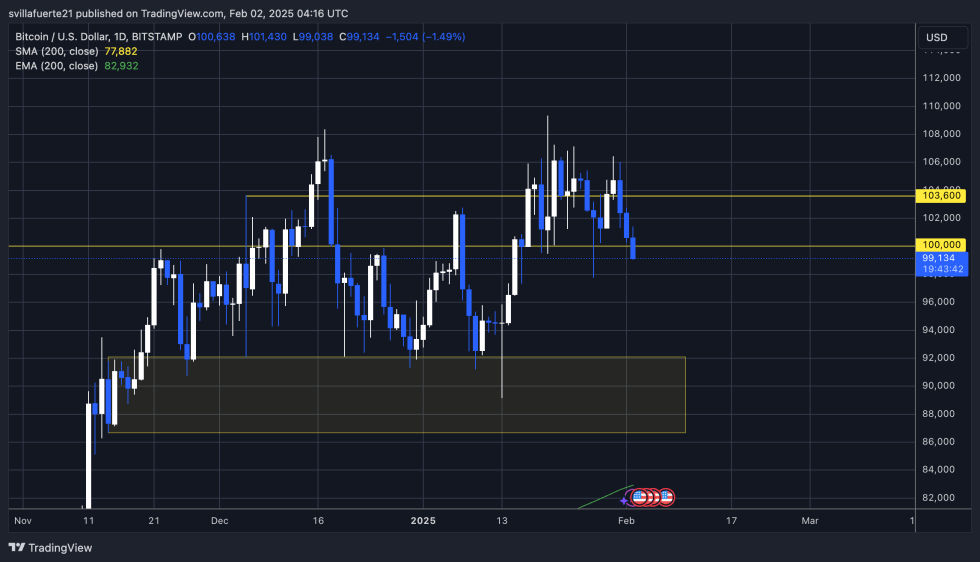

Bitcoin is facing serious selling pressure, as it has dropped below the $100K mark, raising concerns about a potential deeper correction. Since mid-January, BTC has been trading sideways, fluctuating between all-time highs (ATH) and the $97,750 level, struggling to find a clear direction.

Sentiment in the market remains divided. Bulls believe this is a healthy retrace before Bitcoin rallies into price discovery, pushing toward the $110K mark and beyond. Meanwhile, bears argue that BTC has already topped out, and the market is entering a distribution phase that could lead to a longer correction.

Key on-chain metrics from CryptoQuant offer a different perspective. Based on the adjusted net unrealized profit/loss (aNUPL) indicators, BTC is currently in a zone of confidence but has not yet entered the euphoria stage. Historically, major bull market tops occur when aNUPL reaches 0.7–0.8, signaling overheated conditions. Currently, BTC sits at 0.4, reflecting moderate optimism and room for further growth if market conditions remain stable.

With Bitcoin’s price action at a crossroads, the next few days will be critical in determining whether BTC can reclaim $100K or face deeper consolidation below key levels.

Bitcoin Showing Strength Despite Volatility

Bitcoin is entering a crucial phase where volatility remains high, but the opportunities for investors could be even bigger. As the market battles between bullish momentum and short-term selling pressure, analysts remain divided on BTC’s next move.

Key on-chain metrics shared by Axel Adler provide a clearer perspective. Based on the adjusted net unrealized profit/loss (aNUPL) indicator, Bitcoin is currently in a zone of confidence but has not yet reached the stage of euphoria. This suggests that while BTC is in a bullish phase, there are no immediate signs of overheating—historically seen when aNUPL hits 0.7–0.8.

At the moment, the aNUPL value sits around 0.4, which reflects a healthy yet moderate level of optimism. For comparison, during the major market tops in 2017 and 2021, aNUPL reached peak levels between 0.7 and 0.8, signaling overheated conditions and impending corrections.

With Bitcoin still far from these extreme levels, the market remains in a stable growth phase. If macro conditions remain favorable, BTC holds strong potential for further gains. However, traders should be prepared for increased volatility as Bitcoin navigates this critical period toward price discovery.

Price Action Details: Key Levels To Hold

Bitcoin has fallen below the $100K mark for the first time in a week, raising concerns among investors as selling pressure builds. The price is struggling to regain momentum, and if bulls fail to reclaim $100K soon, further downside is likely.

At the moment, BTC is testing lower demand levels, with $97,500 emerging as the next key support zone. If Bitcoin holds this level, it could act as a springboard for a recovery, allowing bulls to push back above $100K and potentially start a new rally. However, failing to hold $97,500 would put Bitcoin in a dangerous position, potentially leading to a deeper correction and extended consolidation.

For bullish momentum to return, BTC must reclaim the $100K mark quickly. A strong push above this level would signal renewed buyer confidence and could trigger a surge toward all-time highs. The market remains highly volatile, and the coming days will be crucial for Bitcoin’s short-term direction. If buyers fail to step in, BTC could see a prolonged dip before any meaningful recovery. Holding $97,500 is key, and traders are closely watching for signs of a decisive move in either direction.

Featured image from Dall-E, chart from TradingView