- OP’s head-and-shoulders breakdown signaled a potential collapse, with $0.30 as the next target.

- Declining transactions and weakening demand suggested OP could face a major downturn.

Optimism [OP] is showing signs of weakness as a head-and-shoulders pattern points to a possible major downturn. The coin was trading at $1.16 at press time, up 3.54% in the last 24 hours.

But analysts warn that a deeper decline may be on the horizon.

If the bearish trend continues, OP could drop below $0.30, marking a steep fall from its previous highs.

Bearish reversal pattern signals trouble for OP

Technical analysis reveals a clear head-and-shoulders formation, often signaling the end of an uptrend. The left shoulder formed in early 2023 when OP peaked at around $3.70—$3.80.

The head followed in late 2023 to early 2024, with OP reaching a high of $4.90—$5.00. The right shoulder developed in mid-2024, but the price failed to surpass $3.00, indicating weakening bullish momentum.

The critical neckline at $1.40 served as strong support before breaking down. Following the breakdown, OP dropped sharply to its current price, confirming the bearish trend.

If this pattern fully plays out, OP could slide further, with analysts pointing to $0.70, $0.50, $0.38, and even $0.28 — $0.30 as potential support levels.

Analysts warned that if OP fails to hold above $0.70, we could see a rapid decline toward $0.30, or even lower.

Market activity suggests weakening demand

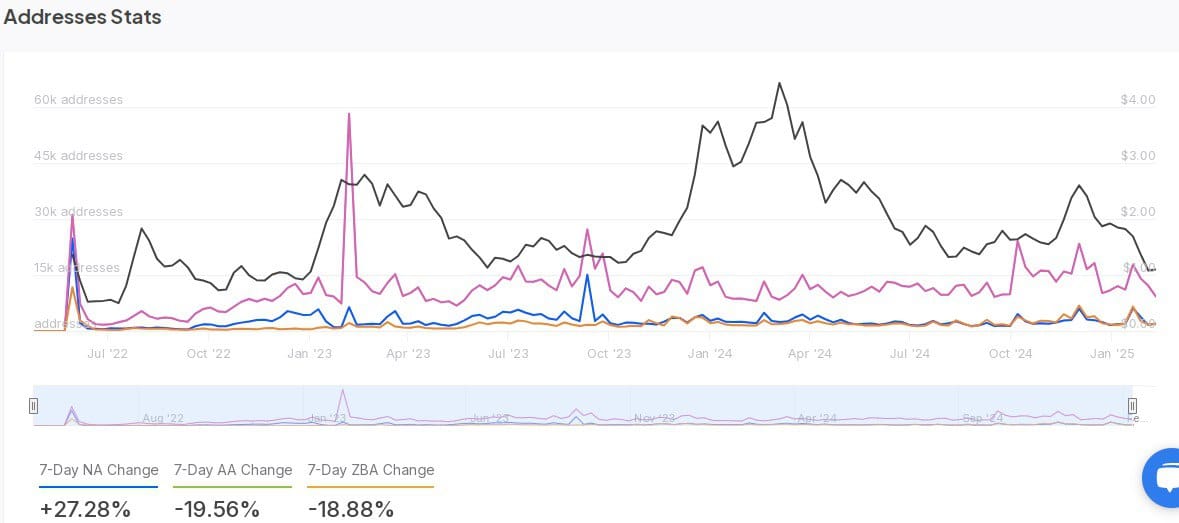

Address data from IntoTheBlock shows mixed signals regarding user engagement. The number of New Addresses (NA) increased by 27.28%, indicating some new interest in OP.

However, the number of Active Addresses (AA) declined by 19.56%, suggesting that fewer users are engaging in transactions.

At the same time, Zero Balance Addresses (ZBA) dropped by 18.88%, meaning fewer wallets are being emptied or abandoned.

These statistics reflect a concerning trend, as a rise in new addresses does not necessarily translate to long-term holders or increased market participation.

Large transactions decline as institutional activity slows

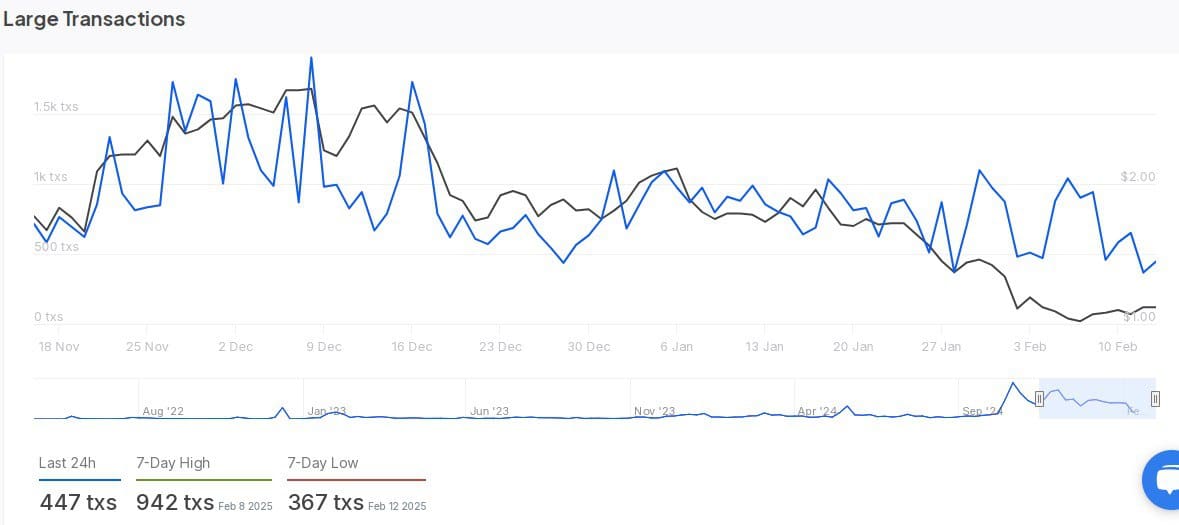

Transaction data shows a decline in large trades, hinting at reduced participation from institutional investors or large holders. Over the past three months, the number of large transactions fluctuated between 500 and 1,500 per day.

On the 8th of February 2025, transactions peaked at 942, while the 7-day low was recorded on the 12th of February 2025, at 367 transactions.

In the last 24 hours, 447 large transactions were recorded, showing a decline from recent highs.

The price of OP remains under pressure, currently hovering around $1.00 — $1.16, which aligns with the declining transaction volume.

Lower large transaction activity could signal a lack of confidence among major investors.

What comes next for OP?

Optimism is now at a critical stage, with traders closely watching its support zones. If OP fails to hold $0.70, the next downside targets are $0.50, $0.38, and ultimately $0.28 — $0.30.

Analysts suggest that a break below $1.00 could accelerate the decline. However, if OP can reclaim $1.40, it could invalidate the bearish scenario.