Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

One crypto exchange’s loss is another crypto exchange’s gain. This holds true with cryptocurrency exchange Uniswap after it recorded a weekly loss of over 20% brought by a large investor offloading a huge number of tokens.

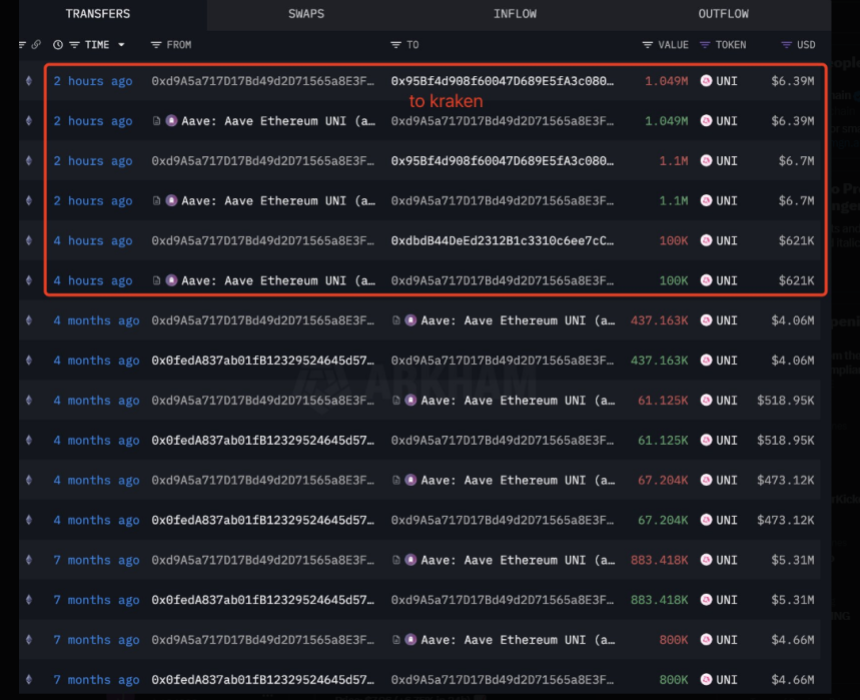

Uniswap’s loss was Kraken’s gain after the said whale transferred 2.25 million UNI tokens to the cryptocurrency exchange platform in what analysts believed was an attempt to cut losses.

Related Reading

Uniswap Down

Analysts said that UNI, Uniswap’s native token, posted a weekly loss of 20% after the coin went down by 2.80% in the last 24 hours. The massive loss brought UNI’s price to go down to $5.80 on Wеdnеsdаy.

According to a crypto analyst, the drop, which came amid the heightened selling pressure, can be attributed to a large investor who offloaded a big chunk of his UNI tokens and transferred it to another crypto exchange platform.

“A whale deposited all 2.25M $UNI($13.71M) to #Kraken 2 hours ago,” Lookonchain said.

A whale deposited all 2.25M $UNI($13.71M) to #Kraken 2 hours ago, likely to cut losses.

The whale accumulated 2.25M $UNI($15.57M) at an average price of $6.92 between Sept 7, 2023 and Nov 18, 2024.

At its peak, the whale had an unrealized profit of $26.5M but is now down… pic.twitter.com/7pA0glRT4m

— Lookonchain (@lookonchain) March 12, 2025

‘Cut Losses’

In a post, Lookonchain believed that the whale could be ditching an effort to “cut losses” after a considerable unrealized gain from the UNI token vanished.

“The whale accumulated 2.25M $UNI($15.57M) at an average price of $6.92 between Sept. 7, 2023 and Nov. 18, 2024,” Lookonchain shared.

At its peak, the market observer said the large investor recorded an unrealized profit of $26.5 million. However, recent market conditions have brought down UNI’s unrealized earnings to only $1.86 million, which might be the primary reason why the whale decided to move $13.71 million worth of UNI tokens to Kraken.

Bearish Signal

Another crypto analyst observed that indicators showed a bearish picture for Uniswap. Santiment shared his analysis on what could be the future of Uniswap using the on-chain metrics, saying that the Exchange Flow balance increased from -428,920 to 2.23 million within two days.

The metric, which tracks the net movement of tokens into and out of exchange wallets, showed that there is a possible surge in selling pressure, indicating that many tokens are being moved into exchange wallets.

Another metric, the Supply on Exchanges, illustrated that the token increased by 2.67% in the last 24 hours, which the analyst claimed reinforced the notion of traders offloading their UNI holdings amidst declining confidence in Uniswap’s performance.

Previous data showed that such trends usually result in a further decline in the token’s price.

Related Reading

Other market observers checked UNI’s technical indicators, revealing a negative sentiment towards Uniswap’s native token. The Bollinger Bands showed that it is tightening with the middle band at $7.470. Meanwhile, the upper and lower bands are at $9.332 and $5.608, respectively.

Analysts said that the UNI’s price is on the lower band, indicating a strong bearish momentum, which could explain the drop in unrealized profit for the token.

Featured image from Medium, chart from TradingView