- Ethereum’s exchange reserves remain at historic lows, potentially signaling a supply-driven price increase.

- The prolonged low reserves could lead to upward price pressure in the near term.

Ethereum [ETH] appears to still be lagging behind despite the broader crypto market bullish sentiment.

While Bitcoin [BTC] created yet again another all-time high, last week, ETH continues to still struggle to break past major resistance.

However, at the time of writing the asset is up 4% in the past day with a press time trading price of $3,195.

Amid all of these, one significant factor influencing Ethereum’s price movements is the reserve levels on spot exchanges.

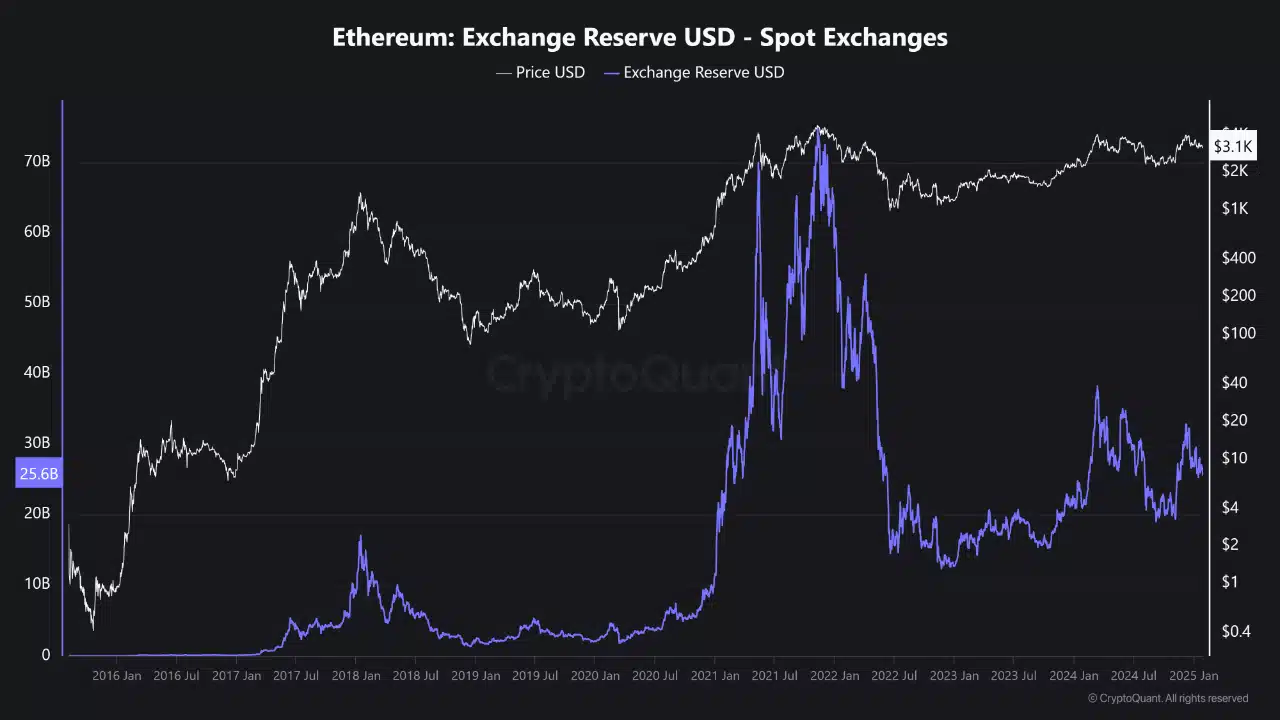

According to an analysis published on the CryptoQuant QuickTake platform, Ethereum reserves have exhibited notable historical trends.

Tracking Ethereum reserves over time

The analyst outlined how Ethereum’s reserve levels have shifted over the years, highlighting their potential impact on price.

During the 2017–2018 bull market, reserves steadily increased, reaching a peak in early 2018. This surge coincided with the heightened interest in Ethereum and related projects.

With the rise of decentralized finance (DeFi) in 2020 and 2021, Ethereum reserves saw another significant boost as users poured assets into protocols and platforms built on the Ethereum network.

However, as the market matured, the end of 2021 marked the beginning of a notable decline in reserves. Large-scale withdrawals from exchanges set the stage for persistently low reserve levels in 2023 and beyond.

These historically low reserve levels have important implications for Ethereum’s price.

The continued drop suggests that many market participants prefer to move their Ethereum holdings off exchanges, potentially for long-term storage.

This behavior often indicates confidence in Ethereum’s value as a long-term asset.

Current trends and market implications

As of 2024, Ethereum reserves on spot exchanges remain near historic lows. This limited supply on exchanges could contribute to upward price pressure, as fewer coins are readily available for trading.

