In the world of decentralized networks, the battle lines are drawn not just between different blockchains but within the communities they spawn. Bitcoin, having weathered its own civil war, has emerged stronger, proving its resilience and commitment to the principles of decentralization, freedom, and Truth. Ethereum, on the other hand, is currently embroiled in internal strife, revealing a stark contrast in community ethos and leadership philosophy.

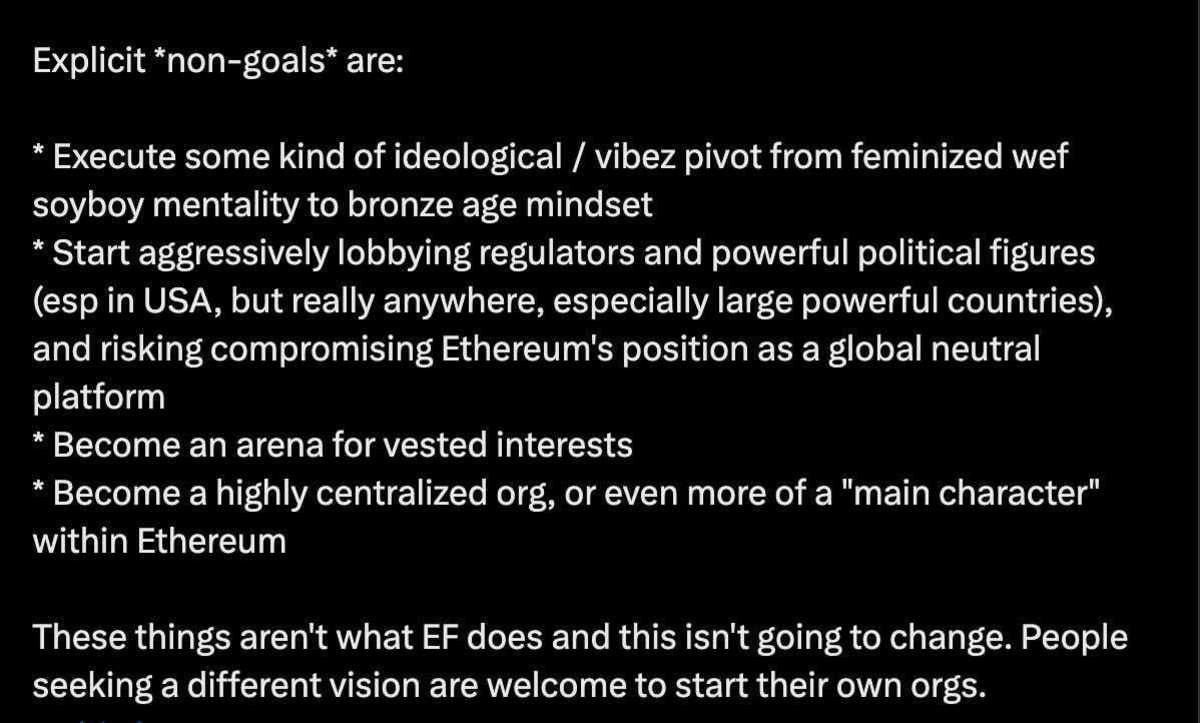

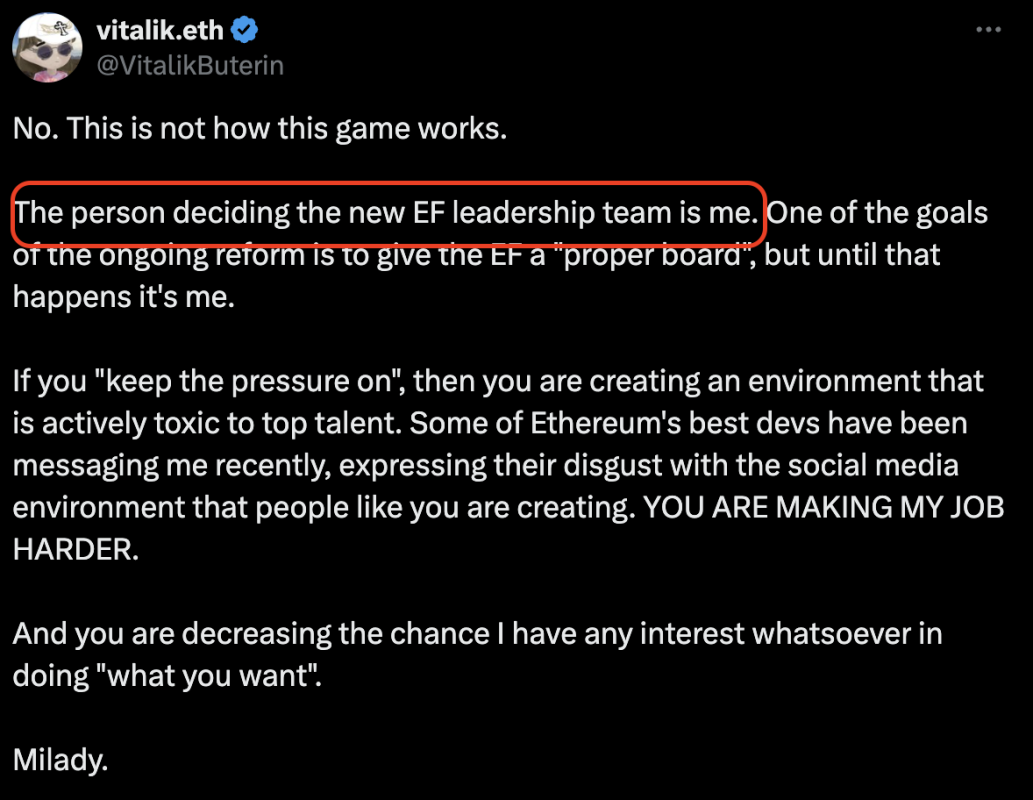

Vitalik Buterin’s recent tweets concerning the Ethereum Foundation drama are a testament to this. They expose a community that seems to prioritize PERCEPTION over substance, a hallmark of the bureaucratic and “woke” culture that has infiltrated society at large. Ethereum’s approach, under Buterin’s guidance, reflects a refusal to adopt the “bronze age mindset” that has been pivotal in Bitcoin’s success. This mentality, often derided as “toxic maximalism” by outsiders (the term “maximalism” was coined by Vitalik himself, by the way), champions unapologetic truths and a fierce defense of core values like decentralization and security.

Toxicity, in this context, becomes a virtue. It favors those willing to speak uncomfortable truths and maintain the integrity of the blockchain’s original vision. Choosing the path of bureaucratic, HR-friendly discussions leads to a landscape where managing perceptions overshadows achieving actual results. Ethereum’s current predicament is not just a long time coming but perhaps a necessary wake-up call for those who have strayed from the path of what blockchain technology was meant to achieve.

