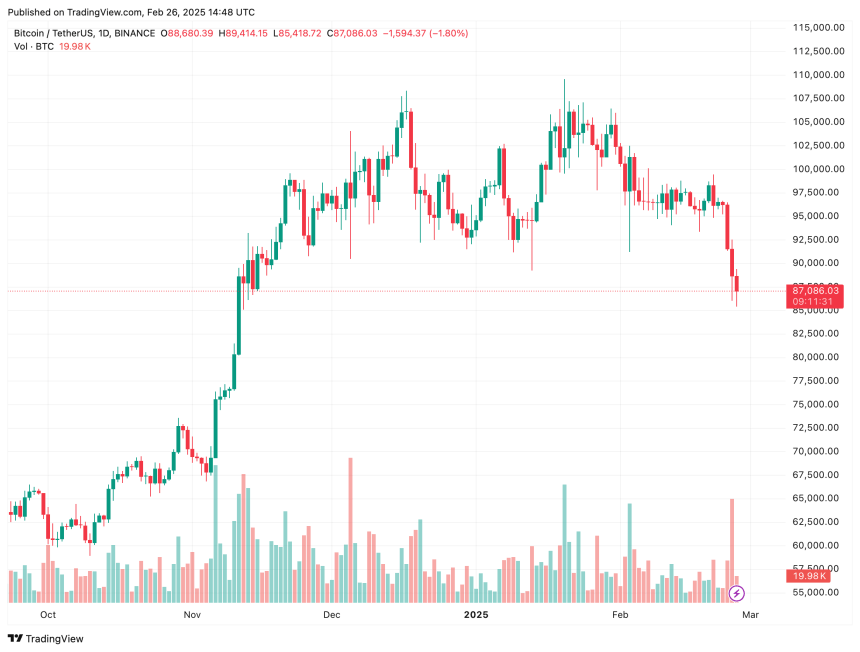

Bitcoin (BTC) has experienced one of its largest price pullbacks in recent times, plunging from $96,131 on February 24 to a potential local bottom of $85,418 today. The decline triggered liquidations exceeding $1.5 billion, with the majority coming from long positions.

Is It Time To Buy Bitcoin?

The recent price action suggests that the crypto market is reacting to bleak macroeconomic conditions, driven by US President Donald Trump’s proposed trade tariffs and a hawkish stance from the US Federal Reserve (Fed).

The total crypto market cap has now fallen below $3 trillion for the first time since November 2024, signaling growing bearish sentiment around risk-on assets. Major altcoins like Ethereum (ETH) have fallen by more than 10% in the past week.

Related Reading

However, despite yesterday’s downturn, overall sentiment toward the crypto market appears to be improving. In an X post, Andre Dragosch, European Head of Research at Bitwise, suggested that the worst may be over for BTC.

Dragosch shared the following Cryptoasset Sentiment Index, which is flashing a strong contrarian buy signal for the flagship cryptocurrency. The analyst added:

Wide-spread bearishness among flows, on-chain, and derivatives data implies that downside risks are fairly limited. Risk-reward appears to be quite favourable at these prices.

To further illustrate the level of bearishness surrounding risk-on assets, Dragosch highlighted that US spot Bitcoin exchange-traded funds (ETFs) recorded their single largest daily net outflow on record yesterday. Data from SoSoValue supports this assessment.

Additionally, the Crypto Fear & Greed Index remains in bearish territory. Dragosch noted that sentiment levels are “already as bearish as during the macro capitulation last August.” At that time, BTC made a local bottom at $49,000 before rallying to multiple new all-time highs (ATHs).

