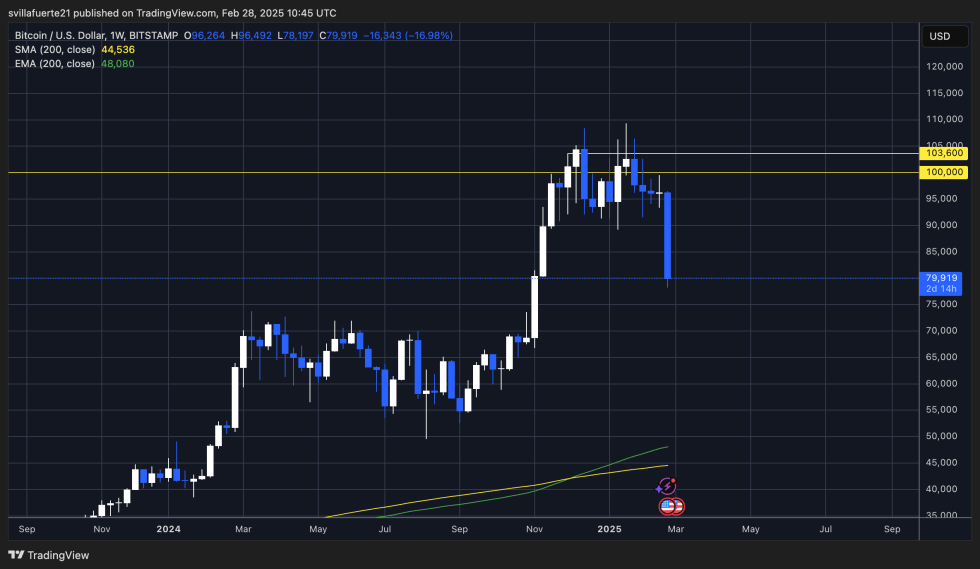

Bitcoin has lost crucial support levels as the market struggles to find demand, allowing bears to gain momentum. Analysts are calling for further corrections, with fear dominating sentiment across the crypto market. Bitcoin has now dropped over 28% from its late January highs, and concerns are mounting that bears could take prices even lower in the coming weeks.

The broader financial markets are also facing uncertainty, adding to Bitcoin’s struggles. Data from CryptoQuant reveals that BTC currently has an 80% correlation with the S&P 500 index, meaning that movements in traditional markets are heavily influencing Bitcoin’s price action. This suggests that macro factors, such as interest rate expectations and stock market trends, could play a crucial role in Bitcoin’s next move.

While some analysts believe BTC could stabilize around current levels, others warn that the ongoing downtrend could continue, bringing Bitcoin into lower demand zones if bulls fail to reclaim control. The next few days will be critical, as Bitcoin’s ability to hold key levels or break lower could define its short-term and long-term trajectory in this volatile market environment.

Bitcoin Faces Further Risks

Bitcoin has experienced a massive correction, with fear dominating the market as risks of further declines grow. The situation is not just limited to crypto—the U.S. stock market is also struggling, failing to confirm an uptrend amid growing economic uncertainty. Over the past few weeks, volatility and uncertainty have intensified, especially as Trump’s policies come into effect, impacting both traditional and digital asset markets.

Top analyst Axel Adler shared an analysis on X, revealing that the S&P 500 is likely to pull back another 5% based on the macro reports he read. This is significant because Bitcoin currently has an 80% correlation with the index, meaning that any further downside in traditional markets could directly impact BTC’s price action. If Adler’s prediction is accurate, Bitcoin is likely to continue its price drops, with a potential move into lower demand levels.

The next few weeks will be crucial as Bitcoin struggles to find strong support. With macro uncertainty rising and investors remaining fearful, BTC must hold above key demand zones to avoid an extended bearish phase. If stocks recover, BTC could follow—but if the S&P 500 pulls back further, BTC could see even more downside before finding stability.

Featured image from Dall-E, chart from TradingView