Bitcoin is navigating a highly volatile phase, with significant price swings dominating the market. After dropping to a low of $89,100 last week, the cryptocurrency staged a remarkable recovery, surging to a new all-time high (ATH) yesterday. While the price action leans bullish, uncertainty still clouds the market as traders assess whether BTC can sustain its upward momentum in the short term.

Top analyst Axel Adler shared valuable insights that highlight the long-term bullish outlook for Bitcoin. According to Adler, Bitcoin’s mining difficulty has been on the rise since August 2024, with quarterly difficulty changes increasing from negative values to an impressive +24%. This upward trend in mining difficulty reflects growing miner activity and confidence in Bitcoin’s long-term prospects. As more miners deploy advanced equipment, the network’s hash rate strengthens, solidifying the blockchain’s security and resilience.

This increasing difficulty is a critical indicator of network health and suggests sustained interest in Bitcoin despite its recent volatility. With the fundamentals aligning and bullish sentiment building, Bitcoin’s long-term trajectory remains optimistic. However, as the market adjusts to current conditions, investors are keeping a close watch on key levels and trends to determine Bitcoin’s next move.

Bitcoin Miners Activity Signal Strength

Bitcoin is on the brink of a massive surge, with market conditions aligning to suggest a bullish trend in the coming weeks. After breaking its all-time high (ATH), Bitcoin has reignited investor optimism, fueled further by the pro-crypto stance of President Donald Trump’s administration. As policies aimed at fostering cryptocurrency adoption and innovation take center stage, the market is buzzing with anticipation of a new wave of growth for BTC and the broader crypto space.

Top analyst Axel Adler recently shared compelling data on X, highlighting a critical factor underpinning Bitcoin’s long-term strength. Starting from August 2024, Bitcoin’s mining difficulty has shown consistent growth, with quarterly difficulty changes rising from negative values to an impressive +24%. This shift reflects a significant increase in miner activity, driven by the deployment of new, advanced equipment across the network. The result is a substantial boost in the overall hash rate, further enhancing Bitcoin’s security and decentralization.

Adler emphasizes that this increase in mining activity is more than a technical adjustment—it represents the optimistic outlook of miners, often seen as a bellwether for market confidence. Miners’ willingness to invest heavily in infrastructure indicates their belief in Bitcoin’s sustained upward trajectory.

With fundamentals strengthening and institutional confidence building, Bitcoin appears poised for another leg higher. The combination of technical resilience, increasing network security, and supportive macroeconomic factors sets the stage for a potentially transformative rally.

As BTC continues to flirt with new milestones, the coming weeks could start a historic phase in the cryptocurrency’s evolution. Investors are now closely watching its next moves, confident that the stage is set for BTC to reach unprecedented heights.

BTC Price Action Details: What To Expect

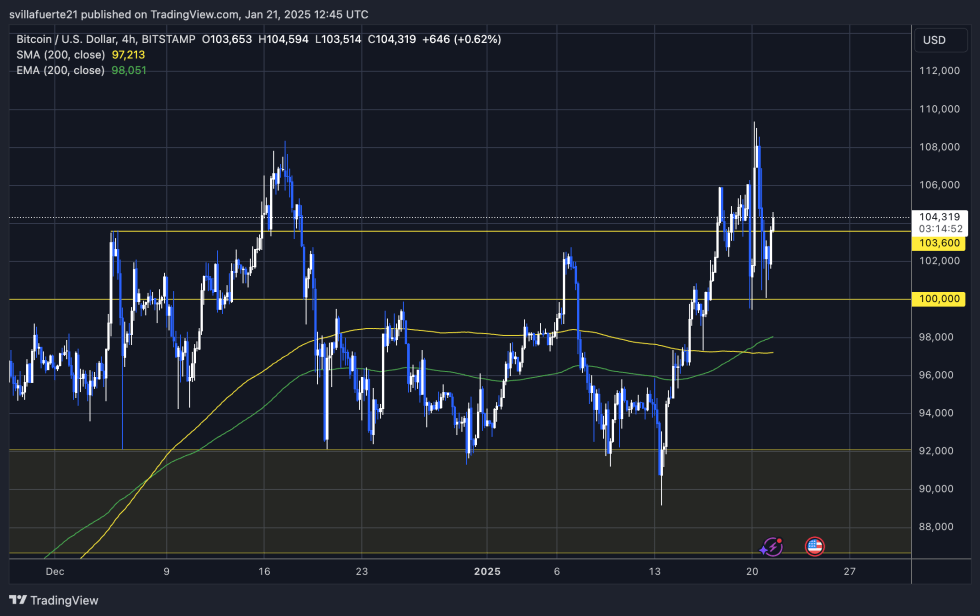

Bitcoin (BTC) is currently trading at $104,300 after demonstrating resilience by holding strong above the critical $100,000 level yesterday. This psychological and technical support zone has reinforced bullish sentiment, giving investors hope for further gains as BTC consolidates near its all-time high (ATH).

Now, the focus shifts to reclaiming the $106,000 mark, the final supply level acting as resistance before BTC can break out to new heights. A decisive move above this level would clear the path for a massive rally, potentially pushing Bitcoin into uncharted territory. Reclaiming $106K would also signal increased buying activity and renewed confidence among traders, setting the stage for BTC to surpass its ATH.

Holding above the $100,000 mark in the coming days will be critical for maintaining upward momentum. This level serves as a foundation for the ongoing rally, and consistent support here could create the conditions necessary for a breakout.

With the market sentiment turning increasingly bullish and technical indicators aligning, Bitcoin appears well-positioned for a significant move higher. If bulls can reclaim key levels and sustain momentum, a push above ATH is inevitable, potentially triggering a broader rally across the cryptocurrency market. Investors are closely monitoring BTC’s next steps as it flirts with historic milestones.

Featured image from Dall-E, chart from TradingView.