Bitcoin appears poised for significant upside movement following a strong start to 2025. However, questions remain about the market’s overall health and whether the current bullish momentum can be sustained over the coming weeks and months. Here, we’ll take an unbiased and data-driven look into the underlying numbers supporting our current trend.

For a more in-depth look into this topic, check out a recent YouTube video here: Bitcoin Data Driven Analysis & On-Chain Roundup

Miner Recovery

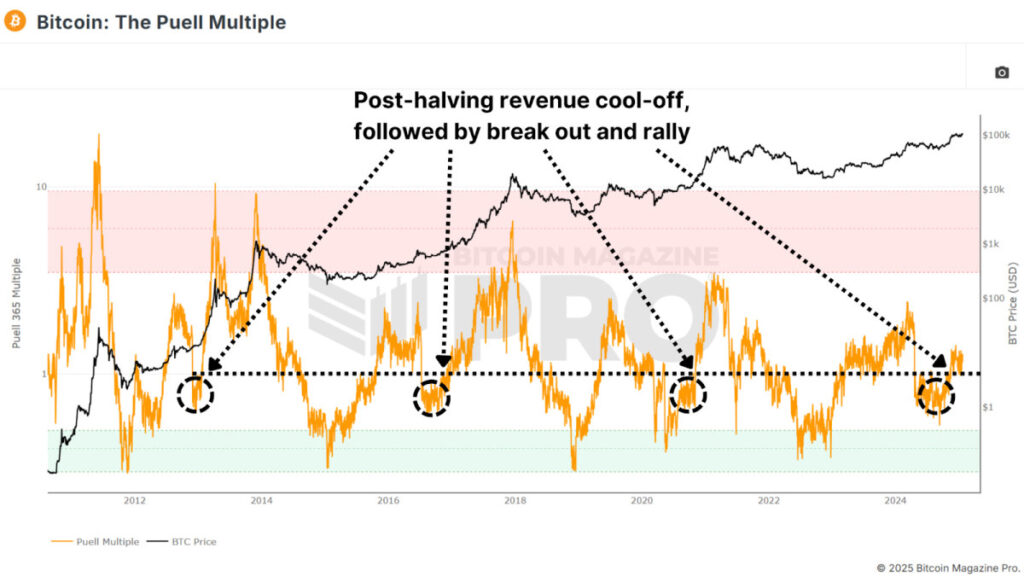

The Puell Multiple, a measure comparing miners’ daily USD revenue to its yearly average, suggests that Bitcoin’s fundamental network strength remains strong. Historically, after a halving event, miner revenue experiences a significant dip due to the 50% block reward reduction. However, the Puell Multiple recently climbed above the key value of 1, indicating a recovery and a potentially bullish phase.

Previous cycles show that crossing and retesting the value of 1 often precedes major price rallies. This pattern is repeating, signaling strong market support from mining activity.

