- The symmetrical triangle advised a breakout focusing on $0.00003255.

- Shiba Inu’s NVT Ratio dropped 2.3%, reflecting elevated community exercise.

Shiba Inu [SHIB] has drawn important market curiosity because it fashioned a symmetrical triangle on the 4-hour chart.

This chart sample typically represents a part of market uncertainty, however analysts anticipate an upward breakout in alignment with the broader cryptocurrency bull market.

AMBCrypto dives into the important thing components shaping SHIB’s worth motion and explores the place it would head subsequent.

Symmetrical triangle indicators potential rally

SHIB was consolidating inside a symmetrical triangle sample, suggesting a interval of indecision available in the market.

The chart indicated a possible breakout, with a projected goal worth of $0.00003255, ought to the upward motion happen. This projection implies a doable 32% worth enhance from the present ranges.

The symmetrical triangle, fashioned by converging help and resistance traces, represents a typical continuation or breakout sample in technical evaluation.

A decisive breakout above resistance may set off bullish momentum, whereas a breakdown beneath help might lead to additional declines.

The 4-hour chart confirmed that Shiba Inu was consolidating inside a slender vary, as indicated by the highlighted crimson zone. The worth was hovering close to $0.00002478, at press time, reflecting lowered volatility after a earlier surge.

The Alligator indicator, with its three Shifting Averages, revealed that the traces have been converging, signaling an absence of clear directional momentum.

Moreover, the True Power Index displayed bearish values at -3.5790 and -7.9681, suggesting sellers at present keep management however with weakening stress.

The Superior Oscillator, with a adverse worth of -0.00000101, confirms an absence of bullish momentum.

SHIB at a key degree between highs and lows

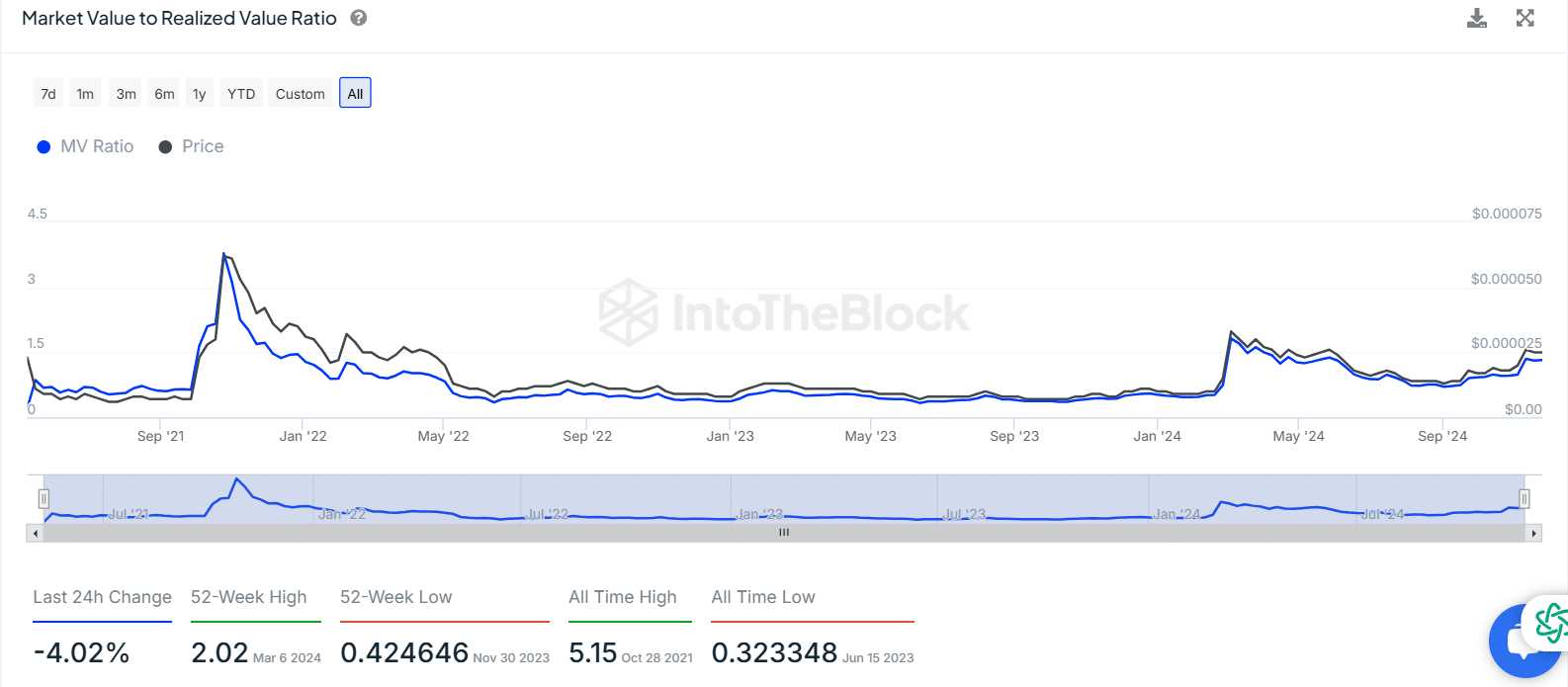

The MVRV ratio just lately declined by 4.02% over the previous 24 hours, indicating potential profit-taking or lowered market optimism.

