Bitcoin has experienced a quiet weekend following the massive volatility it faced last week. The price closed around the $96,500 mark for five consecutive days and has ranged between $95K and $98K in the past hours, signaling a lack of clear direction in the short term. This indecisive price action has left bulls struggling to reclaim control, while bears are unable to push the price into lower demand zones.

Despite the recent consolidation, market uncertainty continues to weigh on investor sentiment, with both sides waiting for a decisive move. Bitcoin’s resilience above critical support levels contrasts sharply with the significant sell pressure faced by altcoins. According to key metrics shared by Glassnode, Bitcoin has remained near its starting position over recent weeks despite ongoing market volatility. Meanwhile, altcoins, particularly Ethereum and ERC-20 tokens, have experienced notable underperformance, reflecting weakness in adoption and positioning within the broader market.

As Bitcoin holds steady in its range, it highlights its strength compared to the broader crypto market, signaling a shift in investor preference toward the leading cryptocurrency. However, with no clear breakout above $98K or breakdown below $95K, the coming days will be crucial in determining Bitcoin’s short-term direction amid the ongoing market uncertainty.

Bitcoin Outperforms As Altcoins Bleed

Bitcoin is leading the crypto market amid ongoing volatility and uncertainty, demonstrating resilience while most altcoins continue to bleed. Bulls have managed to push BTC above the $90K level, maintaining the bullish structure despite turbulent market conditions. However, price action remains indecisive in the short term, with no clear breakout or breakdown as volatility continues to dominate.

Key metrics from Glassnode shared on X reveal that Bitcoin has remained near its starting position over recent weeks despite experiencing significant volatility. In contrast, altcoins have faced heavy sell pressure, particularly those built on Ethereum’s ERC20 standard. ERC20 tokens are a type of cryptocurrency that operates on the Ethereum blockchain, following a standardized set of rules for token creation and deployment. They are widely used for decentralized applications, initial coin offerings (ICOs), and various DeFi projects.

All ERC20 sub-sectors, including DeFi, gaming, and utility tokens, have underperformed recently, reflecting broad-based weakness in both adoption and market positioning. This stark contrast highlights Bitcoin’s relative strength, as investors increasingly favor the leading cryptocurrency amid uncertain conditions.

While Bitcoin holds steady, the lack of a decisive move suggests the market is still seeking clarity. Bulls must push BTC above key levels like $98K and $100K to reignite bullish momentum, while bears aim to test demand closer to $90K. The coming weeks will be critical in determining whether Bitcoin can sustain its leadership role or if market-wide uncertainty will trigger further downside.

Price Struggles Between Key Liquidity Levels

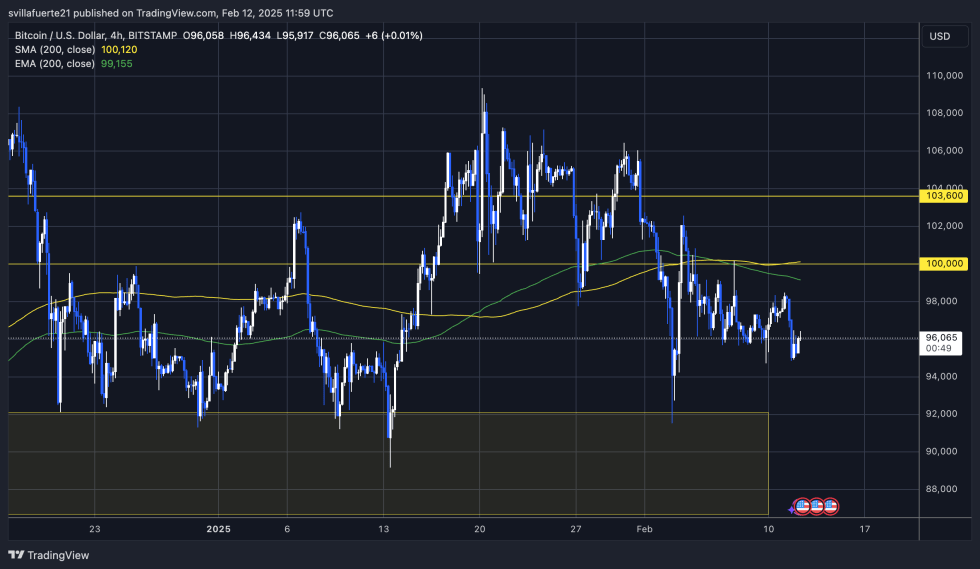

Bitcoin is trading at $96,100 after several days of sideways price action, ranging between $94,700 and $98,500. Short-term direction remains uncertain as bulls and bears continue to battle for control. Bulls have struggled to reclaim the $100K mark, a critical level for confirming bullish momentum, while bears have failed to push the price below $95K, where strong demand continues to hold.

For Bitcoin to confirm a short-term reversal, bulls must reclaim the $98K mark as support and push decisively above $100K. This move would signal strength and set the stage for a potential rally toward all-time highs around $109K. However, the inability to break above $100K has left the market in a speculative phase, with both sides cautious about the next significant move.

If the $95K level is lost, Bitcoin could face a sharper correction, with lower demand levels around $89K likely coming into play. This area represents critical support, as it aligns with the realized price of new whale investors, a level where large players are unlikely to sell at a loss. The coming days will be pivotal in determining whether BTC can regain bullish momentum or if further downside is on the horizon, deepening uncertainty across the market.

Featured image from Dall-E, chart from TradingView