Substantial Upside Potential

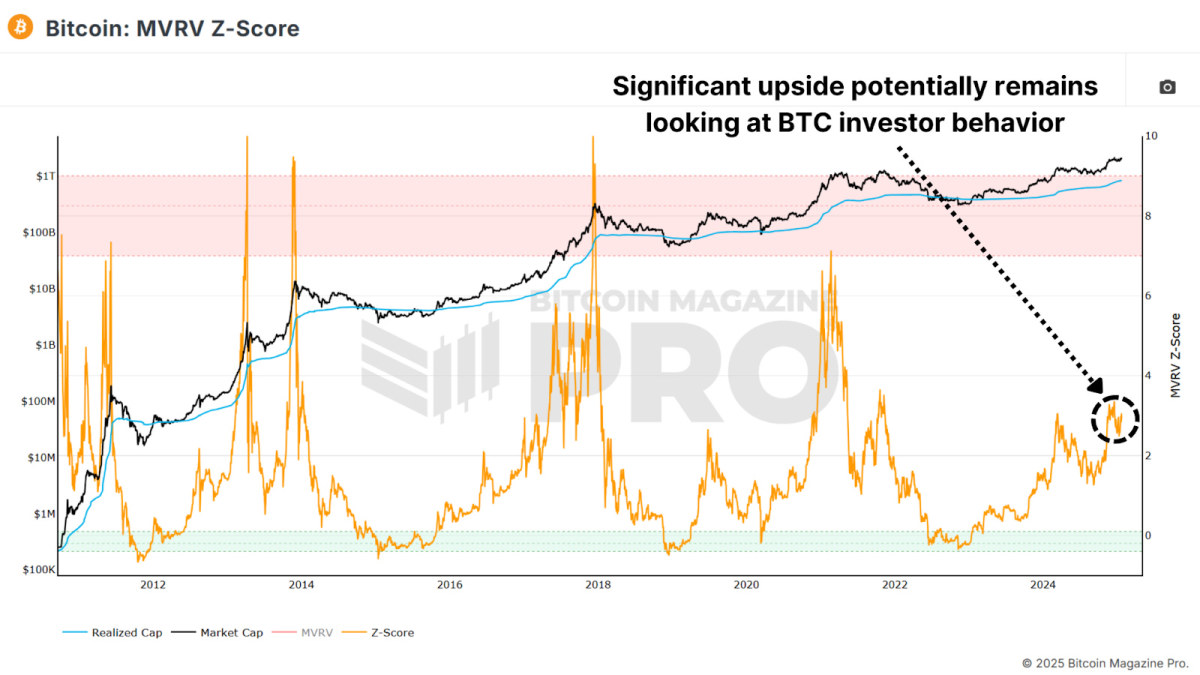

The MVRV Z-Score, a metric analyzing Bitcoin’s market value relative to its realized value, or average accumulation price for all BTC, suggests current values remain well below historical peak regions, outlining considerable room for growth.

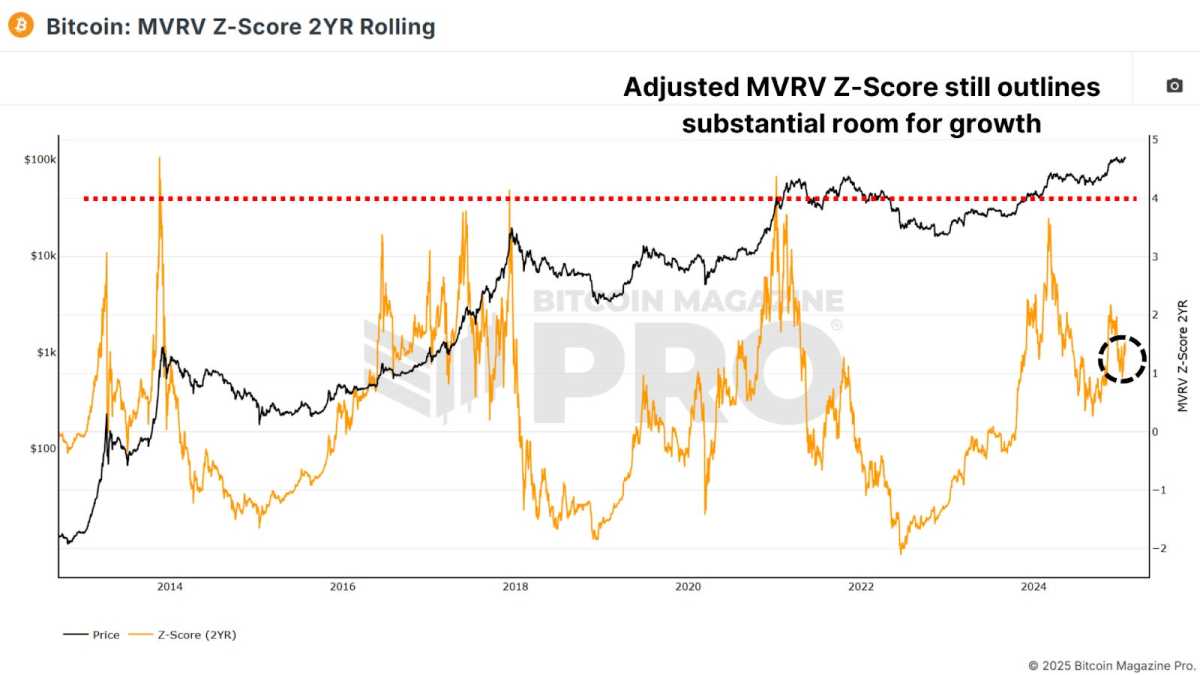

A two-year rolling version of the MVRV Z-Score, which adjusts for evolving market dynamics, also shows bullish potential. Even by this adjusted measure, Bitcoin is far from previous cycle peak levels, leaving the door open for further price appreciation.