MVRV was properly beneath its 52-week excessive of two.02 on the sixth of March 2024, suggesting the market is in a much less speculative part in comparison with peak intervals.

Traditionally, the MVRV ratio reached an all-time excessive of 5.15 in October 2021, signaling extremely overvalued situations and subsequent corrections.

In contrast, the all-time low of 0.3233 in June 2023 coincided with undervalued situations, presenting potential shopping for alternatives.

At current, the ratio hovers nearer to impartial, implying neither excessive undervaluation nor overvaluation.

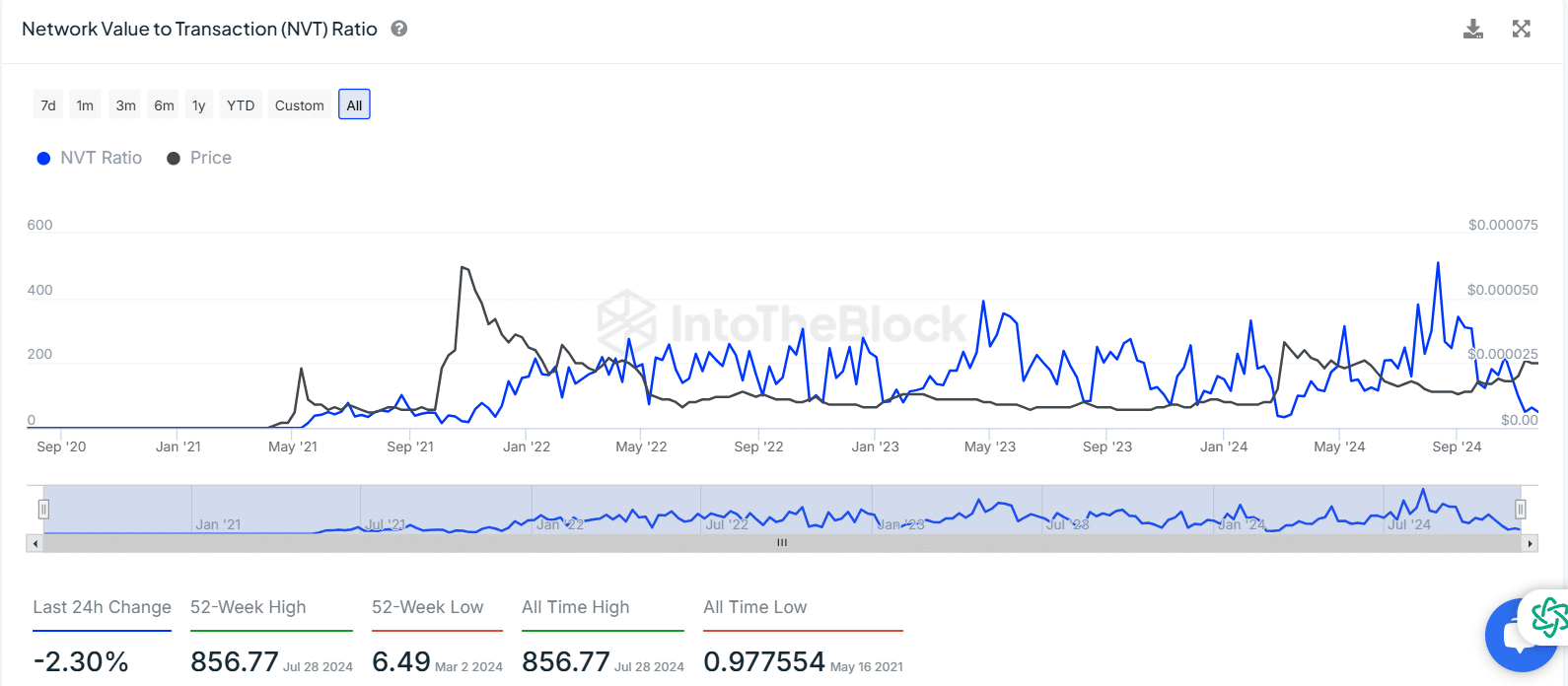

NVT ratio displays elevated community exercise

Shiba Inu’s Community Worth to Transaction (NVT) Ratio, alongside its worth, supplies insights into the asset’s valuation relative to its transaction quantity.

The NVT ratio decreased by 2.30% within the final 24 hours, highlighting a slight enhance in transaction exercise in comparison with community worth.

The ratio stays properly beneath its 52-week excessive of 856.77 on the twenty eighth of July 2024, reflecting a cooling part from beforehand overvalued situations.

Is your portfolio inexperienced? Try the SHIB Profit Calculator

Information exhibits the historic significance of the NVT ratio, with an all-time excessive of 856.77 and a low of 0.9776.

Excessive NVT values sometimes point out overvaluation, whereas low values recommend undervaluation. At the moment, the ratio is nearer to impartial ranges, indicating balanced transaction volumes relative to Shiba Inu’s market worth.