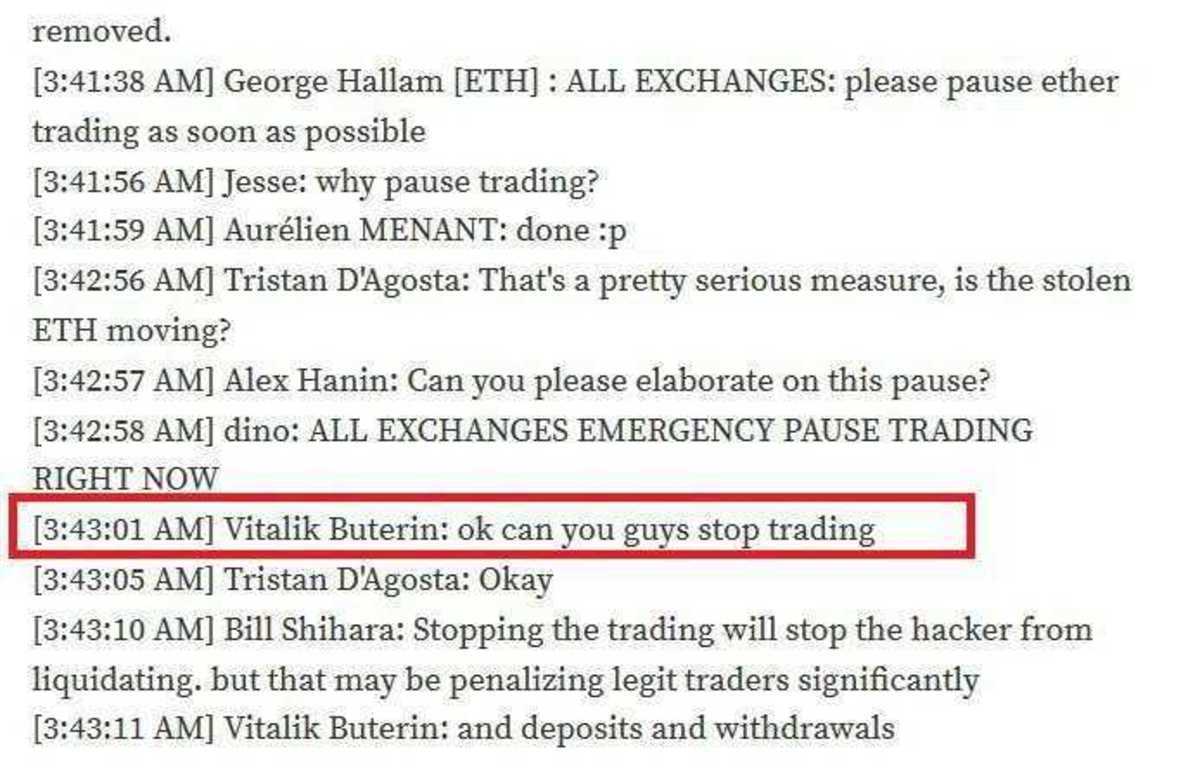

In contrast, Ethereum’s current turmoil showcases a leadership that is cracking under pressure, revealing Buterin’s true colors – not for the first time.

Bitcoin, unlike Ethereum, does not have a Foundation, and this is by design. Does this make our governance process a hundred times harder? Absolutely, and that’s precisely the point. Even though I might not always agree with the criticism leveled at Bitcoin Core, I recognize the value in knowing they can be replaced at any given moment. The Ethereum Foundation has always been a magnet for centralized control, and the power vacuum its collapse would leave will sow chaos. Bitcoin’s governance might be organized chaos, but Ethereum is now facing a spell of unorganized chaos that could further tarnish its reputation. I’d love to see Vitalik return to Bitcoin; he’s undeniably intelligent. Yet, his current role as the “man in control” is exactly why Bitcoin avoids having a public figurehead. The plebs, the node runners – are in control, and that’s the better way.

The “.ETH” community’s apparent lack of commitment to these foundational blockchain principles suggests a future where Ethereum might not just suffer greatly from its civil war but could also lose its relevance.

The irony here is palpable; while Ethereum struggles, other platforms like Solana stand to gain.

But it seems like those making this migration do not learn from their mistakes. They recognize the ugly side of Ethereum and Vitalik, but instead of seeking the true axioms of a good network, they move to an even more centralized alternative.

However, this shift is likely temporary. The so-called “On-Chain refugees” fleeing the chaos of Ethereum will eventually find their way back to Bitcoin, the original and only cryptocurrency that has consistently delivered on its promises without the drama. They need one more rug pull on the Solana side before they finally end their journey, like all of us – Bitcoin only.

This drama within Ethereum has been brewing for years, and while it might be late in coming, it’s not soon enough for Humanity. The time wasted building upon what some might argue is a fundamentally flawed system could have been better spent advancing technologies that genuinely uphold the ideals of decentralization and freedom.

As Ethereum continues to navigate its internal conflicts, it serves as a cautionary tale. It underscores the importance of a community that values Truth over narrative, freedom over control, and decentralization over centralized decision-making. Bitcoin emerging stronger from its civil war wasn’t just about survival; it was about proving the soundness of its principles. Ethereum’s ongoing struggle might just be the catalyst needed for the blockchain community to return to those roots, recognizing that in the realm of digital currencies, only those built on genuine, unyielding principles will stand the test of time.

Bonus Take – PLEASE make this happen Nic: https://x.com/nic__carter/status/1881029931011903772

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Articles Guillaume writes in particular may discuss topics or companies that are part of his firm’s investment portfolio (UTXO Management). The views expressed are solely his own and do not represent the opinions of his employer or its affiliates. He’s receiving no financial compensation for these takes. Readers should not consider this content as financial advice or an endorsement of any particular company or investment. Always do your own research before making financial decisions.