Related: We’re Repeating The 2017 Bitcoin Bull Cycle

Sustainable Sentiment

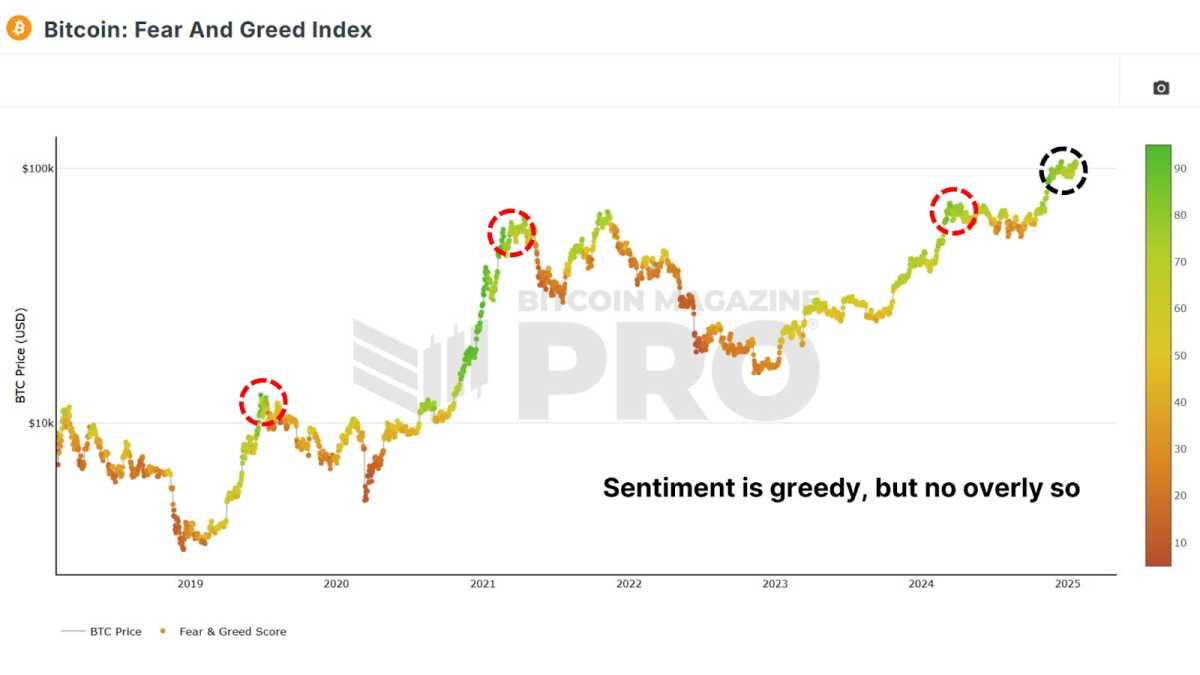

The Bitcoin Fear and Greed Index is currently at a healthy and sustainable amount of Greedy sentiment, indicating greedy but sustainable sentiment. Historical data from the 2020-2021 bull cycle shows that greed levels around 80-90 can persist for months, supporting prolonged bullish momentum. Only when values approach extreme levels (95+) does the market typically face significant corrections.

