Data shows the cryptocurrency derivatives market has witnessed a mass liquidation event as Bitcoin and other digital assets have plunged.

Crypto Liquidations Have Exceeded $680 Million In Last 24 Hours

According to data from CoinGlass, a large amount of liquidations have occurred on the derivatives platforms during the past day. “Liquidation” here refers to the forceful closure that any open contract has to go through after it has amassed losses of a certain degree (the exact value of which may depend on the exchange).

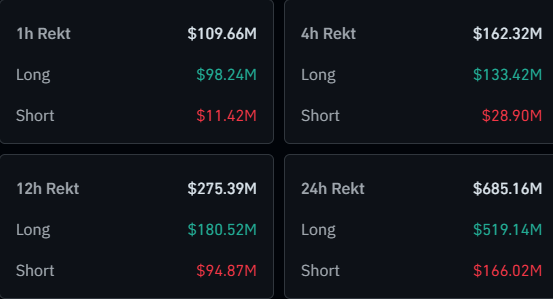

Here is a table that shows the numbers related to the latest cryptocurrency liquidations:

Looks like longs have been the most heavily affected by the flush | Source: CoinGlass

As is visible above, around $685 million in contracts have ended up finding liquidation during the last 24 hours. Out of these, $519 million of the positions were long ones, equivalent to just under 76% of the total.

The reason behind the dominance of long liquidations is naturally that Bitcoin and other assets have observed a drawdown in this window. Though, $166 million in shorts still managed to get caught up in the flush as a result of the fact that the crash has been bumpy, rather than straight down.

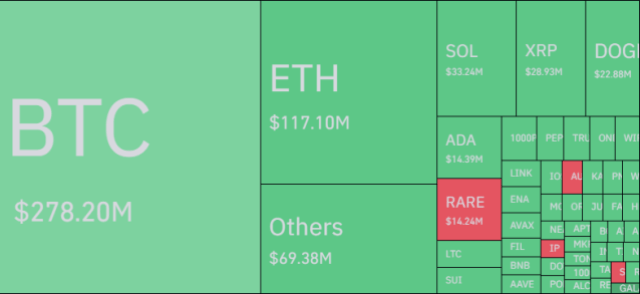

In terms of the contribution to the event by the various symbols, BTC has occupied the largest share at $278 million, as the below heatmap displays.

The breakdown of the liquidations by symbol | Source: CoinGlass

Interestingly, Ethereum (ETH), the second largest cryptocurrency, has seen less than half as many liquidations as BTC, which means speculative activity has been more heavy around the original digital asset as compared to the altcoins recently.

An event like today’s where a mass amount of liquidations take place at once is popularly known as a squeeze. Since the latest event involved the longs more heavily, it would be called a long squeeze.

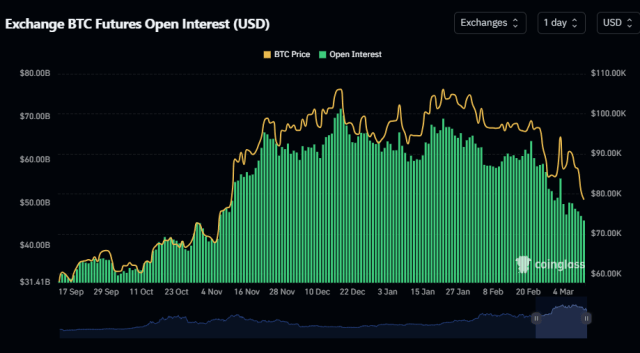

A squeeze is more probable to occur when the market is overleveraged. An indicator that can be useful to track for potential overheated conditions is the Open Interest, which measures the total amount of positions (in USD) related to a given asset that are open on all derivatives exchanges.

Below is a chart that shows the trend in the Open Interest for Bitcoin over the last few months.

The value of the metric appears to have been sliding down in recent days | Source: CoinGlass

From the graph, it’s apparent that the Bitcoin Open Interest has been following a downward trajectory for a while now and the latest long squeeze only furthered this drawdown. Thus, it appears speculative activity in the market is constantly going down.

This development may be positive for the cryptocurrency, as a cooler derivatives market means less chances of chaos that comes with a squeeze.

BTC Price

At the time of writing, Bitcoin is trading around $79,400, down over 6% over the last week.

The trend in the price of the coin over the last five days | Source: BTCUSDT on TradingView

Featured image from Dall-E, CoinGlass.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.