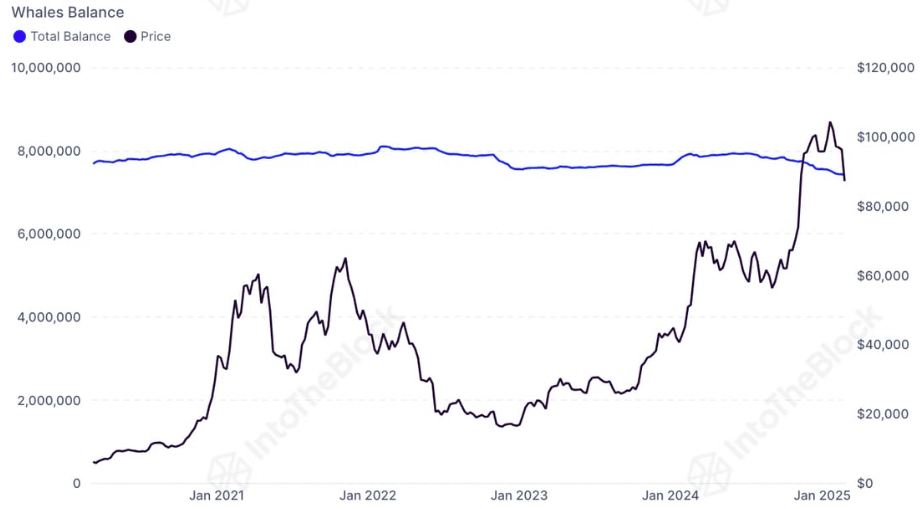

Bitcoin whale holdings have reached their lowest level in six years, raising concerns about the asset’s price trajectory amid its current price struggles. Interesting data from on-chain data analytics platform IntoTheBlock shows that the aggregate amount of Bitcoin held by whales has dropped to levels last seen in 2019.

The decline comes at a time when Bitcoin is struggling to maintain momentum above $90,000, with most of the past week’s trading occurring between $85,000 and $90,000.

Whale Holdings Plummet As Netflow Drops Sharply

Bitcoin has been under intense selling pressure for the past two or so weeks, which has, in turn, allowed it to lose its strong footing above $90,000. Interestingly, IntoTheBlock’s latest data indicates that the netflow of Bitcoin among large holders has taken a substantial hit, as there have been more outflows than inflows from these whale addresses. As it stands, the total number of BTC held by whale addresses is now at its lowest level since 2019.

Image From X: IntoTheBlock

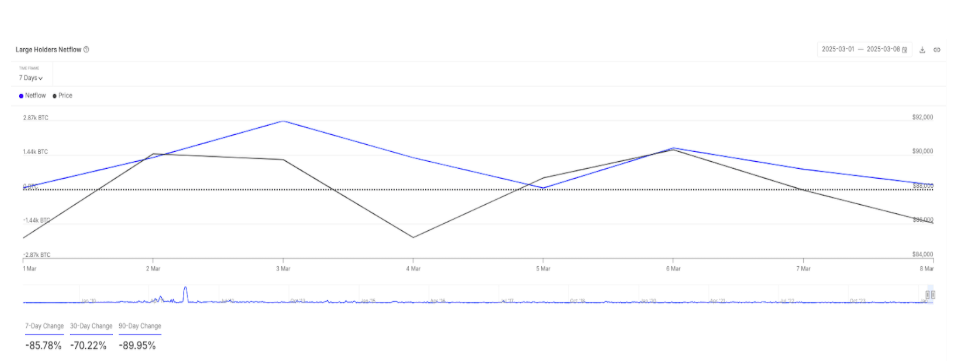

IntoTheBlock’s whale transaction metrics follow addresses holding at least 0.1% of the total circulating supply of Bitcoin. Over the past seven days, whale net flow has dropped by 85.78%, and in the past 30 days, it has declined by 70.22%. A sharp reduction in whale accumulation often signals diminishing confidence among major investors, leading to fears of increased selling pressure.

What This Means For Bitcoin’s Price Amid Market Struggles

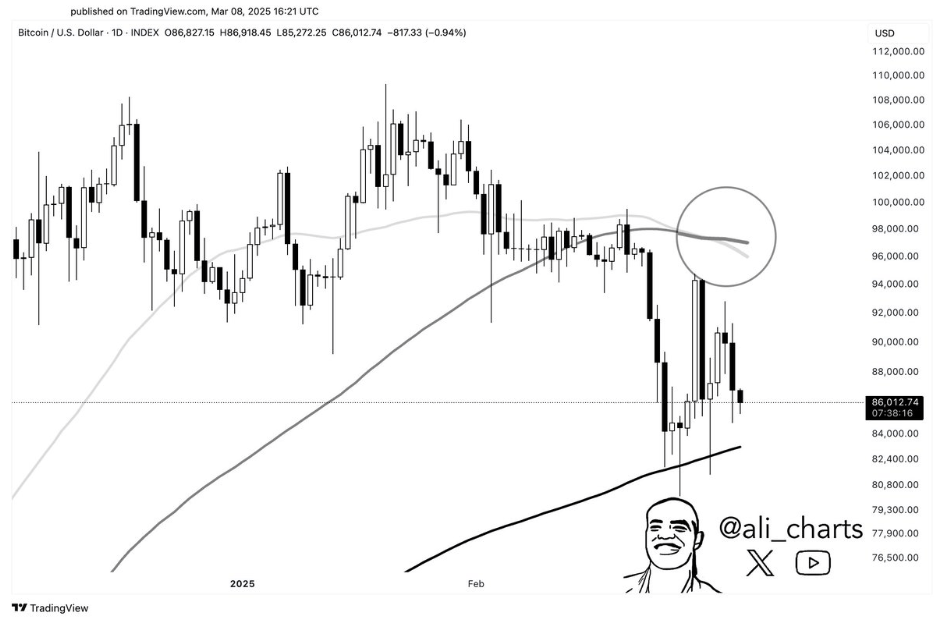

At the time of writing, Bitcoin is trading at $86,115, reflecting a 0.5% decline in the past 24 hours and a slight 0.2% drop over the past week. This relatively small movement suggests that Bitcoin has entered a consolidation phase at this level, as buying and selling pressures appear nearly balanced.

Throughout the past week, bulls attempted to push Bitcoin above the key $90,000 resistance level, briefly succeeding on multiple occasions. However, sellers have repeatedly regained control and dragged the price below this threshold. The recently launched US crypto reserve has failed to add much to the bullish momentum, with crypto participants seemingly discouraged by the specifics of the reserve.

This is the trend relayed in the amount of whale holdings. If whales continue offloading Bitcoin rather than accumulating, the supply dynamics could tilt against a strong breakout above $90,000. As such, there’s the possibility of a deeper pullback towards lower support levels at $82,000 and $78,000 again this new week.

Adding to these concerns, crypto analyst Ali Martinez pointed out a technical development. As noted by the analyst, there’s been a crossover between the 50-day and 100-day moving averages on the daily candlestick timeframe chart. This crossover has seen the 50-day moving average crossing below the 100-day moving average, making it a death cross with downside risks if Bitcoin fails to attract fresh buying interest.

Image From X: Ali Martinez

Featured image from Built In, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.