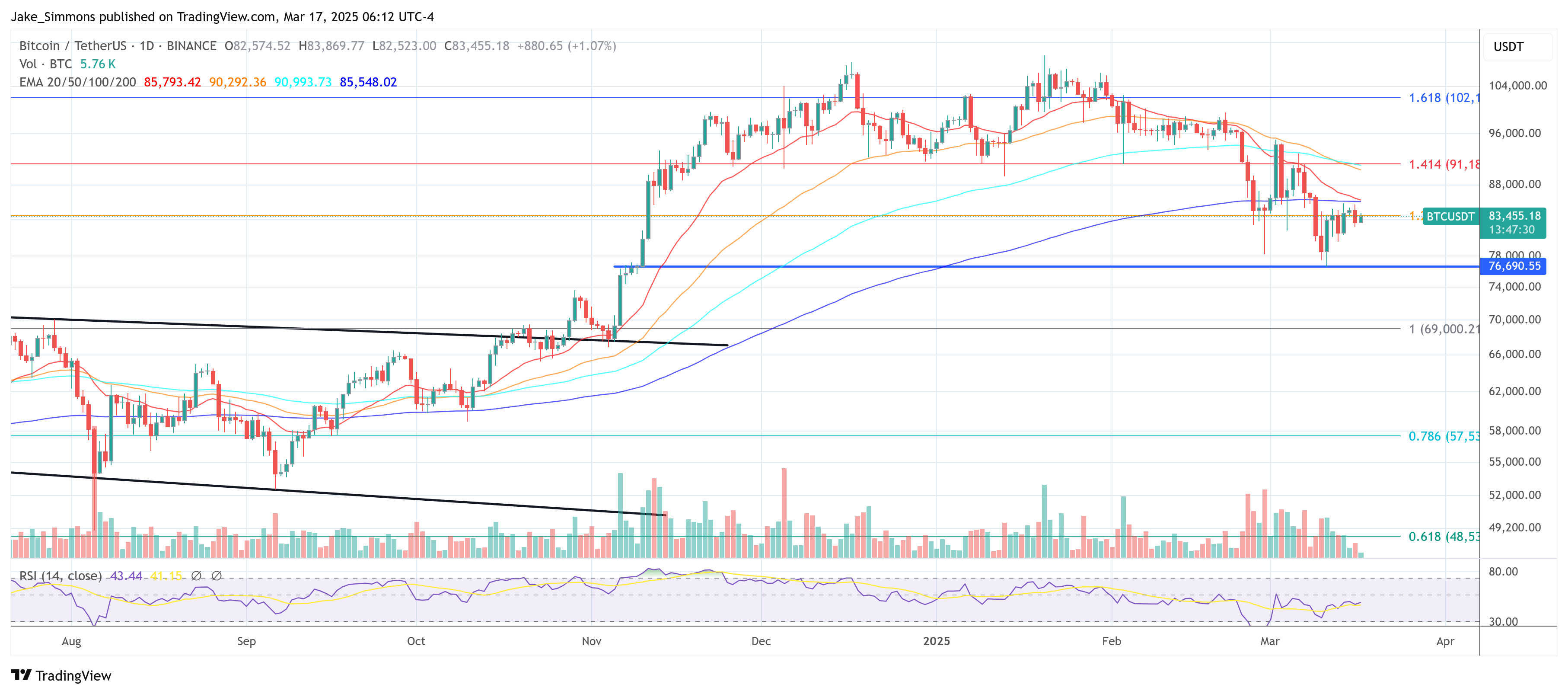

Bitcoin has shown resilience by bouncing to its 200-day moving average since last Tuesday when it fell as low as $76,606, yet it remains below this key technical threshold. In this volatile market environment, a major whale has taken a contrarian position by establishing a highly leveraged short on Bitcoin perpetual futures via Hyperliquid.

Huge Bitcoin Whale Goes Short

According to data from Hyperliquid and blockchain analyst Lookonchain, the whale’s short position is valued at over $445 million and utilizes 40x leverage. This position comes with a liquidation price set at $85,940, and despite the inherent risks, the trader is already reporting an unrealized gain of $4.4 million.

Pseudonymous trader CBB (@Cbb0fe) galvanized a group of market participants to target the position. Lookonchain’s report highlights a coordinated effort to force the whale’s hand: “This whale still managed to turn a profit despite being hunted by a team! 11 hours ago, @Cbb0fe publicly formed a team to hunt this whale who shorted BTC with 40x leverage. Just one hour later, the team was in action, driving BTC above $84,690 in a short period,” Lookonchain said on X.

Related Reading

Notably, the whale was forced to deposit $5 million USDC to increase margin and avoid liquidation. “But the hunt ultimately failed. The whale continued to increase his position to short BTC. Currently, the whale is profiting from closing positions through Twap. His current position is 5,406 BTC ($449M), with an unrealized profit of $4.4M.” the blockchain analytics service added via X.

In a series of rapid-fire tweets, CBB further intensified the situation by stating: “The hunt has begun,” adding “If you are willing to hunt this dude with size, drop a DM, setting up a team right now and already got good size.” He later added: “We have lost a battle but we have not lost the war. Locked in.” and “Holy fuck please Eric Trump send help from the divine father to liquidate this mfer.”

Related Reading

Hyperliquid has positioned itself at the forefront of this unfolding drama, emphasizing the platform’s role in providing unmatched transparency in high-leverage trading. In a statement posted on X, Hyperliquid commented: “Hyperliquid has redefined trading. When a whale shorts $450M+ BTC and wants a public audience, it’s only possible on Hyperliquid. […] Anyone can photoshop a PNL screenshot. No one can question a Hyperliquid position, just like no one can question a Bitcoin balance. The decentralized future is here.”

Hyperliquid was recently thrust into the spotlight following an incident involving a prominent whale who executed a “liquidation arbitrage.” In that event, the extraction of floating profits led to a margin shortage that triggered forced liquidations, transferring risk to the decentralized exchange’s HLP vault.

At press time, BTC traded at $83,455.

Featured image from iStock, chart from TradingView.com