A recent study by Cornerstone Research indicates that in 2024, the US Securities and Exchange Commission (SEC) witnessed a notable decrease in enforcement actions related to crypto. The number of cases dropped by 30% in Gary Gensler’s final year as SEC chairman, from 47 in 2023 to just 33 in the previous year.

In spite of this reduction, the monetary fines rose to an all-time high of nearly $5 billion.

A Year Of Record-Breaking Penalties

Though enforcement numbers dropped, the SEC gathered penalties never seen before. The majority of this entire amount came from a single multi-billion dollar settlement. It is a far cry from the years Gensler led, in which fines, although significant, were less focused in specific cases.

Despite a brief rise in the number of lawsuits filed against the crypto industry in the final months that SEC Chair Gary Gensler was in office, the agency overall saw a 30% decrease in enforcement actions against the industry last year. https://t.co/ONnMsaAIOo pic.twitter.com/bMEMIiQ0V3

— Law360 (@Law360) January 24, 2025

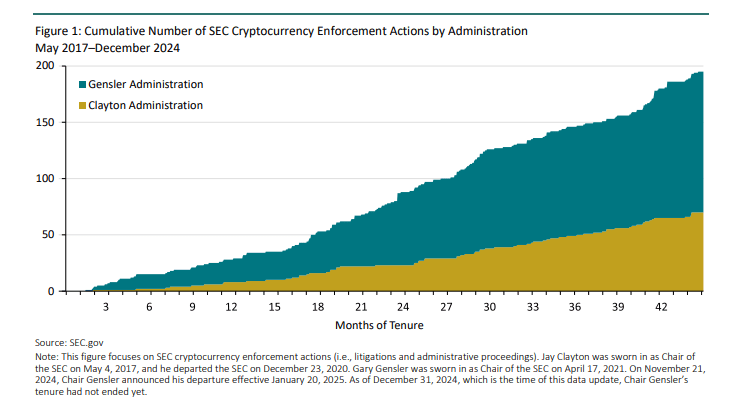

Between April 2021 and December 2024, the US regulatory body levied fines totaling over $6 billion for 125 activities related to cryptocurrencies. When compared to the collection of $1.50 billion that Jay Clayton oversaw from 2017 to 2020, this amount is over four times greater than that amount.

Source: Cornerstone Research

Gensler’s Aggressive Stance On Fraud

Gensler’s administration placed a strong focus on fraud. Around 66% of cases during Clayton’s term involved claims of fraudulent activities, a significant rise from 54% during his tenure.

The SEC also kept looking at unregistered securities sales. Under Gensler, such infractions accounted for about 63% of all enforcement actions—a little lower than the 71% noted in the Clayton era. Notwithstanding the changing character of these lawsuits, this trend underscores the SEC’s relentless commitment to control of crypto-sector activity.

Enforcement Trends In Comparison To Their Predecessors

Between the Gensler and Clayton administrations, there is a stark contrast in their approaches to cryptocurrency regulation. Gensler oversaw 125 enforcement actions in just over three years, whereas Clayton initiated only 70 during a comparable timeframe.

BTCUSD trading at $104,770 on the daily chart: TradingView.com

The fact that Gensler resolved 98 of these cases demonstrates a strong enforcement commitment. In reaction to cryptocurrency markets’ complexity and digital asset proliferation, the SEC has become more active.

The Road Ahead For Crypto Regulation

The record fines underline the SEC’s influence on shaping the cryptocurrency environment even if enforcement actions in 2024 decreased. With Gensler leaving, it is yet unknown how the new leaders will oversee the crypto industry.

Industry insiders are still in discussion, meantime, whether the SEC would keep its strict posture or change to fit evolving market conditions. Gensler’s legacy emphasized a period of rigid monitoring and record-breaking penalties, implying that US financial authorities would most likely keep giving crypto control top priority.

Featured image from Evelyn Hockstein/Pool via Getty Images, chart from TradingView