The number of active addresses in Bitcoin has increased, with a peak of 912,300 on February 28. The most recent instance of this level was on December 16, 2024, when Bitcoin was trading at $105,000, Glassnode data shows.

Traders are closely monitoring the outcome of this surge, which some analysts interpret as a precursor to a potential market shift.

Number of active BTC addresses. Source: Glassnode

Market Prepares For Potential Capitulation

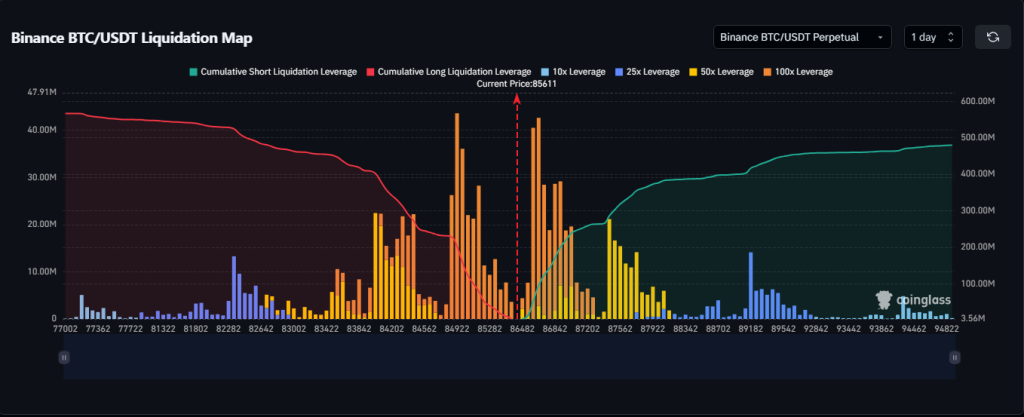

Capitulation is a phrase that refers to the sharp price swings that occur when investors sell in distress. The latest drop in Bitcoin below $84,000 has raised concerns, as a retreat below this level might result in over $1 billion in leveraged long liquidations, CoinGlass data shows.

Previously, similar events occurred in the marketplace. Panic selling often signals a bottom before a comeback when it reaches its peak. This could be a watershed moment for Bitcoin if it follows previous trends.

BTC exchange liquidation map Source: CoinGlass

Active Addresses Surge As Market Adjusts

The rising count of active addresses suggests that more people are moving Bitcoin. This could mean traders are either reacting to market swings or rearranging their assets. Whether favorable or negative, this trend is evident before notable changes in the market.

Important events in Bitcoin’s price behavior have aligned with years’ worth of network activity surges. Traders are keeping a tight eye to see if this rise in addresses causes a rally or more falls.

Bitcoin Key Metric Signals Oversold Conditions

The Market Value to Realized Value (MVRV) Z-score of Bitcoin is among other important benchmarks. March 1 saw this metric at 2.01. A lower score would signal a possible bottom since it implies that the asset is now reaching oversold levels.

When the MVRV Z-score crosses oversold area in the past, Bitcoin’s price has reversed. Though it is not a guarantee, speculators consider this data point while assessing the direction the market will travel.

Support And Resistance Levels Are Crucial

The ability of Bitcoin to keep a price over $80,500 will determine either its stabilization or continuation of slide. If prices drop below $84,000, there is likely much more reduction since liquidations could increase the pressure.

Concurrently, the development of a recovery could follow from strong buying interest at these levels. Since they know a rebound might provide the market fresh momentum, many traders are closely tracking these pricing points.

As Bitcoin negotiates this uncertain phase, technical indicators and investor mood will probably affect its next movements. Whether the alpha coin finds a bottom or suffers more drops will depend much on the next several days.

It’s likely that both technical signs and how investors feel will affect Bitcoin’s next moves as it moves through this challenging phase. The next few days will be very important in figuring out whether it hits bottom or continues to fall.

Featured image from Gemini Imagen, chart from TradingView