- Smart money wallets aggressively bought FARTCOIN, with one whale investing $8.78M at $1.15 per token.

- A rejection at the resistance may lead to a pullback toward $1.00 or even $0.80 support.

Fartcoin [FARTCOIN] was the main gainer in the memecoin market over the last 24 hours, rising by 15.4% to trade at $1.26.

Its market cap hit $1.25 billion, pushing it into the top 20 memecoins by market value, as per CoinMarketCap.

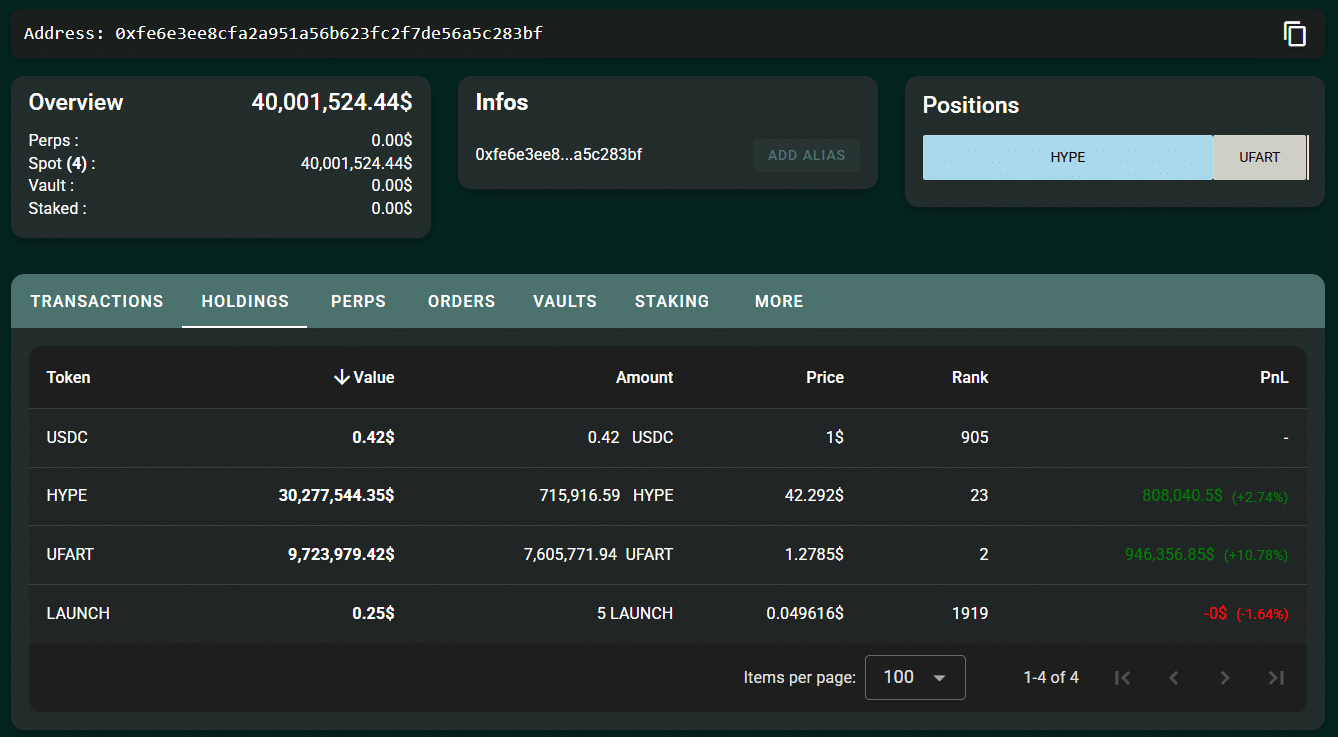

$40M wallet goes big on FARTCOIN and HYPE

Much of this rally stemmed from aggressive whale buying.

Stalkchain’s data noted that Fartcoin became the most purchased token by smart money. This suggested an increase in the trust of institutional investors in decentralized exchanges [DEXs].

Additionally, a single whale used $40.42M USDC, of which $8.78M was used to buy 7.6M FARTCOIN at $1.15 per token. The remaining amount was used to purchase 715,917 HYPE tokens at $41.16 each.

This whale rotated funds out of SOL, BTC, and ETH, taking a $2.17 million hit to reallocate into memecoins.

That kind of conviction, especially after FARTCOIN’s prior 18% drop, suggests confidence in a bounce from current levels.

Due to the extreme recovery and the eye of whales, FARTCOIN may be beginning a new accumulation duration.

Having the smart money support and gaining momentum, the short-term upside was one of the main factors to monitor by both traders and investors.

Price action respects the channel

Technically, the FARTCOIN/USDT chart continued a strong upward trend in the form of a rising channel, as it rebounded off the $1.15 -1.20 mid-range support.

The daily chart saw regular higher highs and higher lows, confirming bullish power.

However, the $1.60–$1.70 resistance band stood firm.

A close above this zone would open the path toward $2.16, where the upper trendline aligns with the next supply cluster.

On the reverse side, failure to overcome the supply area of $1.60 -1.70 could result in a corrective move back towards $1.15 -1.20 or lower.

A break of price below that support would see the upward-sloping channel foundation around the $1 area, or even the wider demand area around the $0.80 level, become the new point of focus.

So far, bulls have maintained control above the trendline, but the next leg higher hinges on a breakout above $1.50 backed by strong volume.

Until then, consolidation inside the current range seems likely.