Franklin Templeton introduced its OnChain US Money Market Fund (FOBXX) on Solana yesterday, February 12.

The tokenized fund was previously available on Ethereum, Avalanche, Aptos, and Coinbase’s Base.

The latest move came a day after the investment firm filed for a Solana exchange-traded fund in Delaware.

Solana attracts institutional players following its remarkable performance in the past few months.

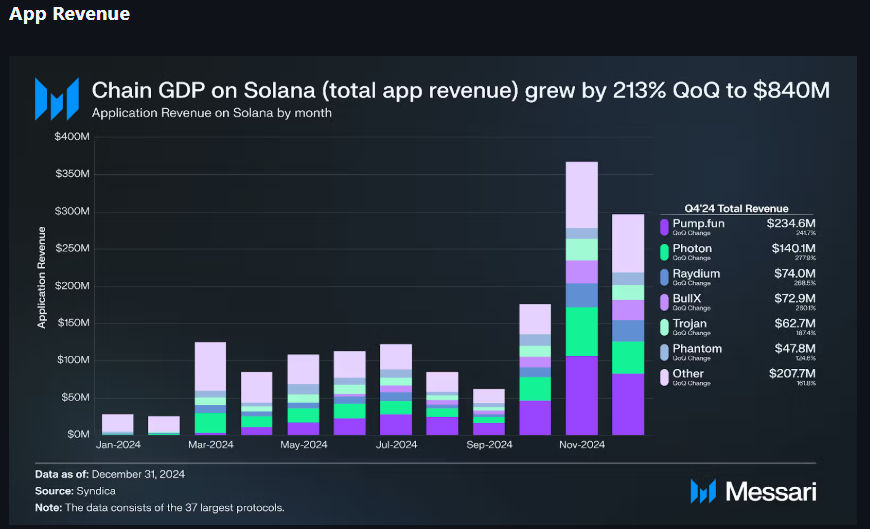

Messari’s latest report showed that Solana applications accrued $840M in revenue in Q4 2024 – a remarkable 213% surge.

Franklin Templeton taps Solana to expand its tokenized fund

Solana confirmed that the trillion-dollar investment company has launched its FOBXX fund on its ecosystem.

Breaking news: $1.5T AUM firm Franklin Templeton’s tokenized money market fund (FOBXX) is now available on Solana!

This is finance evolving in real-time 🧵

Tokenization involves moving traditional assets to digital financial platforms to ensure efficient and fast transactions.

Developments around this subject have seen increased interest from market enthusiasts and institutions.

Meanwhile, Franklin Templeton has explored the Solana blockchain lately.

The launch of FOBXX on Solana came a day after the firm joined the SOL spot ETF race.

That step usually heralds filings with the United States SEC.

Thus, the asset manager might register for a SOL exchange-traded fund with the SEC soon.

Meanwhile, Solana has been attractive for launching new products, especially on DEXs.

Pantera Capital’s report shows over 90% of new digital assets in decentralized networks are Solana-issued – a remarkable surge from 1% in December 2024.

Even Donald Trump’s family launched their meme assets TRUMP and MELANIA on the SOL network, which amplified speculations of a spot Solana ETF approval this year.

Notably, Solana closed the past year with massive performance.

Reports show Solana app revenue surged 213% to $840 million in the fourth quarter of 2024.

SOL App revenue jumps 200% in Q4 2024

Research firm Messari published Solana’s Q4 2024 report last week. It revealed the blockchain’s success in various segments.

Notably, Solana applications saw a 213% surge in total revenue, reflecting a massive QoQ increase from $268 million.

November 2024 recorded the most profits, with app revenue at $367 million.

In addition to the app revenue, Solana overachieved in liquid staking rate, total value locked, and DEX volume.

The latest report from OKX showed Solana eclipsed Ethereum in decentralized exchange volume in 2024.

Solana’s speed, censorship resistance, and security have been crucial for the project’s mainstream adoption.

Meanwhile, the latest developments reveal Solana’s appeal to institutional players.

A spot SOL ETF approval would enhance the altcoin’s mainstream acceptance, translating to impressive price performance.

Polymarket shows an 83% chance of the US SEC authorizing a spot Solana exchange-traded fund in 2024.

Solana traded at $197 after gaining 1.56% in the past 24 hours. Market maker GSR believes a spot ETF could send SOL prices past $1,000.

The post Franklin Templeton expands its tokenized fund to Solana as SOL app revenue soars 200% appeared first on Invezz