Bitcoin experienced a sharp decline from the $106,400 level to the $91,530 mark in less than four days, shedding over 14% and triggering panic across the market. This sudden drop has left many investors uncertain about Bitcoin’s short-term direction as selling pressure intensifies. However, on-chain data suggests that while retail investors are offloading their BTC, large players are seizing this opportunity to accumulate more.

Key data from CryptoQuant reveals that big players are buying while small players are selling, reflecting a classic market reaction during periods of heightened fear. The primary driver behind this selloff appears to be concerns over an escalating U.S. trade war, which has injected volatility into global financial markets. Despite this uncertainty, Bitcoin’s long-term fundamentals remain strong, and historical patterns suggest that these fear-driven dips often present prime accumulation opportunities.

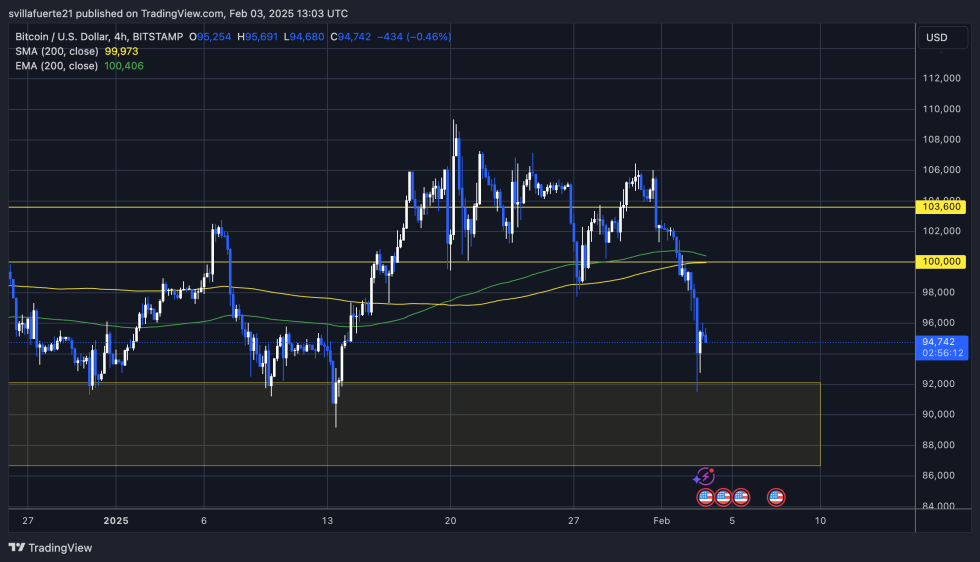

With BTC trading near key support levels, investors are closely watching for signs of a potential recovery. If the price holds above the $90K level, a push back toward $100K could follow. While the short-term outlook remains uncertain, long-term fundamentals continue to point toward price appreciation, reinforcing Bitcoin’s position as a resilient asset in uncertain economic conditions.

Bitcoin Whales Prepare Amid Volatility

Bitcoin had a bearish weekend, and the outlook for the week remains uncertain as selling pressure continues to dominate the market. BTC is now trading 14% below its all-time highs, with bears maintaining control as long as the price remains under the $100K mark. Altcoins have taken an even bigger hit, experiencing sharper declines as the market sentiment tilts toward fear and uncertainty.

However, key on-chain metrics reveal an interesting divergence in investor behavior. Crypto analyst Axel Adler shared data showing that, based on BTC holdings, big players are actively accumulating while small players are panic-selling. This pattern is often observed during significant market corrections, where retail traders exit their positions in fear while institutional investors and whales take advantage of discounted prices.

This “capitulation” event may seem concerning for smaller traders, but history suggests that such sell-offs often pave the way for a strong recovery. When whales accumulate at lower prices, it usually indicates confidence in Bitcoin’s long-term potential and signals a possible bottom formation. If BTC can reclaim $100K and establish it as support in the coming weeks, a bullish rally toward new highs could follow.

While the short-term trend remains bearish, smart money positioning suggests that the market could soon shift back into bullish territory.