Bitcoin’s price will continue to experience volatility until genuine buyers start entering the market, rather than traders seeking arbitrage opportunities, according to a crypto venture capitalist.

“This is a classic case of liquidity games. ETFs didn’t just bring in long-term holders — they brought in hedge funds running short-term arbitrage,” Master Ventures founder Kyle Chasse said in a Feb. 27 X post.

Hedge funds were pursuing “low-risk yields” on Bitcoin

“For months, hedge funds were exploiting a low-risk yield trade using BTC spot ETFs & CME futures,” Chasse added.

He said that volatility will continue for Bitcoin (BTC) as leveraged positions get liquidated and the cash and carry trade will keep unwinding.

“BTC needs to find real organic buyers (not just hedge funds extracting yield),” he said.

Chasse explained that hedge funds were making profits trading the difference between Bitcoin futures price and Bitcoin’s spot price, as the futures’ price was higher.

As the market tumbled, that price difference “collapsed,” making the trade unprofitable. This is commonly known as the cash and carry trade.

Chasse said:

“Hedge funds don’t care about Bitcoin.”

Echoing a similar sentiment, 10x Research head of research Markus Thielen said in a Feb. 27 report that as crypto market sentiment declined, funding rates plunged, likely forcing these trades to unwind.

Chasse explained that hedge funds were never “betting” on Bitcoin’s price to skyrocket; instead, they were pursuing low-risk yields.

Source: Michael Saylor

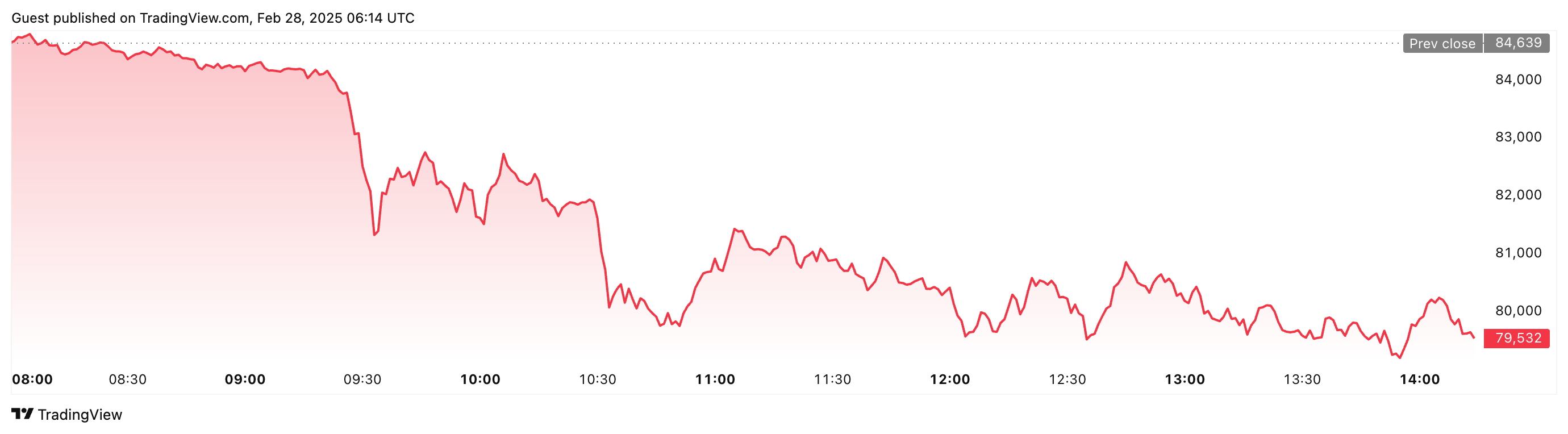

Bitcoin’s price has dropped below $80,000 for the first time since Nov. 10, breaking through that level following Donald Trump’s reelection in the US presidential election.

Bitcoin falls below $80,000 for the first time since November

At the time of publication, Bitcoin was trading at $79,532, as per TradingView data.

Bitcoin was trading at $79,532 at the time of publication. Source: TradingView

Swyftx lead analyst Pav Hundal told Cointelegraph that while Bitcoin could see more downside, most of the shakeout has already played out.

“It is entirely likely that we see Bitcoin test lower at this point, but it is likely that most of the damage has been done,” Hundal said. He added that the upcoming US inflation data on Feb. 28 could improve market conditions if it comes in lower than expected.

Related: Key metric shows Bitcoin hasn’t peaked, has bullish year ahead: Analyst

“Now that the trade is dead, they’re pulling liquidity — leaving the market in free fall,” Chasse said.

Since Bitcoin dropped below $90,000 on Feb. 25, many analysts have blamed macroeconomic uncertainty and concerns over Trump’s proposed tariffs for the decline in both Bitcoin and the broader crypto market.

Magazine: Elon Musk’s plan to run government on blockchain faces uphill battle

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.