On-chain data shows the Bitcoin mining hashrate has recently been closing in on a new all-time high (ATH). Here’s what this could mean for BTC.

Bitcoin Hashrate Has Remained High Despite Market Downturn

The “mining hashrate” refers to an indicator that keeps track of the total amount of computing power that the miners have currently connected to the Bitcoin network.

BTC is a blockchain that runs on a consensus mechanism called the Proof-of-Work (PoW), so the miners use their computing power for solving certain mathematical puzzles.

At no point, however, does the total hashrate work in tandem. Instead, the validators compete against each other to be the first to solve the same problem, using their own individual power. The reward for being the first is the opportunity to add the next block to the network.

While there is no collective BTC power, that doesn’t mean the total hashrate has no consequences or usefulness. For starters, the more the computing power that’s connected to the network, the better is BTC’s security, given that the new power being added is sufficiently decentralized.

The indicator also serves as a way of determining the sentiment among the miners. When the value of the metric rises, it means new miners are joining the network and/or old ones are expanding their facilities. Such a trend suggests the miners believe BTC to be a profitable venture.

On the other hand, a decline in the hashrate implies some of the validators have decided to unplug their mining rigs, potentially because they are no longer able to break even.

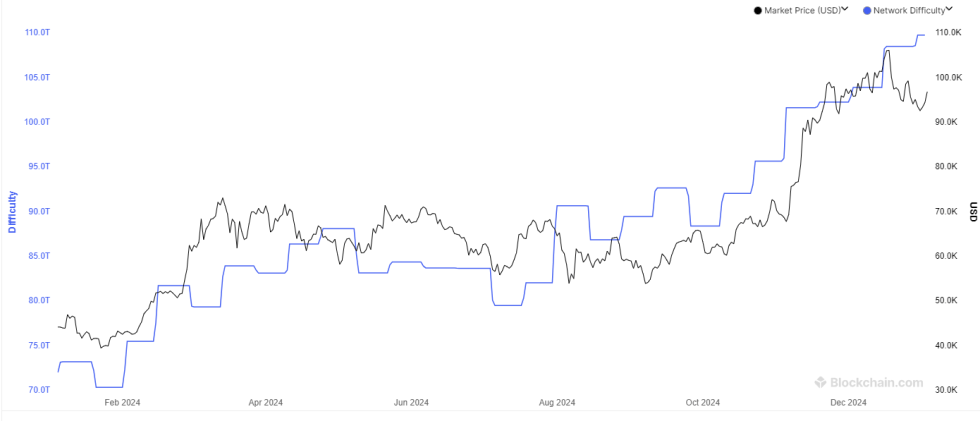

Now, here is a chart from Blockchain.com that shows the trend in the Bitcoin hashrate over the past year:

The value of the metric appears to have been following an upwards trajectory in recent months | Source: Blockchain.com

As is visible in the above graph, the Bitcoin mining hashrate set a new ATH back in mid-December, but the indicator then saw a drawdown as BTC’s price itself fell. Miners receive their rewards in BTC, so the price of the cryptocurrency can be a crucial factor in their revenue.

Interestingly, while BTC has been yet to show any sufficient recovery, the indicator has reversed course and has arrived back near the ATH. The fact that the miners aren’t ready to rollback on their farms yet would suggest they believe the network would end up paying off eventually.

As mentioned before, the total hashrate can have some real consequences for the blockchain. One such result is on the network’s difficulty, a feature that controls how hard miners would find their task.

The BTC network wishes to restrict how much block subsidy the miners receive within a given amount of time, so whenever the miners increase their computing power, it responds by upping its difficulty just enough to keep the pace of the miners the same as before.

Given that the minining hashrate is close to the ATH, it’s not surprising that the difficulty is also sitting at a new record.

The trend in the mining difficulty over the past year | Source: Blockchain.com

BTC Price

At the time of writing, Bitcoin is floating around $96,600, up 1% over the last seven days.

Looks like the price of the coin has been following an upward trajectory recently | Source: BTCUSDT on TradingView

Featured image from Dall-E, Blockchain.com, chart from TradingView.com