Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

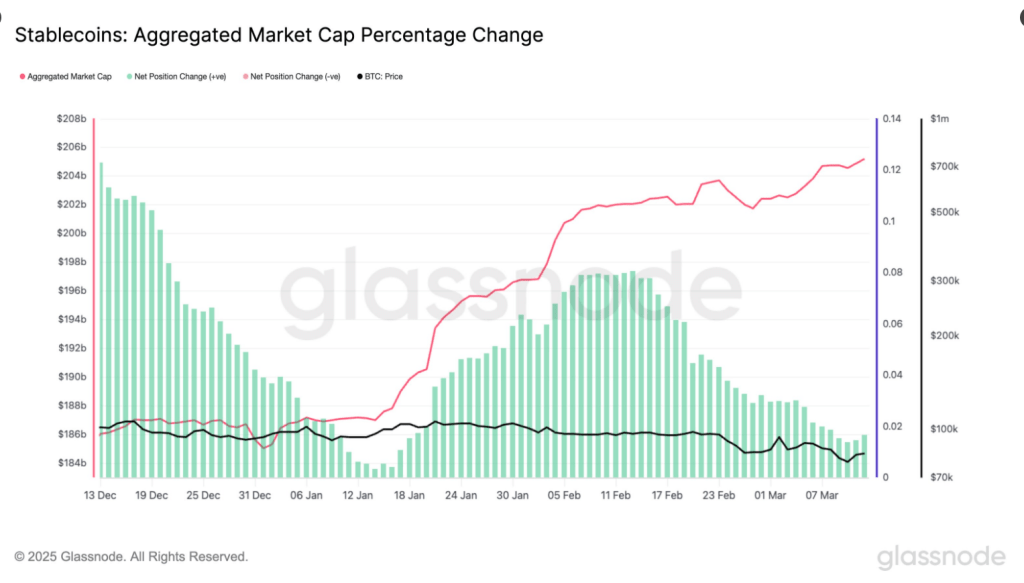

Early in 2025, there was a significant surge in the stablecoin market, with a $20 billion increase in total supply. With a 10% increase from January, the total supply now stands at almost $205 billion. The spike, according to data from Glassnode, comes after a dip in late 2024, when the supply of stablecoins fell from $187 billion to $185 billion.

Related Reading

Stablecoins See A Strong Rebound

For trading cryptocurrencies, stablecoins—like USDT and USDC—often act as a reserve for investors expecting the right time to buy assets like Bitcoin. The most recent rise shows that investor interest has surged, especially in view of last year’s slow down.

Since Jan 1, the aggregate #stablecoin supply has increased by $20.17B (+10.9%), now reaching more than $205B.

For comparison, the December peak clocked in at $187B but the supply actually contracted in the last two weeks of 2024 and dropped to $185B by January 2025. pic.twitter.com/gQbdMEDisb

— glassnode (@glassnode) March 13, 2025

Given the previous fall, this comeback is especially notable. For most of 2024 the market has been losing stablecoins; but, this trend has lately reversed. Although past patterns suggest that Bitcoin’s price may be impacted, it is unknown whether this increase will lead to a rise in purchases of cryptocurrencies.

Bitcoin Investors Watching Closely

A growing stablecoin supply is often seen as a bullish sign for Bitcoin. Historically, the price of Bitcoin has risen in line with the stablecoin count. The reasoning is simple: more stablecoins mean more potential capital just waiting to be entered into the market.

Some analysts believe this fresh injection could push Bitcoin higher. However, not all stablecoins are used for trading. Many are held for remittances, payments, or as a hedge against inflation, especially in countries where local currencies are unstable.

As of today, the market cap of cryptocurrencies stood at $2.65 trillion. Chart: TradingView

Stablecoin Exchange Holdings Drop 21%

While the total supply is rising, only 21% of stablecoins are currently sitting on exchanges. This is a significant drop from 2021, when over 50% of the supply was available for immediate trading, Glassnode disclosed. This shift suggests that while new coins are being issued, they are not all being deployed into crypto markets right away.

Related Reading

This could point to one of two possibilities: either stablecoins are being used more often outside of exchanges or investors are still waiting for the suitable moment. Should the latter prove right, the impact on Bitcoin could be less notable than expected.

What This Means For Bitcoin’s Future

The stablecoin market is currently experiencing a resurgence, which is generally a favorable development for the cryptocurrency sector. However, it is uncertain whether this will result in a short-term increase in the price of Bitcoin. Stablecoin utilization has fluctuated, and additional economic variables will contribute to this development.

At the time of writing, Bitcoin was trading at 82,264, down 1.1% and 6.9% in the daily and weekly frames.

Featured image from Warwick Business School, chart from TradingView