Over time, such conditions can lead to stronger price movements if demand increases.

Although Ethereum’s current price remains below critical resistance levels, the ongoing low reserve environment may set the stage for a new bullish trend.

For now, it is worth monitoring other on-chain metrics to gain insights into Ethereum’s potential short-term trajectory.

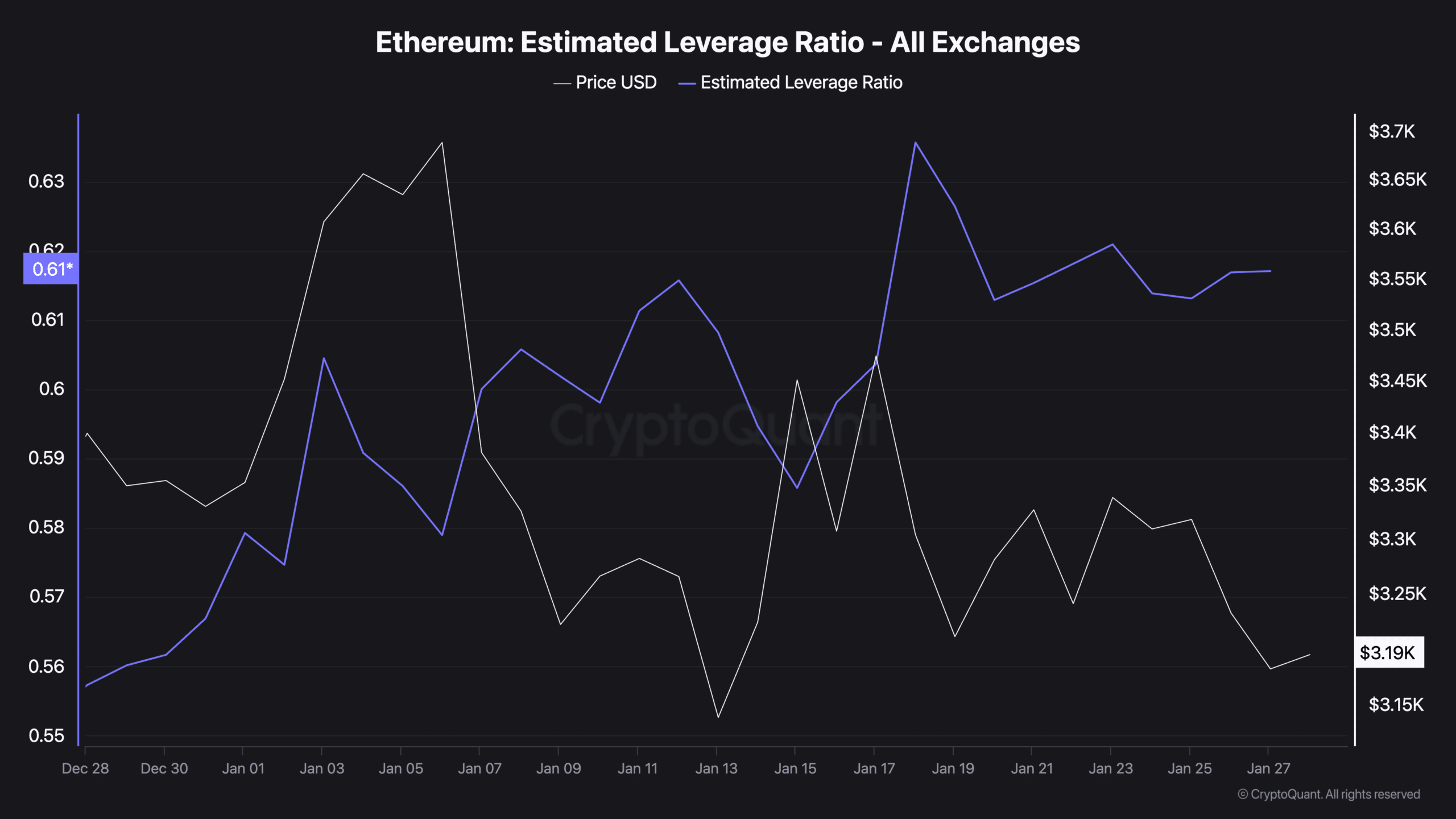

For example, data from CryptoQuant indicated a recent increase in one particular metric from 0.58 on the 15th of January to 0.63 on the 18th of January, followed by a slight decrease to 0.61 on the 27th of January.

Read Ethereum’s [ETH] Price Prediction 2025–2026

This fluctuation suggests a period of consolidation, where market participants are adjusting their positions in response to changing conditions.

If the metric continues to hold above certain thresholds, it could signal growing confidence among investors and potentially pave the way for upward price movements.