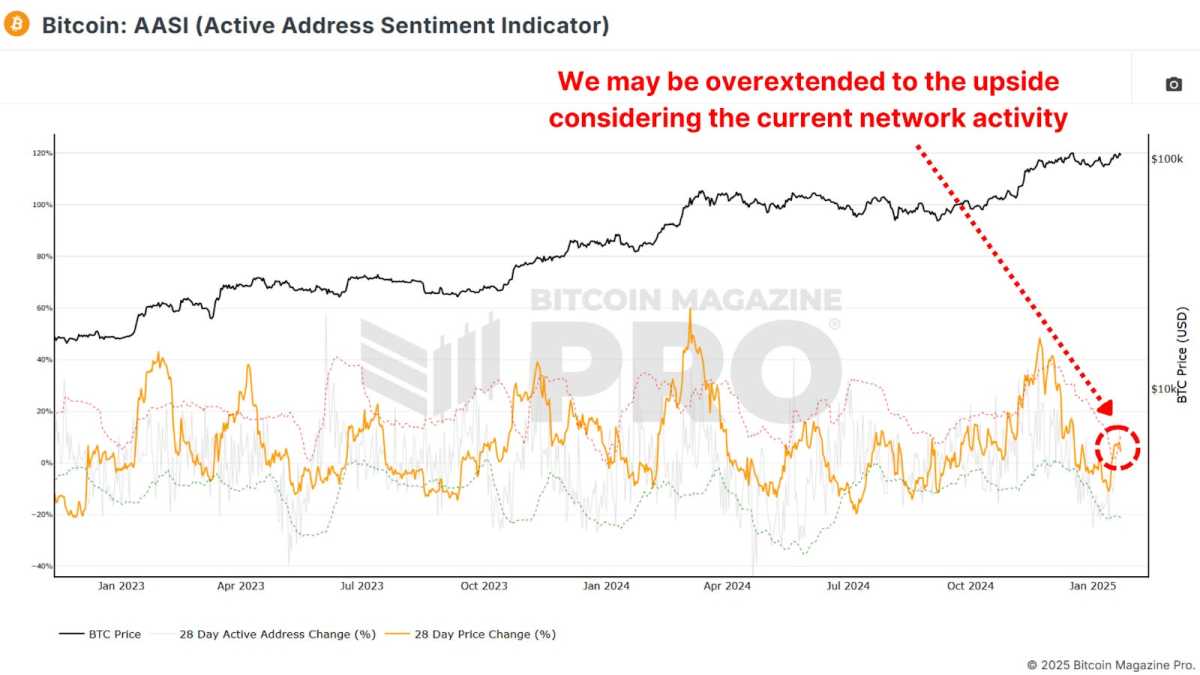

Network Activity

The Active Address Sentiment Indicator reveals a slight dip in network activity, suggesting retail investors have yet to fully re-enter the market. However, this could be a positive sign, indicating untapped retail demand that might fuel the next leg of the rally.

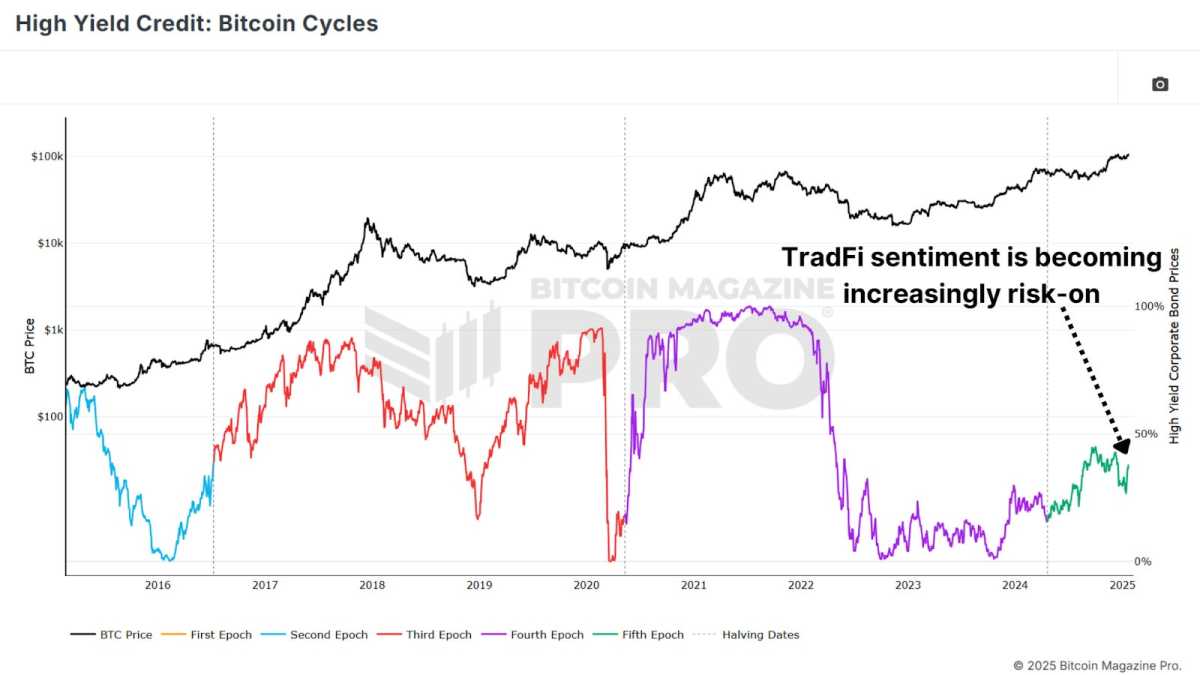

Risk Appetite Shifts

Traditional market sentiment is showing improving signals. High Yield Credit appetite is increasing as the macro-economic environment shifts to a more risk-on outlook. Looking at corporate bonds that offer higher interest rates due to their lower credit ratings compared to investment-grade bonds. Historically, there has been a strong correlation between Bitcoin’s performance and periods of heightened global risk appetite, which have often aligned with bullish phases in Bitcoin’s price.

Related: What Bitcoin Price History Predicts for February 2025

Conclusion

Bitcoin’s on-chain metrics, market sentiment, and macro perspective all point to a continuation of the current bull market. While short-term volatility is always possible, the convergence of these indicators suggests that Bitcoin is well-positioned to reach and potentially surpass our current all-time high in the near future.

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.