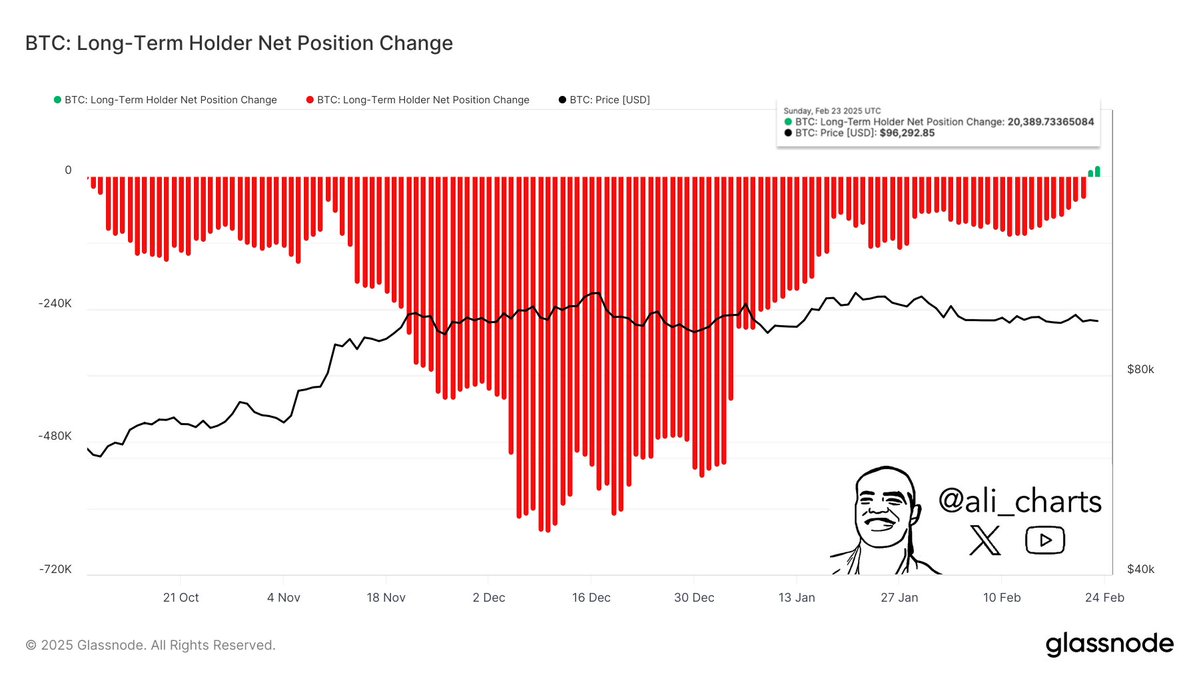

On a more optimistic note, on-chain data indicates that crypto whales are capitalizing on market uncertainty. According to crypto analyst Ali Martinez, long-term holders have accumulated nearly 20,400 BTC following the recent sell-off.

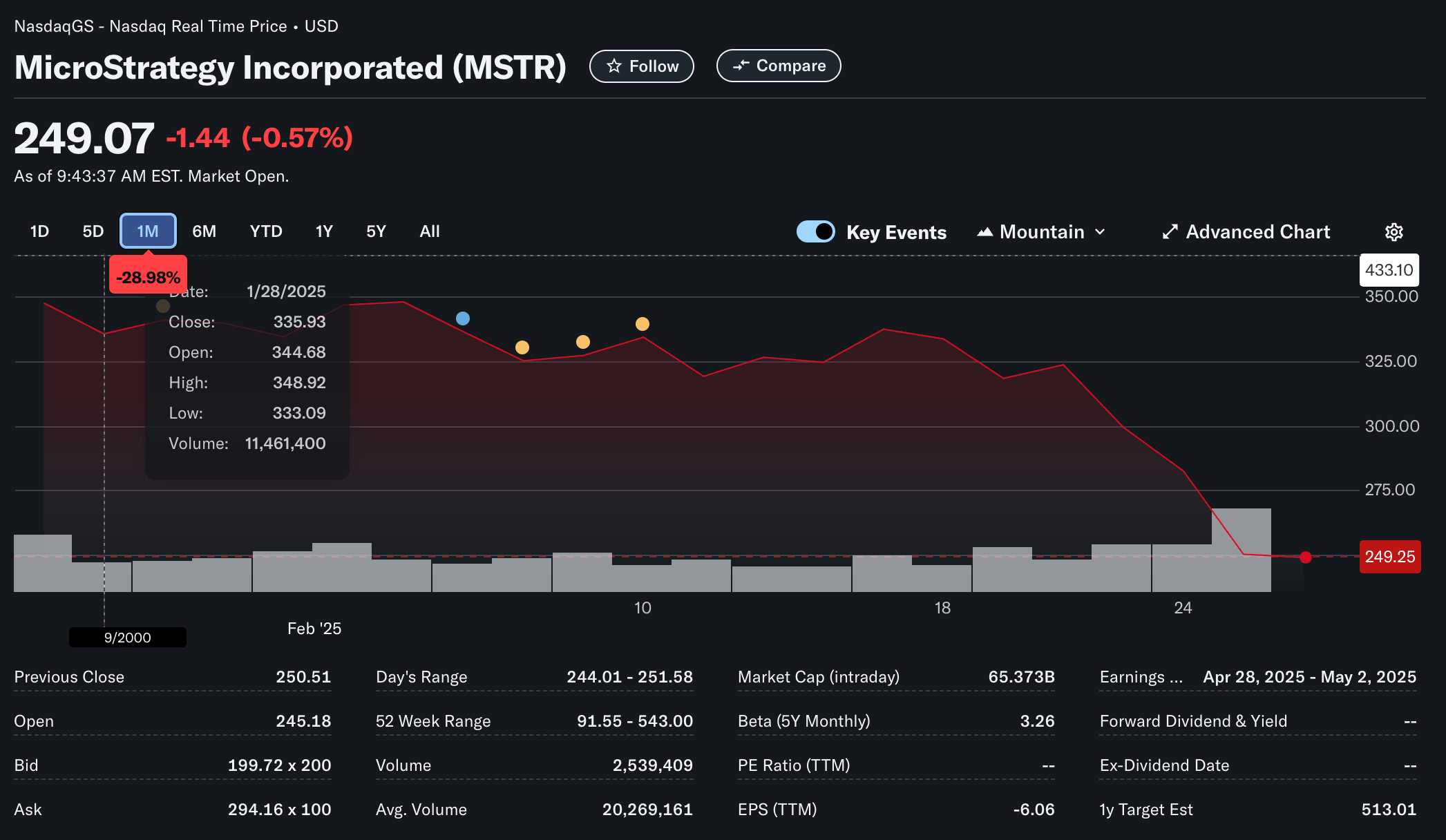

Strategy Falls With BTC Crash

In line with BTC’s decline, Strategy stock MSTR has also suffered, plummeting 55% from its peak of $543 in November 2024. At the time of writing, MSTR trades at $249, down approximately 29% over the past month.

Despite the overall bearish sentiment, recent analysis comparing BTC’s returns to other assets, such as gold and stocks, shows that while Bitcoin’s cumulative annual growth rate has slowed in recent years, it continues to outperform traditional asset classes significantly.

Related Reading

However, not all analysts share Dragosch’s optimism. In stark contrast, Standard Chartered recently warned that BTC may face further downside before resuming its bullish trajectory. At press time, BTC trades at $87,086, down 1% in the past 24 hours.

Featured image from Unsplash, Charts from X, Yahoo! Finance and TradingView.com