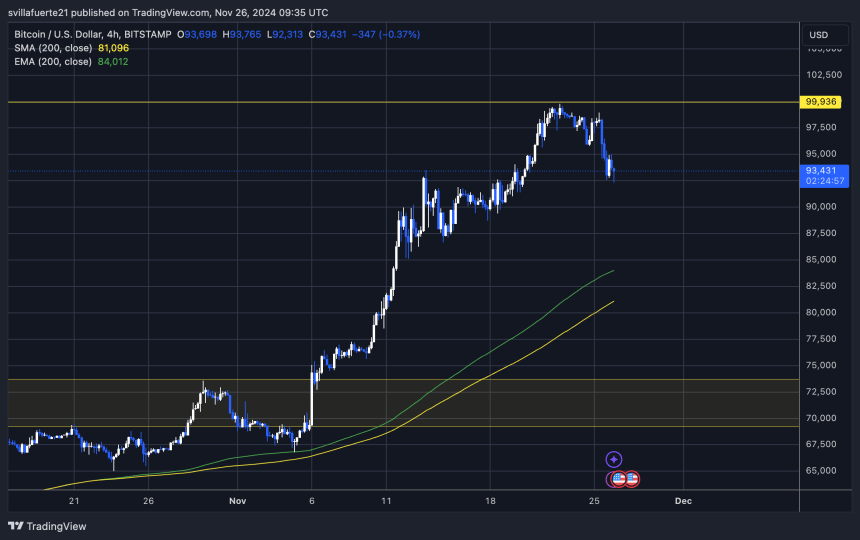

After a historic rally, Bitcoin has confronted its first main setback, pulling again 7% from its all-time excessive of $99,800. This comes after a powerful surge from $67,500 on November 5, marking a virtually 50% climb in just some weeks. The worth motion has largely been “solely up,” attracting vital consideration from merchants and traders alike.

Associated Studying

Nevertheless, the present pullback highlights rising warning out there. Market warning stated leverage ranges stay elevated regardless of latest deleveraging efforts. Adler’s evaluation reveals that rising quick positions and consolidation beneath the psychological $100,000 mark have contributed to the retracement.

While Bitcoin’s performance remains strong in the broader context, this dip indicators a possible shift in market sentiment. The query is whether or not BTC can collect sufficient momentum to interrupt previous the $100,000 barrier or if additional consolidation is on the horizon.

Many traders think about this pullback a wholesome pause in a bullish cycle, however the excessive leverage ranges counsel continued volatility. All eyes are on Bitcoin because it navigates this crucial part, with the subsequent few days more likely to decide its short-term route.

Bitcoin Bears Exhibiting Up

After three weeks of minimal resistance from bears, indicators of their resurgence emerge as Bitcoin struggles to interrupt previous the $100,000 stage. This crucial value level, which many believed would act as a springboard for additional good points, has as a substitute highlighted rising bearish sentiment. According to CryptoQuant analyst Axel Adler, the latest value motion marks a possible shift in momentum.

Adler’s evaluation on X reveals that regardless of a wave of latest deleveraging, leverage ranges out there stay elevated. Many key lengthy positions have been established across the $93,000 mark, offering bears with a chance to revenue as BTC didn’t push larger. This stage has now turn into a battleground, with Bitcoin’s lack of ability to maintain upward momentum signaling the opportunity of additional draw back threat.

Bitcoin’s value hovers round this key stage, elevating the probability of a correction towards $88,500 or extended sideways consolidation beneath $100,000. Such a situation would influence Bitcoin and set the tone for altcoin efficiency within the coming weeks.

Associated Studying

The following two weeks shall be pivotal as market contributors carefully watch Bitcoin’s value motion. A decisive transfer, whether or not up or down, will form the broader cryptocurrency panorama and decide whether or not that is merely a pause in a bigger rally or the beginning of a deeper correction.

BTC Testing Recent Demand

Bitcoin is buying and selling at $93,500 as bears regained management after it hit an all-time excessive final Friday. This retracement marks a shift in momentum, however bulls nonetheless can reclaim dominance if the value stays robust above the crucial $92,000 help stage. Holding this stage would maintain Bitcoin’s value motion structurally bullish and sign resilience within the face of elevated promoting stress.

If Bitcoin sustains energy above $92,000, the outlook for the quick time period stays optimistic, with the potential for one more try at breaking key resistance ranges. Nevertheless, a drop beneath this mark would sign short-term weak spot, doubtlessly triggering additional declines. The following crucial stage to observe could be round $84,000, the place the 4-hour 200 EMA aligns as a help zone.

This stage represents a significant line within the sand for bulls. A breakdown beneath it might speed up bearish momentum, extending the correction and dampening market sentiment. Then again, holding above $92,000 would reinforce bullish confidence, setting the stage for a restoration and a possible pushback towards earlier highs.

Associated Studying

Merchants and traders are carefully watching these ranges, as Bitcoin’s potential to remain above $92,000 will decide whether or not it stays in a short-term bullish construction or succumbs to bearish pressures.

Featured picture from Dall-E, chart from TradingView