Bitcoin has struggled to regain bullish momentum, weighed down by global trade war fears and the uncertainty surrounding US President Donald Trump’s executive order to establish a Strategic Bitcoin Reserve last Thursday. While the announcement was expected to boost confidence, macroeconomic conditions continue to dictate market trends, keeping BTC below key resistance levels.

Despite the positive news, broader market concerns—particularly rising tariffs and economic instability—have kept investors on edge. The crypto market remains highly reactive to macroeconomic shifts, and for now, these external pressures are preventing BTC from gaining upside traction.

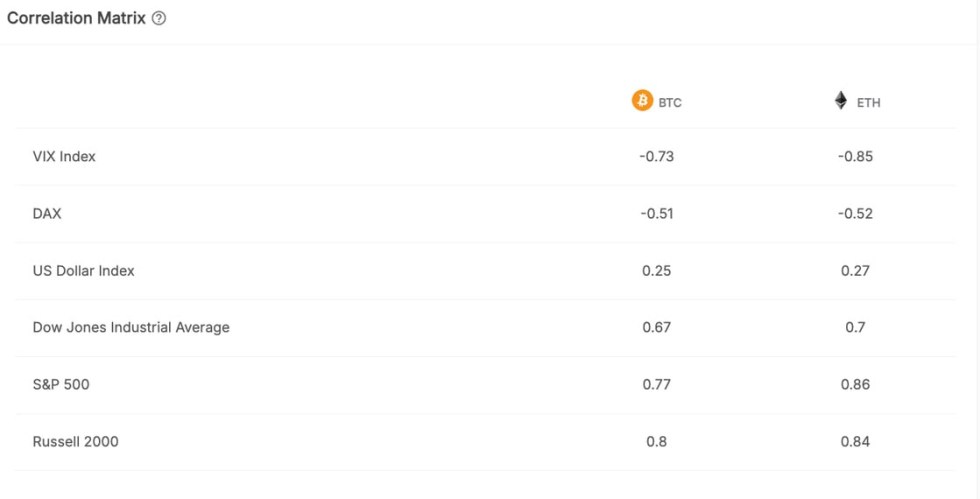

According to on-chain metrics, Bitcoin and Ethereum have once again become highly correlated with the US stock market, indicating that traditional financial trends are having a stronger influence on crypto prices. With stocks facing uncertainty, Bitcoin’s ability to break out of its current range remains questionable.

Could these macroeconomic developments push the market even lower, or is Bitcoin preparing for a surprise reversal? With volatility increasing, the coming days will be crucial in determining BTC’s next move. Traders and investors are now watching closely to see whether BTC can shake off its stock market correlation or if more downside is ahead.

Bitcoin Struggles With Macroeconomic Uncertainty

Even with positive news, such as Trump’s Strategic Bitcoin Reserve announcement, the market has failed to regain bullish momentum. Instead, fear over global trade wars and economic instability continues to weigh heavily on sentiment. Investors are hesitant to take on more risk, keeping BTC stuck in a range with no clear signs of an imminent breakout.

According to IntoTheBlock, Bitcoin and Ethereum have once again become highly correlated with the US stock market, a trend that has historically led to higher volatility in crypto. Tariff-related concerns have been pushing down equities, and since BTC is moving in sync with traditional markets, further declines in stocks could drag BTC even lower.

If the stock market continues to set fresh lows, Bitcoin and the entire crypto sector could face another wave of selling pressure. Until macro conditions improve, BTC remains vulnerable to further downside risk. Investors and traders are closely monitoring price movements, as Bitcoin’s next big move will likely be influenced by broader financial markets rather than crypto-specific catalysts.

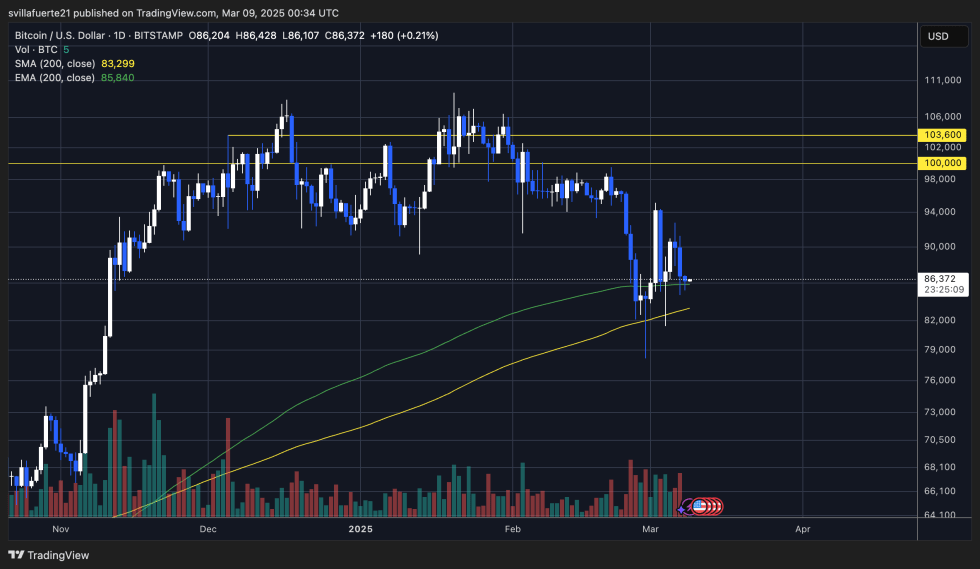

BTC Trades Below $88K

Bitcoin (BTC) is currently trading at $86,300, with bulls defending the crucial $85,000 support level while struggling to reclaim $90,000. This tight range has kept Bitcoin stuck in a period of uncertainty, with neither side gaining clear dominance.

If BTC loses the $85,000 mark, selling pressure could intensify, likely leading to a sharp drop below $80,000. This level would serve as a key psychological and technical support, and a breakdown could trigger a deeper correction, extending the current bearish trend.

On the other hand, if bulls manage to push BTC above $90,000, momentum could shift rapidly in favor of buyers. A breakout above this resistance would signal renewed strength, potentially fueling a fast rally toward $100,000. Given Bitcoin’s history of strong movements following key level breakouts, reclaiming $90K would be a major turning point.

With BTC at a critical inflection point, the next few days will determine whether bulls regain control or if bears drive prices lower, testing deeper demand zones.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.