The Bitcoin (BTC) market is showing an extended sideways movement with no significant price action over the past day. Notably, the premier cryptocurrency has lost all market gains from its sudden 11% price surge from last week returning to previous consolidation levels around $86,000. According to popular crypto analyst Burak Kesmeci, Bitcoin is now set between two important price levels wielding sufficient potential for a substantial price swing.

Bitcoin Faces Make-Or-Break At $84k And $87k Liquidation Zones

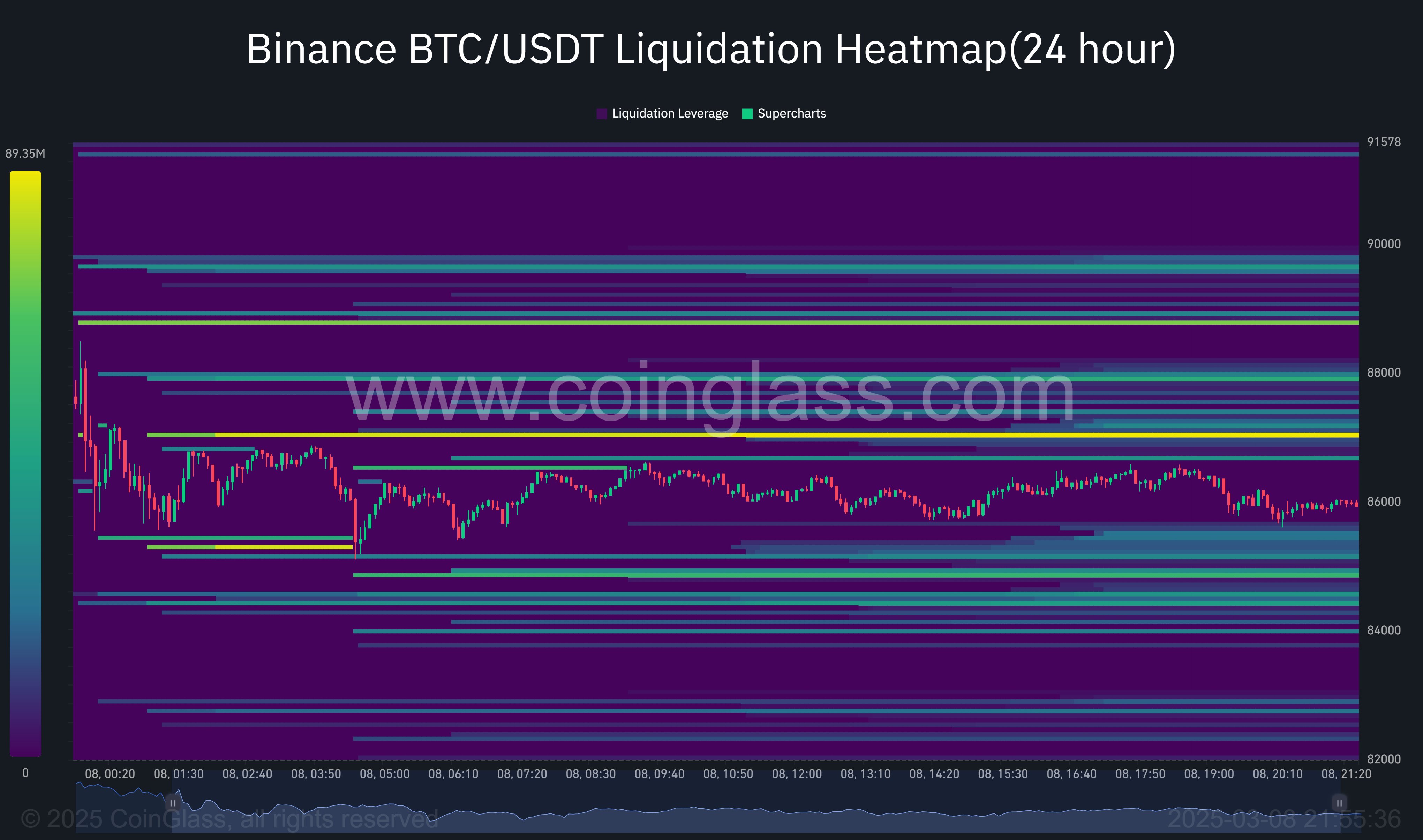

Using a liquidation heatmap, Burak Kesmeci has highlighted two critical price levels that could be influential on Bitcoin’s next move. Generally, a liquidation heatmap visually represents the levels where leveraged positions, both long and short, are at risk of liquidation. The presence of dense clusters indicates that much liquidity is concentrated at a price, meaning many stop losses and liquidation orders are stacked there.

Regions with these massive liquidity often attract price movements as market makers and institutional traders tend to target these liquidity pockets to trigger liquidations thereby allowing them to buy at a discount or sell at a premium. According to Burak Kesmeci, the BTC 24-hour liquidation heatmap from CoinGlass suggests the flagship crypto asset is now between $84,849 and $87,043 representing two key price points crucial to its move.

Based on the analysis presented, $87,043 is serving as resistance suggesting that a price break above this level could trigger a short squeeze as short traders are forced to buy back their positions at higher prices contributing to the demand for a price rally. In this bullish case, BTC could rise to around $90,000 but will require strong buying pressure to push to higher price targets at $94,000 and $99,000.

Meanwhile, the $84,849 price region presents a crucial support zone that a price fall below which would cause the liquidation of a significant amount of long positions thus inducing a substantial selling pressure. If this projection occurs, BTC could find immediate support around $84,000 However, a potential dip to lower levels such as $83,000 or $80,000 may be feasible.

Bitcoin Price Overview

At the time of writing, Bitcoin is trading at $86,389 reflecting a minor 0.11% gain in the past day and a 0.76% gain in the last seven days. However, the premier cryptocurrency is down by 10.84% in the last month leaving most new market entrants in a deep loss.

Meanwhile, the BTC market trading market volume has crashed by 72.39% in the past day indicating a fall in market participation. While the liquidation heatmap analysis presented by Burak Kesmeci shows two likely pathways, investors should also note Bitcoin could remain range-bound between both liquidation zones barring the introduction of a significant market catalyst.

Featured image from Investopedia, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.